Portfolio positioning and approach

Enclosed note discusses our approach to portfolio positioning .

Read MoreEnclosed note discusses our approach to portfolio positioning .

Read MoreWe have put together a brief note explaining our views on whether India has decoupled.

Read MoreWe have put together a brief note explaining why we don’t own commodities.

Read MoreWe have put together a brief note explaining how we take exit decisions.

Read MoreWe have put together a brief note to discuss the importance of shutting out the noise and our process to do the same.

Read MoreEnclosed note contains our perspective on some commonly asked questions.

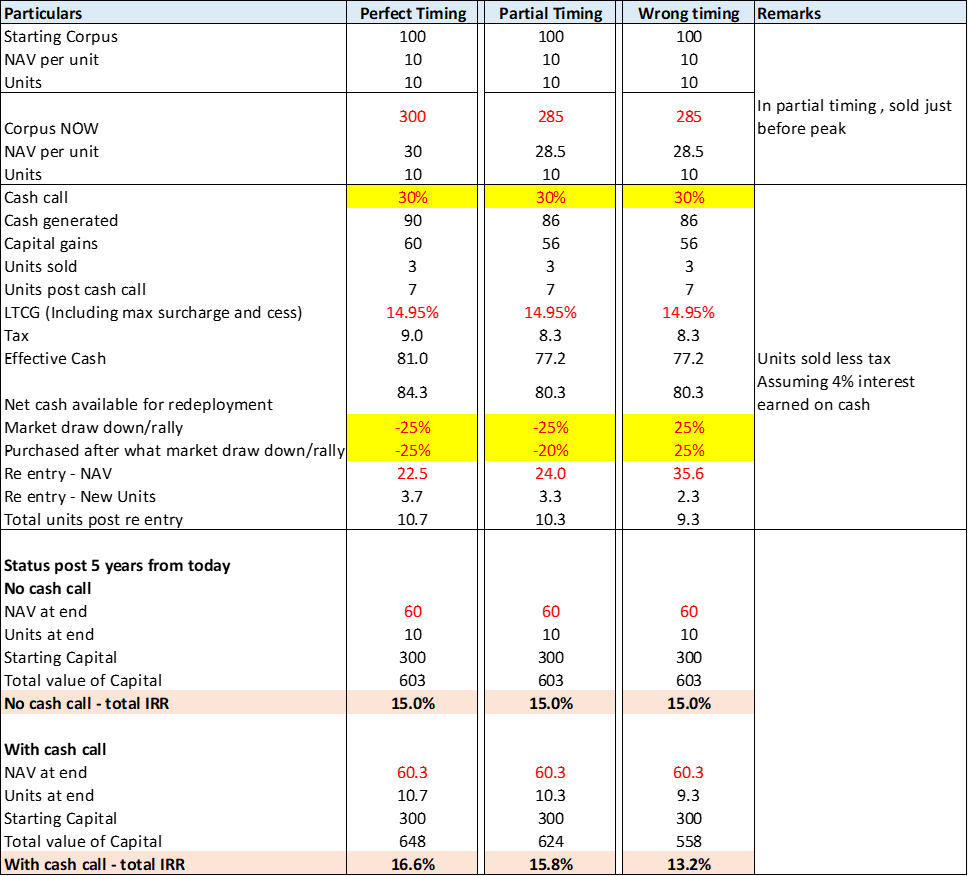

Read MoreIf one gets both legs of market timing—selling and re-entry—perfectly right, the net impact on incremental IRR versus staying invested is not significant, especially considering the probability of perfect timing is practically zero.1

We enclose calculations below:

Why is it that market timing seldom works?

Then why do people continue to be tempted by cash calls?

So how to protect against drawdowns?

At Solidarity, we firmly believe that trading and investing don’t mix as one has to train the brain to think long term during moments of stress and not freeze.

Please click here if you would like to download the PDF version of this blog

Enclosed note contains our perspective on some commonly asked questions.

Read MoreWe have put together a brief note explaining how we take exit decisions.

Read More