Summary views

- Shivalik Bimetal offers possibilities of 15-20%+ Sales CAGR and 17-20%+ PAT CAGR over long periods. We see structural tailwinds of end market growth, potential for market share gains globally and forward integration into value-added products. Margins should expand from forward & backward integration and operating leverage.

- The Ghumman family now has full control over the company with larger shareholding having recently bought stake from the other promoter group at 610 per share1. A single promoter group can drive more decisive decision making and we are already seeing more investments behind Sales and R&D.

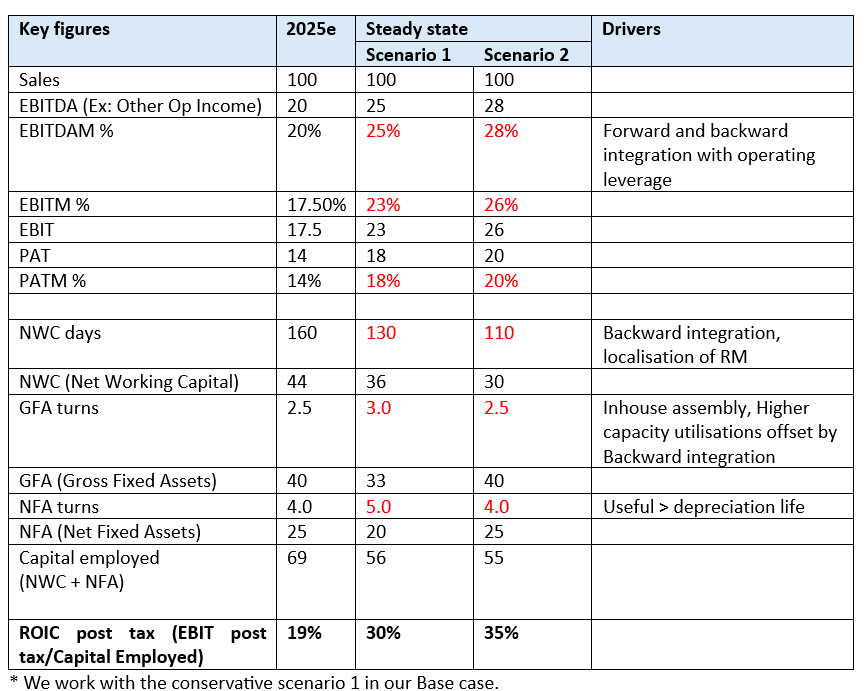

- Business is resilient & derisked and should generate meaningful Free Cash Flow over next few years despite Cap ex due to high steady state post tax ROIC of 30-35%+ due to the wide Technology moat.

- Recent share price correction (~35% decline from peak) can be explained by short-term growth challenges and market corrections. We remain optimistic long term and have used the correction to increase our position size to ~4% as we find current valuations attractive. Any further decline will be an opportunity to add more to our positions.

- Shivalik is a Phase 3 co poised to become Phase 4. We have explained our framework in our last blog.

What do they do?

- Shivalik is a high-precision welding company that primarily specializes in joining metals mainly through Electron Beam Welding (EBW) & Diffusion Bonding.

- Electron Beam Welding for Shunt Resistors is a high-precision welding process that uses a focused beam of high-velocity electrons (2/3rd speed of light) to join materials.

- Diffusion bonding for Bimetals is a joining process where two or more alloys are fused together at elevated temperatures.

- Shivalik mainly caters to three broad segments – Shunt Resistors (~40% of Sales FY25e), Thermostatic Bimetals (~45%) and Electrical Contacts (~15%).

What do their products do?

- EBW Shunt Resistors are used to detect and measure the flow of electrical current in a circuit in applications such as Energy Meters, Automotives, Battery Management Systems etc. Some of their customers are Vishay, Hella, Continental etc (Tier 1 suppliers to OEMs) and they compete with global players like Isabelenhuette.

- Thermostatic Bimetals are a combination of two or more alloys with different thermal coefficients2 which bend when heated and so are used to trigger Circuit breakers for Switchgear, Electrical appliances etc. Some of their customers are Schneider, ABB, Siemens etc. and they compete with global players like EMS and Aperam.

- Electrical Contacts are used as connecting points to allow/interrupt electricity flow when a switch is turned on/off and are used in Switchgears, Smart Meters etc. Their customers include C&S Electric, Havells, Anchor and they compete with domestic players like Modison, Choksi and Heraeus.

In a later section we explain why the moat in these products is wide and entry barriers are high which enable a very high ROIC.

Brief history of Shivalik

- Shivalik was set up by Mr N S Ghumman and Mr SS Sandhu in 1984 as Asia’s first Thermostatic Bimetal company. It later forayed into the Cathode Ray Tube parts to cater to the growing TV demand in India which gave it access to the EBW technology in 2000.

- It entered Silver Contacts in 2006 via JV with Checon USA but took full control of the entity in 2023. It also entered a JV with ArcelorMittal for Cladding material.

- While the CRT parts business got disrupted due to the rise of LED/LCD screens, promoters showed foresight by successfully diversifying into Shunt Resistors in 2015 by leveraging its EBW tech know-how.

- In 2011, Shivalik acquired Sandvik’s Bimetal bonding equipment at an attractive price. Today Shivalik has the largest Electron Beam welding and Bonding capacity globally.3

- The company is currently being run Kabir and Sumer Ghumman post the exit of the Sandhu family in 2024. The Ghumman family bought a portion of the Sandhu family stake in Sept 2024 to increase their shareholding from ~26% to ~33% at 610 per share.

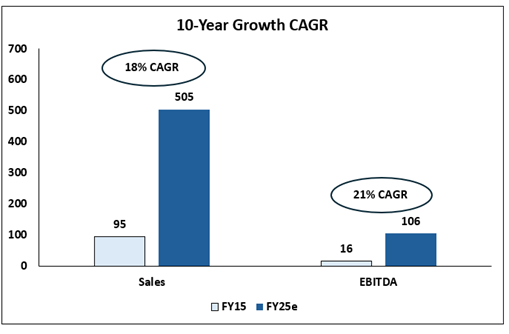

Shivalik has a good execution track record

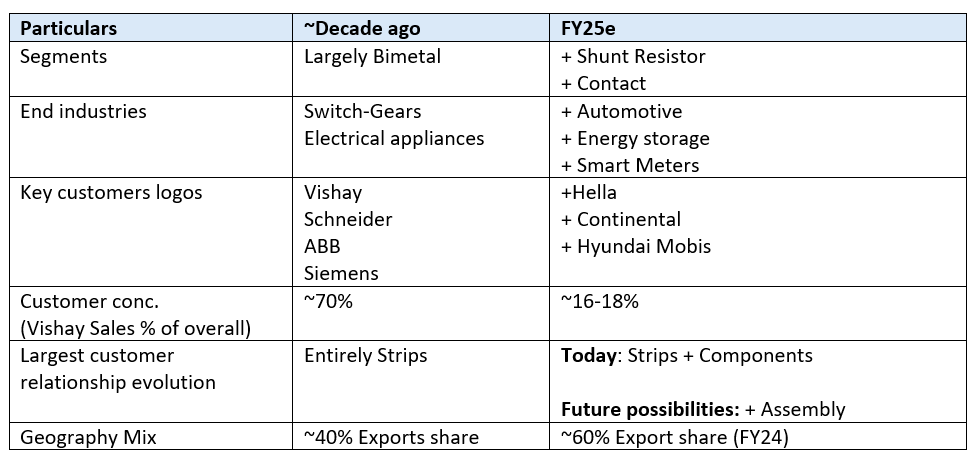

Healthy growth has been accompanied by improvement in Earnings quality and resilience

- Business has become more diversified across Segments (Shunts, Bimetals & Contacts), customers, geographies (~60% Export FY24) and end industries (Automotive, Switchgear, Appliances, Smart Meters etc).

- Share of Sales from their largest customer is now at manageable levels of < 20% and we expect this to further reduce as new customers ramp up over time.

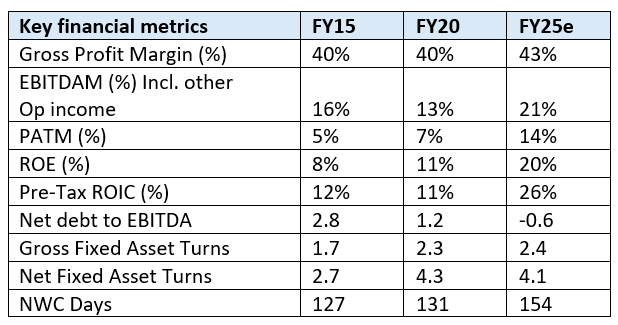

- Economics has improved over time due to a better mix (Higher share of Shunt Resistors, exports, and forward integration).

- Current Profit margins are resilient and carry low risk from China dumping. Any increase in US tariffs will be passed on to customers due to specialized nature of products.

Improvement in margins and ROIC over time

Shivalik is very well positioned for sustainable growth over long periods of time

Shivalik has grown Sales at a healthy pace of ~18% CAGR over the last decade. We can never predict growth. However, we believe conditions for 15-20%+ Sales CAGR for long periods exist.

- Supportive growth environment in all product segments.

- Scope for market share gains in core product categories.

- Expanding addressable market through forward integration.

- Stronger competitive edge as Shivalik has expanded its technology skill sets which reduces risk of margin compression.

Full control with one business family can mean more decisive decision making. The Ghumman family are increasing investments in the business for growth (Capex, Sales/marketing team, R&D for new technologies/products, hiring professionals across various functions etc).

Shivalik enjoys growth prospects across all segments

Shunt Resistors

We estimate this segment to grow at 15-20%+ Sales CAGR for long periods of time.

Shunts enjoy structural tailwinds:

- Automotive vertical will benefit from rapid growth in Electric/Hybrid Vehicles versus ICE vehicles4 and rising usage of electronics in passenger vehicles, both which require more Shunts.

- In India, Smart Meters are key to reducing losses of discoms and is expected to grow rapidly over the next decade as only ~1.25 Cr 5out of 25 Cr target has been installed till now. Rising localisation of Relay Manufacturing6 will drive demand for Shunts, of which Shivalik should get disproportionate share. Shunts are key components in Smart meters, and we estimate the peak market size to be ~1250 Cr.7

Shivalik is a dominant player in India with 80%+ share and has scope to gain market share globally (~15% global market share) due to its strong track record on quality and cost advantage from its end-to-end India manufacturing setup. Over the next few years there is strong scope for wallet share gains with some large Tier 1 Auto customers that have been added in recent years.

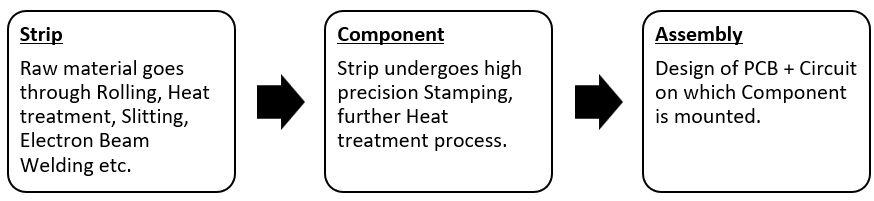

Shivalik has made meaningful progress in forward integration as it started with Shunt Resistor Strips in 2015, built capabilities for Components by 2019 and is now foraying into Assemblies.

These initiatives will expand the Total Addressable Market as Components are ~2x value vs Strips with superior margins (~400 bps higher EBITDAM) 8and Assemblies are expected to be >10x/unit Sales value versus Components albeit with lower margins. Shivalik is seeing strong interest as customers prefer an end-to-end player which reduces supply chain complexity and lowers logistic cost/product lead time. We expect this to be a meaningful PAT growth driver over time.

Bimetals

This segment is more niche and hence Sales would grow at low to mid-teens. In India, Shivalik enjoys strong dominance (~80% market share) and should grow in line or slightly faster than nominal GDP as it benefits from growth in real estate/infra.

However, with its current capacities, Shivalik can cater to ~35% of existing global Bimetal requirements versus ~15% market share at present. Shivalik has existing relationships with MNC customers (Schneider, Siemens, ABB etc) and can gain global wallet share as it offers high quality with cost benefits and supply chain reliability as global competitors such as EMS and Aperam Alloys are large $ Bn businesses for whom Bimetal is a smaller, non-strategic segment.

Electrical Contacts

This segment could grow Sales in mid to high teens for long periods. This a larger market ($1Bn globally FY25e)9 compared to the other 2 verticals, however, more competition exists.

In India, business should grow at a healthy pace driven by demand from Switchgears and Smart meters.10 The export market remains largely unexploited given erstwhile restrictions due to JV with Checon corp USA. We expect this segment to grow strongly given Shivalik now fully controls this entity and can leverage existing relationships with global customers (C&S Electric, Anchor, Legrand etc).

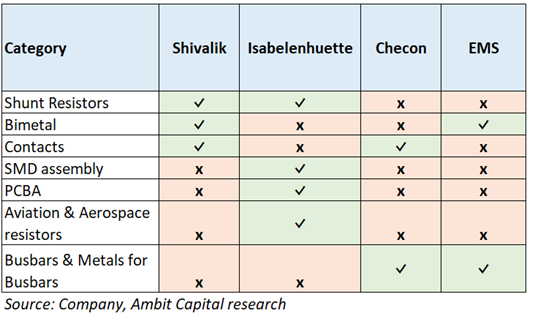

Aggregate We expect the company to deliver 15-20%+ Sales CAGR for long periods. Business is diversified so delays in one segment could be compensated somewhere else. Shivalik is expanding its Sales and R&D team and can over time enter new verticals where global peers are present thereby creating new markets.

PAT growth should be higher at 17-20%+ CAGR given multiple levers exist (forward and backward integration, operating leverage).

- Higher share from smaller high accuracy Resistors in the mix should be margin accretive.

- Forward integration from Strips to Components Assembly will add significant absolute margins. Assembly isn’t just a screwdriver operation but requires engineering.

- There is large scope for operating leverage as current capacities can deliver ~1600 Cr Sales versus ~500 Cr at present and fixed costs are ~15% of Sales. We additionally expect more Automation in the business.

- Proposed backward integration should drive improvement in margins and NWC days. It will also help secure RM supply chain given high import dependence today and lower lead times.

Shivalik generates healthy economics as products are backed by wide technology moat with low competition intensity

Shivalik operates in a highly favourable industry structure (4-5 players globally ex China11) and enjoys a strong position with 80-90%+ market share12 in Shunts and Bimetals in India.

There is strong domain expertise and sticky customer relationships with marquee global names (Vishay, Schneider, Siemens etc) with whom trust is well established.

The products are low cost (Shunt/Bimetal is ~5-10% of Bill of Materials13), but highly critical to end product performance.

- EBW Shunts are used for very precise measurement of current flow and must work in tough operating conditions for its entire life cycle (Consider even extreme situations like a car being driven uphill in negative temperature weather which results in large power drawn from the battery.) and so require high-precision welding with the Electron beam focussed on a very narrow diameter of 0.1mm to ensure metallurgical properties of alloys welded aren’t impacted. They are highly customized for each application and so switching costs are very high.

- Bimetals have strict tolerances around the physical dimensional (Thickness, shape etc) and strength of bonded material and go through stringent testing before approval.

Quality of Contact is key to good current flow and shelf life (Switches are used multiple times leading to some erosion). Precious metals like Silver are consumed hence a more efficient player can drive better cost savings.

The moat is wide, and entry barriers are high as

- Technology in this industry is closely guarded. Shivalik is a very credible player who over the last 4 decades has built its tech know inhouse and should be able to navigate new technology adoptions in the future as they have done before.

- Shivalik buys components and assemble their own EBW machines which is nearly ~50% lower Cap ex and has shorter lead time (6 months vs upto 2 years) 14versus bought out machines.

- High degree of customisation, low cost to end product, and criticality to performance means approval cycles are long and so there is no incentive for customers to switch vendors. Shivalik has in fact expanded wallet share with customers through forward integration.

This is reflected in their EBITDA margin profile (We estimate mid to high 20s for Shunts, mid-20s for Bimetals and low to mid-teens for Contacts). We estimate steady state ROIC Post tax to be upwards of 30-35%+ which is quite rare in B2B businesses. Very high ROIC means significant Free Cash Flow even after investing for growth.

Current valuations are reasonable given high ROIC business with longevity of growth

Shivalik is a very high-quality business (Dominant player, derisked, technology moat, net debt free with high ROIC) with longevity of growth. Promoters have demonstrated resilience in adversity and have grown the business in a focused manner by pursuing profitable opportunities. This will be a very hard asset to replicate.

We find current valuations reasonable for the uniqueness, ROIC and growth possibilities.

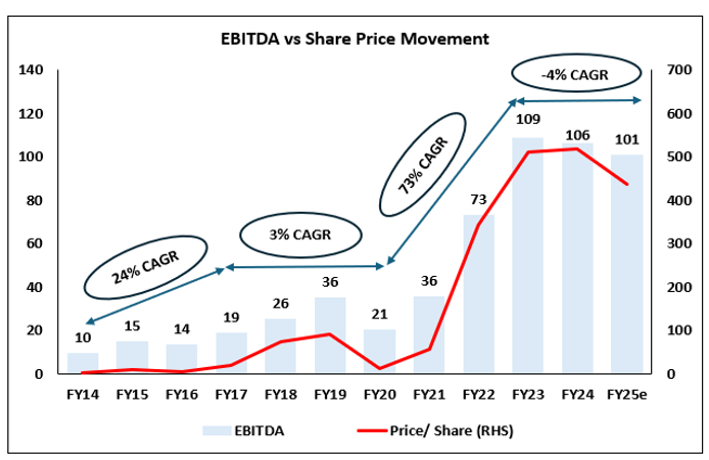

Shivalik has compounded earnings over long periods at a healthy pace even though there have been periods of slowdown in the short term. The current earning slowdown is due to softness in demand and inventory destocking impact for US automotive (particularly EVs) and softness in both global and domestic Infra, even as Shivalik has outperformed the end industry.

While markets might be concerned with weak short-term earnings growth, we are willing to stretch time given the long-term opportunity remains intact and promoters inspire trust. An ownership mindset means we need to live through periods of short-term earnings weakness. As one can see from the chart below, stock prices track earnings trajectory, and as earnings turn, the stock price will follow.

Any further price declines subject to relative opportunities, can be used to add to our position given we can go up to 8% position weight in such names.

Disclaimer

The information or material (including any attachment(s) hereto) (collectively, “Information”) contained herein does not constitute an inducement to buy, sell or invest in any securities in any jurisdiction and Solidarity Advisors Private Limited is not soliciting any action based upon information. Solidarity and/or its directors and employees may have interests/positions, financial or otherwise in securities mentioned here. Solidarity may buy securities in companies owned by its clients. This information is intended to provide general information to Solidarity clients on a particular subject or subjects and is not an exhaustive treatment of such subject(s). This information has been prepared based on information obtained from publicly available, accessible resources and Solidarity is under no obligation to update the information. Accordingly, no representation or warranty, implied or statutory, is made as to the accuracy, completeness or fairness of the contents and opinion contained herein. The information can be no assurance that future results or events will be consistent with this information. Any decision or action taken by the recipient based on this information shall be solely and entirely at the risk of the recipient. The distribution of this information in some jurisdictions may be restricted and/or prohibited by law, and persons into whose possession this information comes should inform themselves about such restriction and/or prohibition and observe any such restrictions and/or prohibition. Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. Neither Solidarity nor its directors or employees shall be responsible or liable in any manner, directly or indirectly, for the contents or any errors or discrepancies herein or for any decisions or actions taken in reliance on the information. The person accessing this information specifically agrees to exempt Solidarity or any of directors and employees from, all responsibility/liability arising from such misuse and agrees not to hold Solidarity or any of its directors or employees responsible for any such misuse and free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors.

Please click here if you would like to download the PDF version of this blog

- https://www.bseindia.com/xml-data/corpfiling/AttachHis/e9786f93-4e55-4510-9fc0-8bd0121d6c48.pdf ↩︎

- The coefficient of thermal expansion measures how much a material expands/contracts when its temperature changes. ↩︎

- Source: Shivalik IP. ↩︎

- Ambit estimates ~3x TAM per vehicle in EV/HEV versus ICE vehicles. ↩︎

- Source Ambit. ↩︎

- Shunt resistor is part of the Smart meter Relay. Mgmt. estimates 30% relay localisation at present. ↩︎

- 25 Cr Smart meters x Rs 50 Shunt value per meter. ↩︎

- Management estimate. ↩︎

- Source: Shivalik IP. ↩︎

- Rs 100/- Contact value per smart meter. ↩︎

- Basis mgmt. feedback Chinese players mainly cater to China market. ↩︎

- Source: Ambit. ↩︎

- Source: Ambit. ↩︎

- Source: Ambit ↩︎