The futility of taking Cash Calls

If one gets both legs of market timing—selling and re-entry—perfectly right, the net impact on incremental IRR versus staying invested is not significant, especially considering the probability of perfect timing is practically zero.1

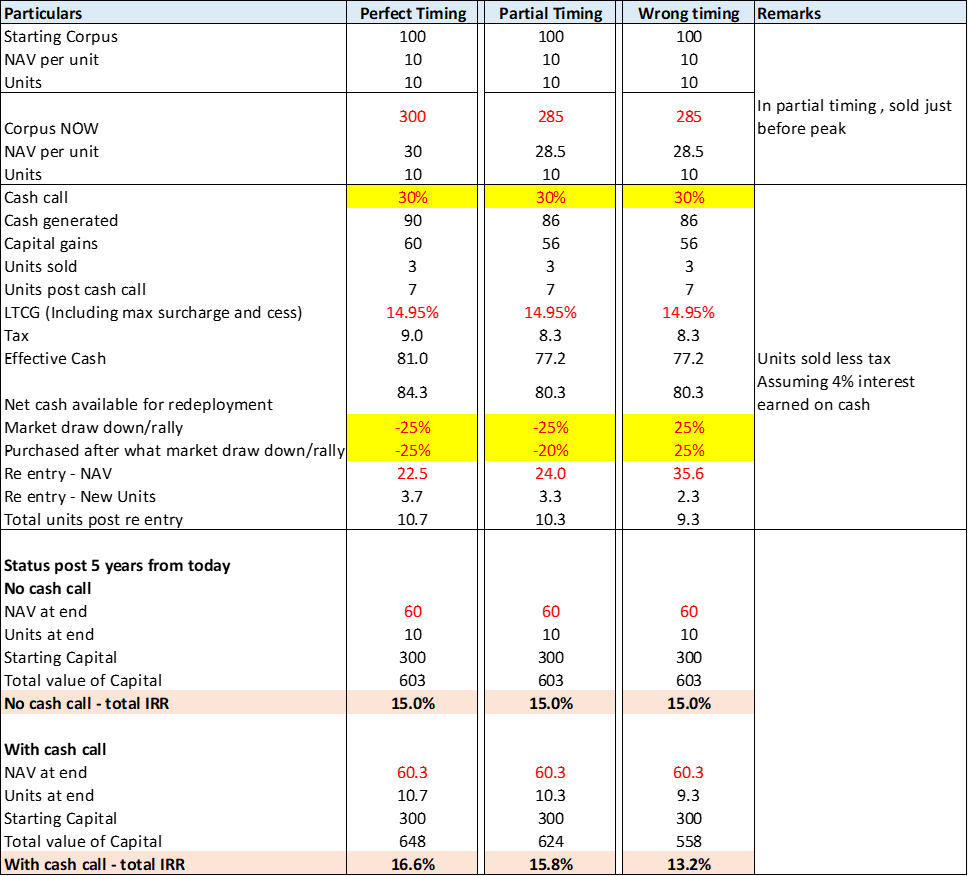

We enclose calculations below:

- Perfect Right Timing: Cash call of 30% at peak and re-entering at 25% market drawdown –> incremental IRR over 5 years vis-a-vis staying invested is 1.6%.

- Partially Right Timing: Cash call of 30% just before peak and re-entering at 20% market drawdown –> incremental IRR over 5 years vis-a-vis staying invested is 0.8%.

- Wrong Timing: Cash call of 30% assuming a peak, but the market rallied instead and thus re-entering at 25% higher levels–> IRR drag over 5 years vis-a-vis staying invested is -1.8%.

Why is it that market timing seldom works?

- An over-heated market can rise much further before it corrects. No one rings a bell at the top or at the bottom. Hence, typically one sells too early.

- Re-entry is difficult at the bottom. At moments when re-entry should happen, our minds are seized with fear as the drawdown reflects near term stress in the environment.

- The protective instincts of the brains kick in overriding rational judgement (“prices factor in the uncertainty”) and one looks to protect remaining capital.

- And if this seems theoretical, we only need to take a minute to reflect how we behaved during Covid-19 fall.

Then why do people continue to be tempted by cash calls?

- Some people genuinely believe they can over optimize short and long term. Such genius is very rare. But then, overestimating one’s competence is a human trait.

- The mathematics is not intuitive. These lessons have been learned painfully because yours truly engaged in this futile activity for many years.

- During times of stress, time horizons compress. We forget the game we are playing. And some of this is biological based on how our brains are wired.

- We take advice from people playing a different game with different incentives. Business news channels need your eyeballs. Your broker needs you to churn.

So how to protect against drawdowns?

- We cannot. The reason historically Equities have been far more rewarding than Bonds is because the “risk premium” is the reward for the pain of enduring market volatility.

- One can only minimize drawdowns by not buying junk. The extent of drawdown and pace of recovery is a good benchmark of the quality of the portfolio.

- The only other protection is to hold some Assets in cash equivalents so one has the comfort of a cushion and not over-invest in Equities beyond tolerance for drawdowns.

- A deeper question though is if one believes one can compound at 15%, why does it matter if there is a drawdown along the way?

At Solidarity, we firmly believe that trading and investing don’t mix as one has to train the brain to think long term during moments of stress and not freeze.

- Hence, not only our investment processes but everything we do is designed to think long term.

- Specifically, derivatives trading is banned at our firm so one can still the mind and not confuse oneself at times of maximum opportunity.

Please click here if you would like to download the PDF version of this blog

- Disclaimer: Originally published on Feb 28, 2021; updated on Jul 16, 2025, for revised LTCG rules. ↩︎