Share price of Life Insurance companies have fallen 8-16% in last 2 days.

Life Insurance companies get almost 25-30% share of their total premiums from long duration savings products which enjoy tax benefits under Section 10 (10D) which make them superior products vs Debt instruments when measured on a post-tax basis.

The budget had 2 announcements with implications for Life Insurance companies:

- Modifications in Section 10 (10D) for premiums over 5 Lacs/year – if the premium paid on Savings policies (excluding ULIPs) exceed INR 5L in a year, then the income earned from those policies will now be taxable (except in case of death benefit).

- The FM signalled intent to nudge individuals to migrate to the new tax regime under which there will be higher exemption limits, but Section 80C tax benefits will be withdrawn.

Many partners wrote in to understand our perspective on this issue. We normally cover such updates in our quarterly letters, however, we thought it appropriate to send an update early.

Our perspective

Life Insurance companies have communicated that the immediate impact due to changes in exemption limits under Section 10 (10D) is marginal.

- HDFC Life has guided that such products (over 5 Lac premium) contribute about 10% of their total premiums collected and ~5% of bottom line as they are lower margin due to shorter tenor.

- ICICI Pru Life has guided that these products contribute about 6% to their total premium and approximately the same to VNB and that the “net impact to the business is expected to be trivial”.

- SBI Life has updated that “non linked policies with annual premium of above ₹ 500,000 is less than 2% of the total APE for 9M-FY2023. The Company strongly believes that the impact is insignificant”.

Why the panic then?

We believe the market has over-reacted. The sector has been facing growth head winds of Banks chasing deposits and steep increase in prices of Term Insurance post Covid. The market not only views these changes as another head wind to short term growth but is perhaps extrapolating that this will impact longer term growth prospects as well.

- Risk that the 5 Lac limit will be decreased over time under Section 10 (10D), or worse even eliminated all-together.

- Concerns that customers who move to the new tax regime will no longer buy Insurance products (protection and/or savings) to avail tax benefits under Section 80C.

We do not share either of these concerns.

- Section 10 (10D) benefits are for long duration investments. These savings are needed to fund long duration infrastructure projects. This is a tail risk but would not be our base case.

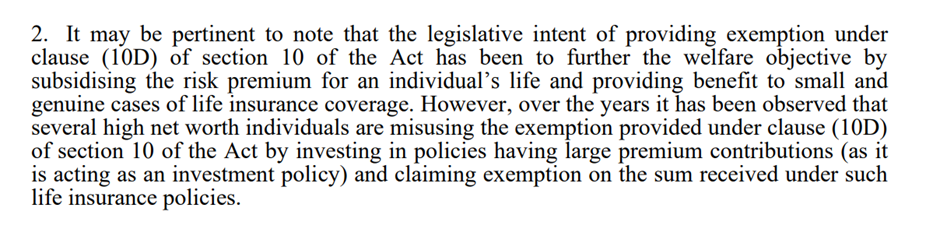

- Further the budget memorandum makes clear that Section 10 (10D) was modified to curb misuse.

- The Revenue Secretary in a TV interview1 clarified on the same mentioning that of the 16Cr policy holders at LIC, less than 2 Lac policy holders were paying premiums >5 Lacs. They seem to be clear on the segment they were targeting.

- A similar provision was introduced for ULIPs in 2021 wherein aggregate premiums of up to INR 2.5L in a year were still kept tax exempt under 10 (10D).

We believe the demand for savings guaranteed products – which contribute about 20-35% to VNB2 for leading private insurers (proxy for profits) will not completely disappear as the customer value proposition is strong, even though it will face some drag in the >5 Lac premium segment.

- Savings products that guarantee returns (with > 5 lacs premium) will have some impact. However, they continue to have a value proposition vs FDs on a pre-tax basis. Many customers buy these products not for tax savings alone but because they allow customers to lock in a certain return for a long period of time which may be useful for example if you want to keep funds aside for a child’s education or marriage.

- Savings guaranteed products with < 5 Lacs premium will continue to have superior post tax returns vs an FD – so will continue to be attractive for low premium paying customers who want to lock in returns for long time periods.

- Basic human nature can be nudged to act in a particular way through tax incentives. However, fundamental inclination to save will not change under the new tax regime. Hence, elimination of 80C benefits will not materially impact how customers save and therefore demand for savings products (Guaranteed, ULIP & Participatory) should not get materially impacted. It should be noted that the 80C limits have not kept pace with increasing income levels.

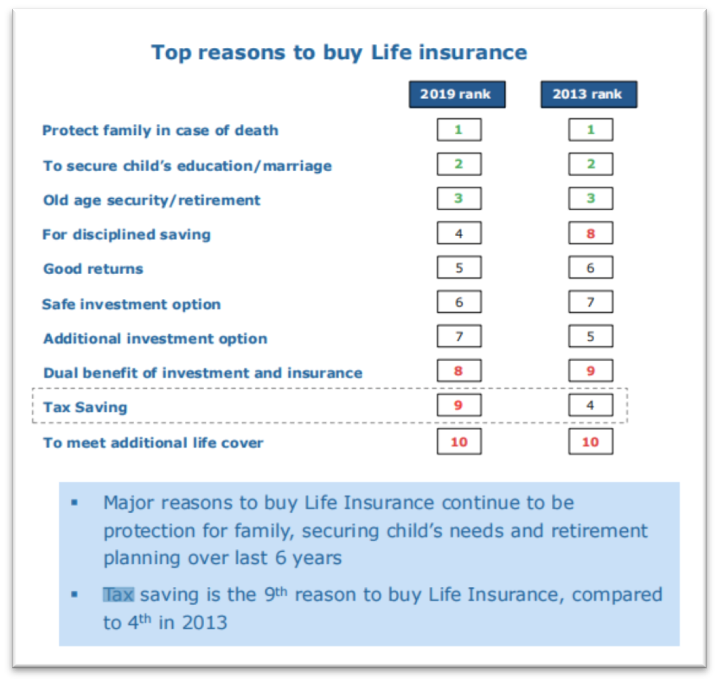

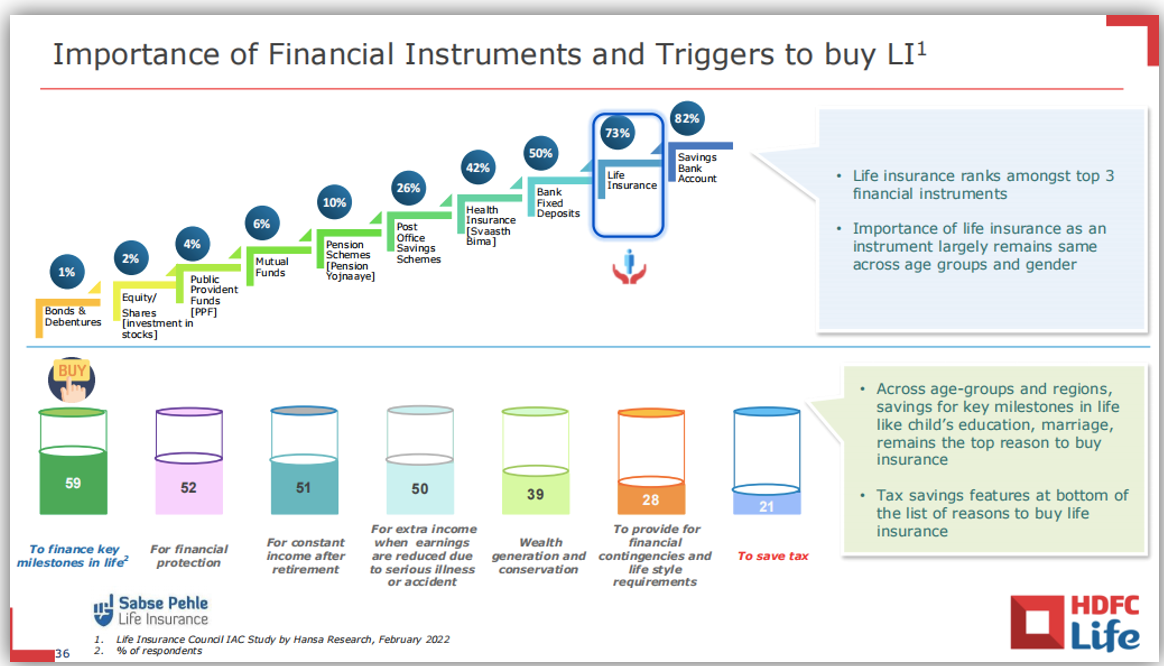

- Demand for protection will not get impacted due to elimination of 80C as “Tax saving” is not the primary reason cited by people to buy Insurance3. In surveys done by Nielsen for HDFC Life in FY 20, tax saving is ranked 9th for in reasons consumers offer for buying Insurance vs 4th in 2013.

Our current stance

It is impossible to estimate impact on short term growth because of multiple variables. Hence, we focus on long term outcomes. The Life Insurance industry has a decadal opportunity for growth due to under penetration of Term Protection and Annuity. Savings products have a differentiated value proposition vs other Financial products and long tenure savings products are needed to fund long duration projects. Moats are strong (brand, distribution). Leading life insurers can grow for long periods while maintaining core ROEs of 15-20%+. Note – Accounting in this industry is complicated and hence reported PAT/Net Worth is not reflective of true ROE.

The market behaviour is understandable as the market immediately de-rates the valuation multiple when short term head winds arise. However, one should not adopt a knee jerk reaction and follow the herd. Covid was supposed to speed transition to Digital. However, within 2 years, most big Tech CEOs realized they overestimated the expected pace of transition.

The changes affected in Section 10(10D) should be a trigger to focus the Industry on growing Protection/Annuity. We believe the leading companies in the industry have not done enough in the past to create market awareness and grow Protection, the principal purpose of Insurance. Leading players have been growing VNB at 20%+ which is quite comfortable. The MF industry with AMFI has done a stellar job with the “Mutual Fund Sai Hai” campaign to encourage investment. Hopefully, the risk of withdrawal of Section 10(10D) will nudge the Life Insurance Industry to act more forcefully. “Nothing focuses the mind like the prospect of an imminent hanging”.

Our response

We worked with 20% sector caps in Life Insurance in the past. We continue to remain invested but reduced the sector position cap to 15% some time ago. The sector has had 2 regulatory changes in the last 36 months. And the risk of normalization of Corporate tax rates in this sector remains a risk. Corporate tax rates for Life Insurance cos at present are 14%? Will the Govt change these to 25%?

We don’t know how to ascertain probabilities and timing of this happening. This will create a one-time 10-15% stock price impact if this happens. While negligible from a decadal perspective, this will create short term pain when it happens.

At present, long term growth and entry valuations for Life Insurance companies are very attractive, even if one assumes that at some point in the near future corporate tax rates will change. For example, ICICI Pru Life is trading at the lowest valuation it has ever traded.

Hence, we continue to stay optimistic. But within the sector caps we have outlined.

Please click here if you would like to download the PDF version of this blog

The information or material (including any attachment(s) hereto) (collectively, “Information”) contained herein does not constitute an inducement to buy, sell or invest in any securities in any jurisdiction and Solidarity Advisors Private Limited is not soliciting any action based upon information. Solidarity and/or its directors and employees may have interests/positions, financial or otherwise in securities mentioned here. Solidarity may buy securities in companies owned by its clients. This information is intended to provide general information to Solidarity clients on a particular subject or subjects and is not an exhaustive treatment of such subject(s). This information has been prepared based on information obtained from publicly available, accessible resources and Solidarity is under no obligation to update the information. Accordingly, no representation or warranty, implied or statutory, is made as to the accuracy, completeness or fairness of the contents and opinion contained herein. The information can be no assurance that future results or events will be consistent with this information. Any decision or action taken by the recipient based on this information shall be solely and entirely at the risk of the recipient. The distribution of this information in some jurisdictions may be restricted and/or prohibited by law, and persons into whose possession this information comes should inform themselves about such restriction and/or prohibition and observe any such restrictions and/or prohibition. Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. Neither Solidarity nor its directors or employees shall be responsible or liable in any manner, directly or indirectly, for the contents or any errors or discrepancies herein or for any decisions or actions taken in reliance on the information. The person accessing this information specifically agrees to exempt Solidarity or any of directors and employees from, all responsibility/liability arising from such misuse and agrees not to hold Solidarity or any of its directors or employees responsible for any such misuse and free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors.

- https://twitter.com/CNBCTV18News/status/1620775948151824384?t=JABb-9dikDpT3JEUAnFtug&s=08 ↩︎

- Proxy for profits ↩︎

- Source of chart: HDFC Life Investor Presentation FY 20, FY 22 ↩︎