Kama Holdings is the Holding company of SRF. Please read this important disclosure. 1

Summary thesis:

- SRF will grow profits at 15%+ over the next decade riding market opportunity and leveraging its strong competitive position. However, we expect valuation multiples for SRF to correct over time as mean reversion takes place and when growth slows down.

- The Holding company discount for Kama has expanded over the last 5 years. This should narrow over-time as the mispricing vs peers gets corrected.

- Hence, buying Kama is akin to buying SRF at a margin of safety. If the discount on Kama does not narrow, we should earn similar returns as one would earn on owning SRF. However, if we are right, we should earn a substantial kicker above returns earned by owning SRF.

Contents

- Investment thesis on SRF

- What explains the vast range of discounts across Holding companies.

- Why should the Kama Hold co discount narrow?

- Section 80M as an additional trigger

- Potential outcomes over next 5 years

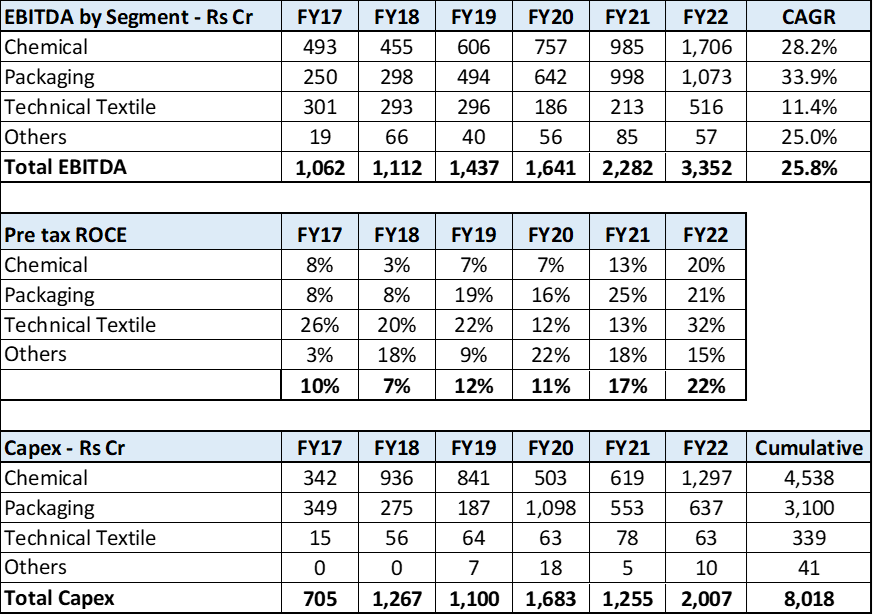

SRF has 3 primary business segments- Chemicals, Packaging Films and Technical Textiles. SRF has market leadership position in all its key businesses and a good execution track record. It is very well positioned as Indian companies take more meaningful positions in global supply chains.

Chemicals This is the segment of primary interest to us. It contributed ~50% of Operating Profits in FY22 and we believe accounts for ~80% of SRF Market cap. SRF’s Chemical business is primarily Fluorine based chemistry where it enjoys a dominant position. Fluorine is an attractive category as it enjoys secular growth tailwinds and has significant entry barriers. The industry structure in India is highly favourable today with 3 credible players (SRF, Navin Fluorine and Gujarat Fluorochemicals). Fluorine is finding greater usage in pharma and agrochemical applications due to its superior efficacy, solubility and environmental compatibility. Emerging opportunities for fluorine in electric vehicles, solar panels and hydrogen fuel cells suggest a long runway for growth exists. Well-run Indian players within this space will continue to benefit from market share gains as global customers de-risk their supply chains. Fluorine is a highly reactive element, is very difficult to handle and transport and so requires specialized infra/machinery, trained manpower. Investments required are significantly higher than traditional chemistries and there is a long learning curve involved. However, once credibility is established, customer relationships tend to be sticky.

Management has invested to capture this opportunity. Almost all cash generated over the last 5 years has been re-invested in Capex and Working Capital. ~575 Cr has been invested in R&D in the last 5 years. SRF has expanded its portfolio to Pharma Fluoro Specialty Chemicals and Fluoro-Polymers, a high share of revenues is from IP in processes developed in house and there is significant backward integration. Not surprisingly, SRFs Chemical business has grown EBITDA > 25% CAGR in the last 5 years.

Management continues to invest in new capacities (guidance for ~12000 Cap ex over next 5 years, ~3x of last 5 years) which supports the thesis of strong short-term growth and 15-18%+ growth for long periods of time at ~18-20% ROCE.

Packaging Films

Packaging Films contributed ~30% of Operating profits in FY22 but we believe contributes about 15% of Market Cap. This business has grown at 22% CAGR over the FY12-22). SRF is well positioned with global cost leadership and multi geography footprint. However, we believe this is not as attractive a business as Chemicals as margins depend on demand/supply gaps and the ability to differentiate is lower. It is therefore a lower cross cycle ROCE business with higher cyclicality in margins compared to Chemicals.

Technical Textiles

Technical Textiles are ~15% of Operating profits in FY22 and plays the role of a cash cow in the portfolio. (Cumulative EBITDA of ~1500 Cr generated over FY18-22, was used primarily to fund capex for the chemical segment as only ~300 Cr has been reinvested in Capex). Mgmt. is not investing behind this segment.

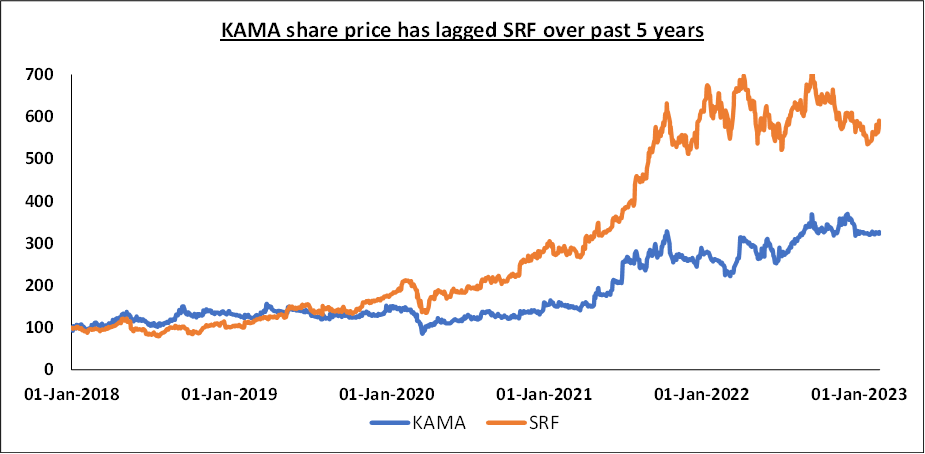

Our history of owning SRF

We first bought SRF in March 2017 at about 300-350/share2 and exited in September 2021 between ~2100-2200/share, primarily due to concerns around valuation. While we expected SRF to continue to grow the Chemical business profits at 15%+, we were unsure about growth longevity in Packaging Films (30% of Operating profits) and Technical Textiles. We felt valuations were running much ahead of fair value and we would earn ordinary IRRs over next 5 years from those levels.

We remain very optimistic about growth in Chemicals, however, we continue to remain cautious on prevalent SRF valuation multiples.

In the section below we explain why owning SRF through Kama allows us to participate in SRFs growth compounding, but at entry valuations that provide a good margin of safety.

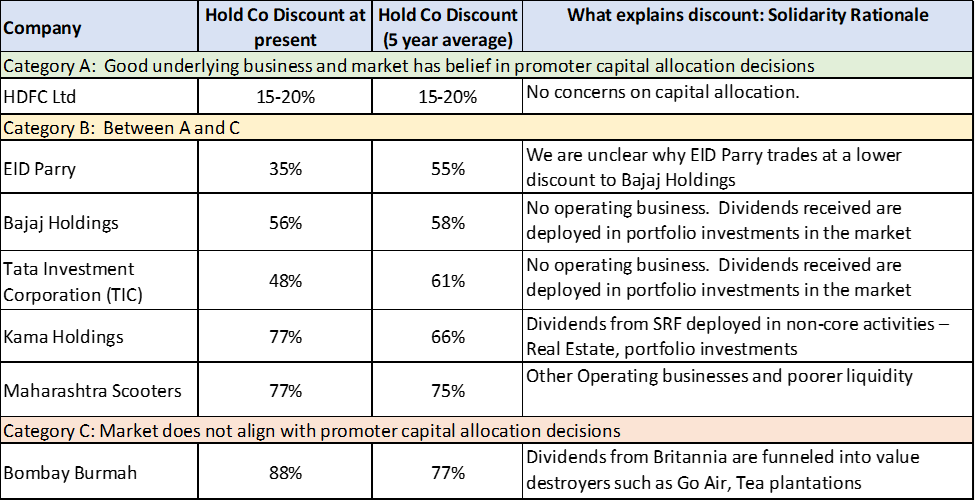

What explains the vast range of discounts across Holding companies?

The wide range of Hold co discounts across companies can be primarily explained by

- Whether minority shareholders want to own the underlying Assets

- Track record of how promoters allocate Capital generated from the “desirable businesses” in the Hold Co

- Do they distribute it to shareholders?

- Invest it in other “not so great” operating businesses owned by the Hold Co or

- Invest it in non-core portfolio investments?

- Liquidity in the stock.

We see the market broadly slotting companies in 3 buckets.

It may interest partners to note that Bajaj Holdings and Maharashtra Scooters, both promoted by the Bajaj family, trade at vastly different Hold co discounts.

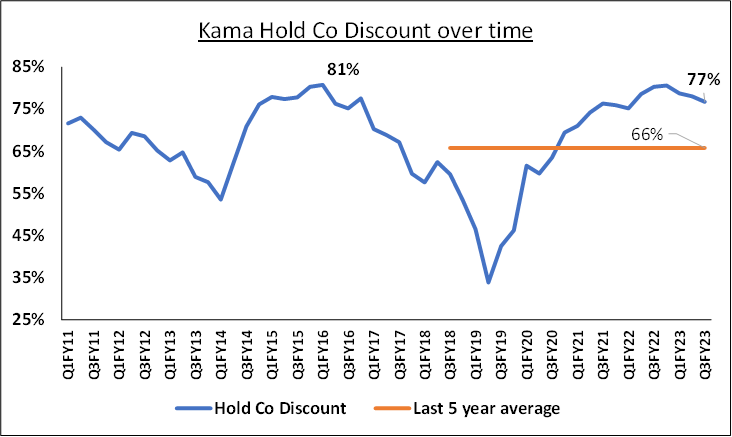

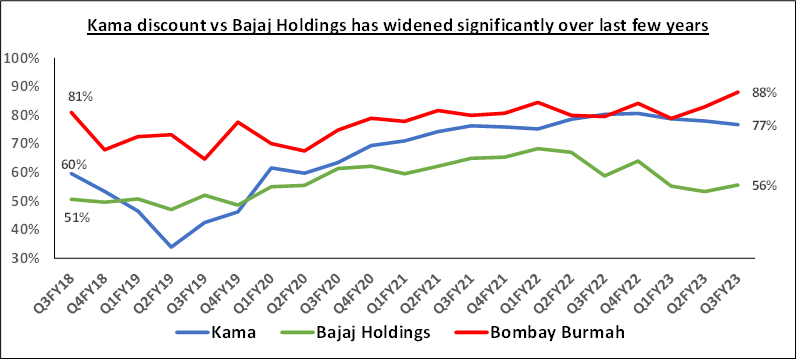

Kama Hold Co Discount over time

Why has the discount widened?

The increase in Hold co discount for Kama over the past 5 years can perhaps be explained by the steep increase in the price of SRF. Investors have participated in the SRF story enthusiastically; however, due to poorer liquidity, Kama has not attracted similar interest. There is no institutional shareholding in Kama (while it is at 31% at SRF as of 1 Jan 23).

Why should the Kama Hold co discount narrow?

Kama’s discount vs peers in Category B is not justified.

- Kama Holdings has only 3 employees. Very clearly, its intent is to be a Holding company and not to build Operating businesses.

- Capital allocation at Kama was very similar to Bajaj Holdings/TIC

- Neither of the three own non – core operating businesses that need capital support.

- Kama has been using SRF dividends for investments in real estate and listed equities.

- Bajaj/TIC primarily use dividends to make investments in listed companies as well

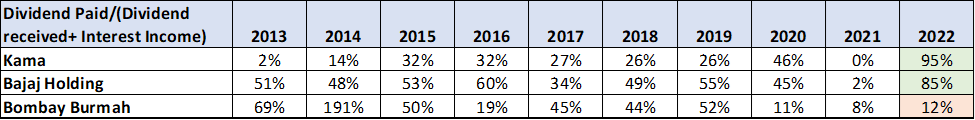

- Introduction of Section 80M in the Income Tax Act in 2020 has improved Capital distributions at Kama.

Increase in Market Cap of Kama over time (as SRF market cap increases) will attract more institutional interest.

Section 80M

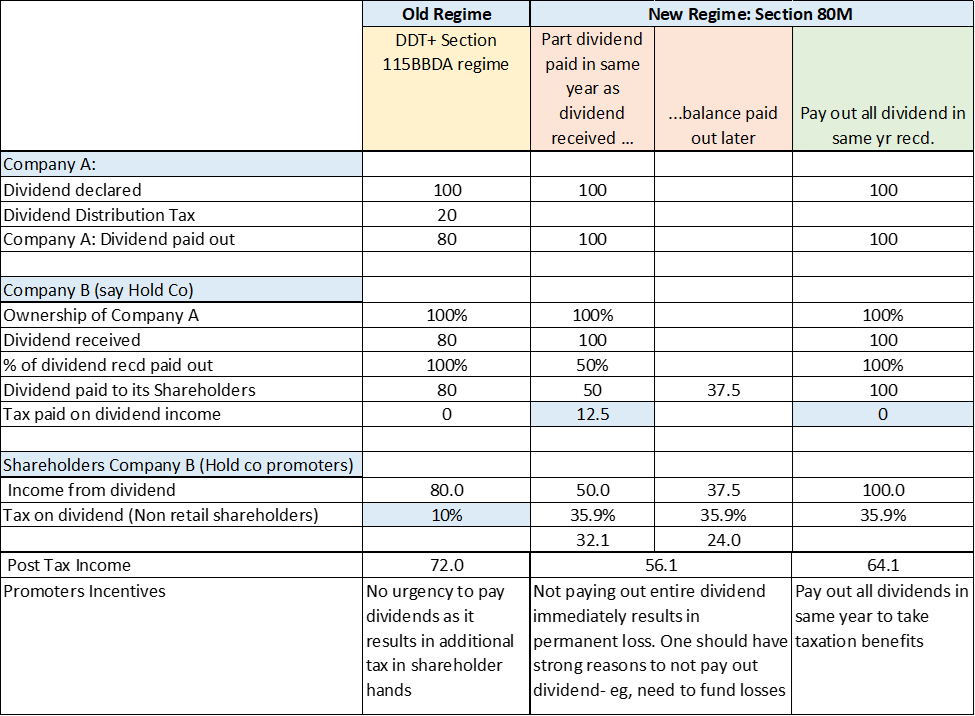

Was re-introduced in the Finance Act 2020. It prescribes that if a company receives dividend from any domestic or foreign company, there is no tax on dividend income which has been distributed in the same financial year. The company only pays tax on dividends received that remain undistributed.

Section 80M makes it inefficient to retain dividends at Hold co levels unless there are Operating losses to be funded in other companies at the Hold Co. Hence, we expect dividend payouts to increase for companies such as Bajaj/TIC/Kama/Maharashtra Scooters.

While its early days, we observe a change in capital distribution at Kama and Bajaj Holdings already in FY22. For example, at Kama

- FY22: 95% of all dividend received by Kama were paid out

- YTD FY23 Kama has just completed a buy-back of 50 Cr

This is a significant step up of cash distribution from date Section 80M has been introduced vs previous years. ~275 Cr Cash has been distributed to Kama shareholders (dividend + buy-back) between FY22-FY23YTD vs 80 Cr between FY 11-FY 21.

However, Kama is still trading close to the discount of Bombay Burmah even though the latter allocates most dividends received into supporting loss making operations like Go Air and Tea Plantations.

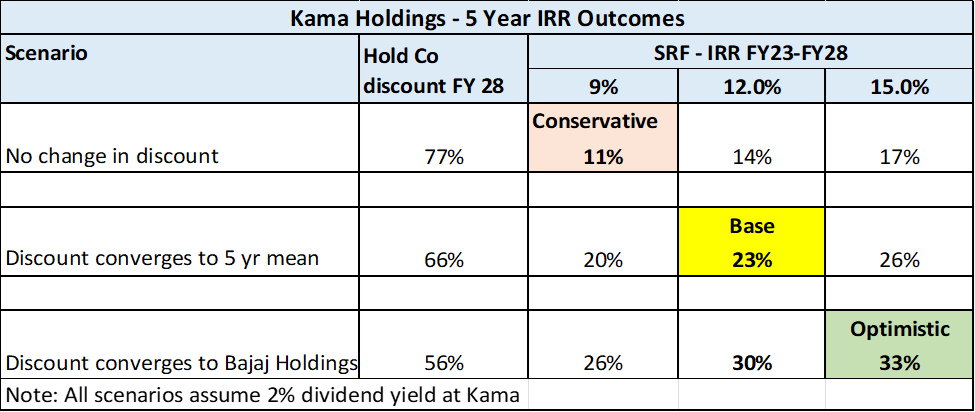

Potential outcomes over next 5 years

Our hypothesis is that the ~77% discount should narrow closer to Bajaj Holdings (56%) as markets realize the mispricing. That would result in a ~90% increase in Kama stock price even if SRF stays flat. If Kama maintains high dividend payouts, the discount could trend even lower. However, low liquidity in the stock (poor institutional interest) is a challenge to this scenario playing out.

| Scenarios | Pessimistic | Base | Optimistic |

| SRF IRR FY23–28e | 9% IRR12-15% growth in Chemicals. Slow-down in other business lines Decline in valuation multiple. | 12% IRR20% growth in Chemicals. Slow -down in other business linesDecline in valuation multiple. | 15%+ IRRGrowth in Chemicals and other business lines maintained. Valuation multiple broadly maintained. |

| Kama Hold Co Discount to SRF | No narrowing of discount. 75-80% | Reverts to 5-year mean.~66% | Narrows to that of Bajaj Holdings~56% |

Please click here if you would like to download the PDF version of this blog

Disclaimer

The information or material (including any attachment(s) hereto) (collectively, “Information”) contained herein does not constitute an inducement to buy, sell or invest in any securities in any jurisdiction and Solidarity Advisors Private Limited is not soliciting any action based upon information. Solidarity and/or its directors and employees may have interests/positions, financial or otherwise in securities mentioned here. Solidarity may buy securities in companies owned by its clients. This information is intended to provide general information to Solidarity clients on a particular subject or subjects and is not an exhaustive treatment of such subject(s). This information has been prepared based on information obtained from publicly available, accessible resources and Solidarity is under no obligation to update the information. Accordingly, no representation or warranty, implied or statutory, is made as to the accuracy, completeness or fairness of the contents and opinion contained herein. The information can be no assurance that future results or events will be consistent with this information. Any decision or action taken by the recipient based on this information shall be solely and entirely at the risk of the recipient. The distribution of this information in some jurisdictions may be restricted and/or prohibited by law, and persons into whose possession this information comes should inform themselves about such restriction and/or prohibition and observe any such restrictions and/or prohibition. Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. Neither Solidarity nor its directors or employees shall be responsible or liable in any manner, directly or indirectly, for the contents or any errors or discrepancies herein or for any decisions or actions taken in reliance on the information. The person accessing this information specifically agrees to exempt Solidarity or any of directors and employees from, all responsibility/liability arising from such misuse and agrees not to hold Solidarity or any of its directors or employees responsible for any such misuse and free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors.

- The Bharat Ram family are promoters of Kama Holdings. They (and legal entities controlled by them) have been clients of Solidarity since 2017. Solidarity manages funds for ~15 other families who are promoters/CEOs of listed families, but whose underlying stock we do not own for clients at present. Some of these businesses are on our watch list and we may own them in the future. ↩︎

- Price adjusted for Corporate action ↩︎