We are investors in the Life Insurance space with 15-20% allocation. These names have seen a steep price correction over the last 12 months with some leading large caps down over 20-25%.

We take this opportunity to explain

- Some basics of the Life Insurance industry and its economics.

- Why we like Life Insurance as a long-term compounding story.

- What could explain the share price correction.

- Our views on LIC and whether we would own it.

- Our investment stance basis current valuations at present.

Important Disclosure

- We disclose position names for transparency and context.

- We reserve the right to change our minds and may not be able to inform you if we do.

- Positions might differ from account to account as we customise each individual portfolio basis valuations at the time of entry.

Some basics of Life Insurance

The Life Insurance industry in India is a combination of 3 different products

- Savings: Mainly consists of 3 products

- ULIPs or Unit Linked Investment Plans, combine investment with Insurance. So it’s a combination of a Mutual Fund with some Life Cover.

- Non-Participatory (Guaranteed products) – Benefits are guaranteed at the start of the contract. Customers pay in premium for a certain period, post which customers receive guaranteed fixed periodic pay-outs or a lumpsum at time of maturity. Example is plans that encourage savings for children’s education.

- Participatory product: It’s a product where 90% of fund surplus is shared with the policyholder. These products have a minimum guaranteed amount payable on maturity/death, with upside shared by way of bonuses, timing of which is at the discretion of the insurer.

- Protection: This is the core product in Life Insurance where one insures for loss of life and is paid a high multiple of premium. Premium is paid over policy period and claim is paid out in event of policyholders’ death.

- Pension/Annuity: Where people are paying in money today to get payments long term to fund their retirements.

Margins vary by product.

- ULIPs are the lowest margin products whereas Protection are the highest margin.

However, from a ROE perspective, the industry claims that each product is largely ROE neutral as ULIPs require lower capital (as risk to Insurance company for the same premium is lower).

Life insurers profits are evaluated based on concepts like “VNB”, “ROEV” and ‘EV” rather than EBITDA, PAT or ROE. This is because accounting in Life Insurance is tricky.

- Customer acquisition costs are very high in year 1, but the benefit of that is accrued over long durations (Life Insurance is a long duration product). Current Accounting standards do not permit amortizing customer acquisition costs over the life of the contract. Which means the faster an Insurance company grows, the lower will be its reported profits. Hence, PAT is not a useful metric to gauge fair value.

- Insurance companies report “VNB” or Value of New Business signed up. This is the expected Profits Insurance companies expect to make on new business over the life of the contract discounted to present value.

- They also report “Embedded Value” which is the Net Present Value of future profits of all business in force added to the Net Worth of the Insurance companies.

- Hence “Return on Embedded Value” or ROEV is used as a proxy to ROE to track capital efficiency of the business.

- IFRS when implemented for life insurers will solve for this accounting anomaly, however timing of implementation is still uncertain.

Some investors do not like the Life Insurance industry as all profitability is premised on assumptions. We are sympathetic to that argument but don’t share these concerns.

- Companies disclose how their reported metrics (VNB, EV) will change if these assumptions vary.

- As a highly regulated industry, these assumptions are transparent.

- Historically, companies have been more conservative on assumptions vs what has played out in reality.

Why we like Life Insurance?

Partners are aware that we look for long duration, predictable compounding. Hence, we seek a large and growing market opportunity backed by a competitive edge.

Life Insurance companies are relatively early in their industry growth life cycle and a long runway for growth exists.

- Protection: Retail protection in India is highly under penetrated with a penetration 1of ~ 12%. The Category could see rapid growth over the next decade, as typically Life Insurance penetration picks up once a country’s GDP per capita crosses $ 2,000. The industry is now running “Sabse Pehle Life Insurance” campaign (akin to AMFI’s highly successful “Mutual Fund Sahi Hai” campaign) which should drive higher customer awareness. While Covid impacted ability to do medical tests, it also created greater awareness of the need for Life Insurance. We expect growth to pick up pace as on ground distribution challenges normalize.

Pension/Annuity: Will benefit from rising retirement savings in India (Retirement corpus has grown from ~18% CAGR over FY10-20 driven by extension of National Pension Scheme (“NPS”) to all Indian citizens in 2009 along with tax exemptions offered). Regulatory changes in 2019 have created tailwinds for Annuity players, with increase in share of Pension that needs to be compulsory annuitized (estimates suggest ~20% of retirement funds need to be compulsory annuitized), more flexibility to buy Annuities from players other than existing Pension vendor (Life insurers manage < 10% of Pension funds FY20). While LIC currently dominates Annuity market, Private players are gaining market share and will benefit from industry tailwinds.2

Savings: While there is a clear trend of shift to Financial Assets from Physical Assets, Savings products offered by insurers compete with other products in the market. Hence the “right to win” for Insurance companies is not as strong.

We are more optimistic on prospects for Term protection and Annuity, which are expected to grow faster as they enjoy structural growth drivers and are categories where insurers enjoy regulatory moats. We see runway for 15%+ growth compounding for the next decade.

Leading players have a competitive edge

- Regulatory moats: Only Life insurers can offer Term Protection and Annuity, which restricts unlicensed competition.

- Strong brands: Trust that commitments will be honoured is key. You would not buy Life Insurance or annuity from a brand you do not recognize and trust.

- Distribution strength: Insurance is a push business. Banking channels continue to remain an important distribution channel in this industry (55% of private sector premium in 2021 was through Bank branches). Leading pvt insurers have benefited from access to deep branch network of their primary banca partner 3, however focus going forward is on de-risking by adding new distribution partners and building proprietary channel.

- Capital intensity means high entry barriers: It takes ~9 years to break even. Not surprisingly, there hasn’t been a new entrant in this industry for close to a decade.

- Disruption risk from Fintech is low. Insurance start-ups like Policybazaar, Cover Fox act as enablers of growth rather than challengers.

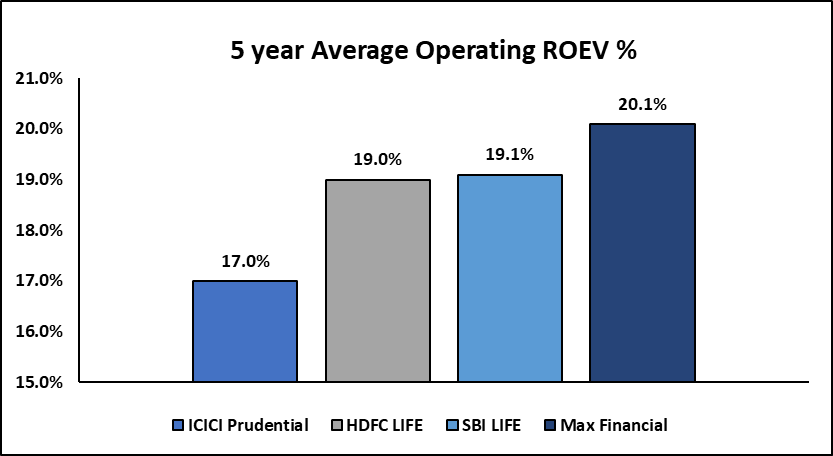

Not surprisingly, the leading private insurers (SBI Life, HDFC Life, ICICI Pru and Max Life) who are competitively placed in this industry in terms of brand trust and distribution strength have gained market share over the last few years while maintaining healthy ROEV.

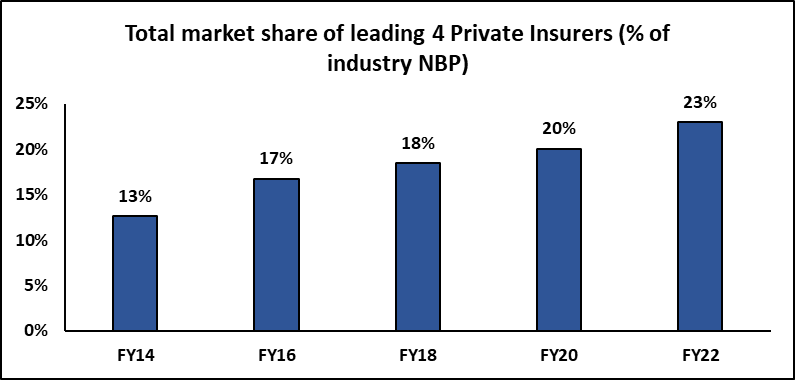

Total market share of leading private insurers (SBI Life, HDFC Life, ICICI Pru and Max Life) has been consistently improving

Source: Spark Capital. New business premium (“NBP”) is Gross premium received for newly issued policies

Note: 5 Year avg ROEV is of FY18-FY22

Why are we investing through a basket approach?

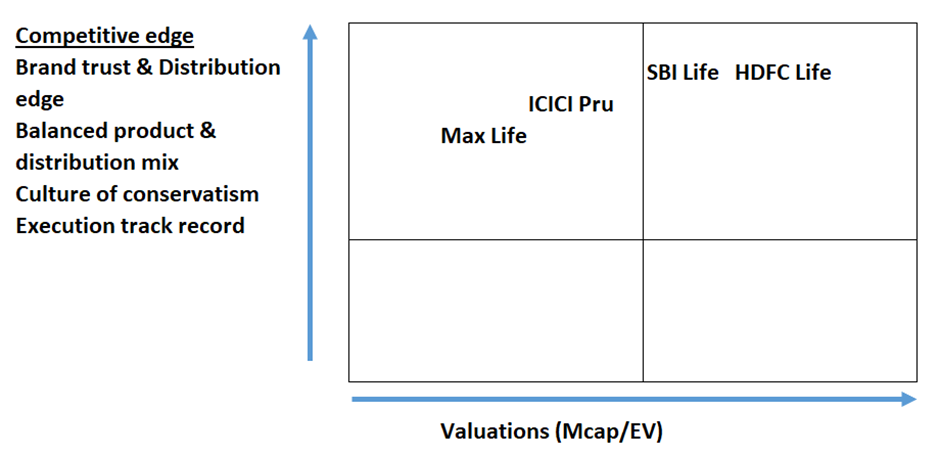

We believe the sector will do well. Each company has certain business model advantages. We have different position weights reflecting our perspective on their strength vs entry valuations. Our stance also reflects our current inability to predict who will execute the best over time. However, over time as it becomes clear who the winners are, we intend to take more concentrated bets in those insurers.

- HDFC Life has demonstrated solid execution, consistency in growth through balanced product and distribution mix, and product innovation. Despite HDFC bank open architecture challenges they have gained market share. Hence it justifiably trades at a premium to the industry.

- While other 3 players are a play on New India, SBI Life is a play on the large untapped opportunity in “Bharat”. It has unrivalled distribution through its exclusive relationship with SBI, lower productivity versus private peers today suggest large scope for cross sell to SBI customer.

- ICICI Pru Life is the market leader in retail protection – the primary purpose for which Insurance should be bought. ICICI Pru has made good progress in derisking itself from both product and distribution perspective.

- Max life has demonstrated good execution by gaining some market share in recent years despite facing challenge of Axis bank going open architecture. It is the market leader in protection via 3rd party online channels. Their Agency channel is one of the most productive amongst peers.

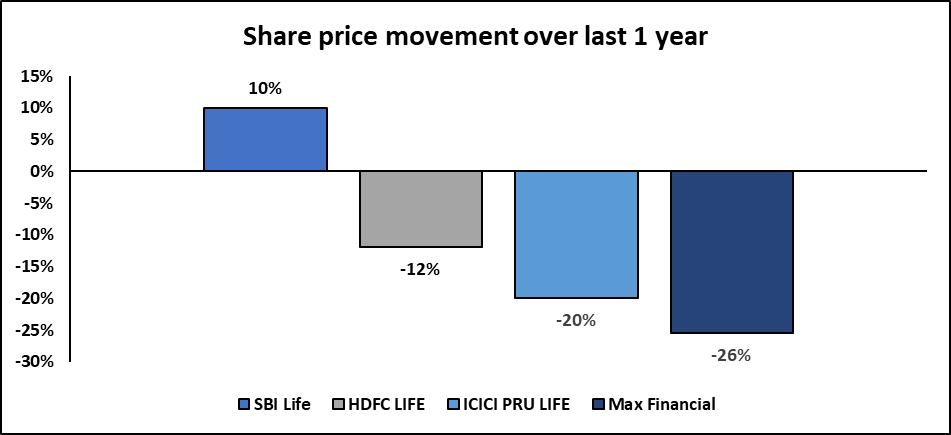

What can explain poor recent share price performance?

Note: CMP is as of 16th Dec 2022 closing

No one really knows what causes stock prices to move the way they do in the short term. Our hypothesis is that there could be 3 reasons to explain current pessimism

Temporary challenges in Protection

The Protection industry was at a nascent stage few years back and witnessed very strong growth over 2015-21, however since the last ~1.5 years there has been a temporary slowdown due to the following challenges – Higher Reinsurance prices and stricter under writing requirements enforced by reinsurers. Life Insurance companies tend to use “Reinsurance”4, i.e. sell down their risk. Over the last few years, insurers had forayed outside of Metro/Tier 1 cities, however the reinsurance rates didn’t reflect this higher mortality risk. However due to covid, reinsurers faced high losses from higher claims, post which they revisited their pricing and increased it to reflect the higher mortality risk on the insurers book. A hike in re-insurance is akin to a hike in input costs. Reinsurance is only one part of the total cost structure 5for insurers, and insurers have managed higher Reinsurance rates by taking price hikes and increasing retention limits. This frequent price hikes and changes in under writing norms has made it challenging for distribution partners to sell protection, given push nature of the product. However, feedback from insurers is that despite higher prices, demand from customer continues to remain intact, and once situation on ground stabilizes, Protection growth is expected to recover.

Temporary challenges with Banca distribution channel

Leading private insurers have exposure of 30-65% from Banca channel 6 .This channel is expected to face temporary challenges over next few quarters as Banks prioritize deposit mobilisation over cross sell of insurance products as recent loan growth has been strong and excess liquidity on banks balance sheet has been utilised. However this issue should resolve over time as pace of loan growth normalizes and insurers keep adding non banca distribution partners over time.

Impact from rising interest rates

Insurance companies are valued based on Embedded Value. A 1% increase in Interest rates has a 4.2% impact on ICICI Pru’s Embedded Value, which assuming ~2.5x Mcap/EV should translate to ~10% one-time impact on share price.

Our investment stance at present

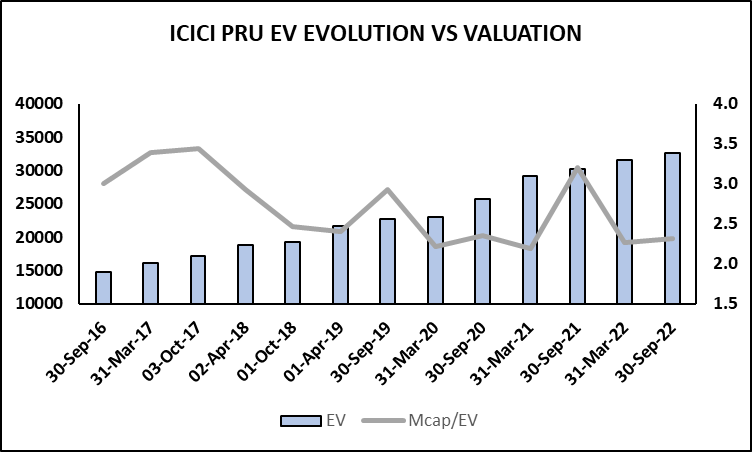

As can be seen from the chart below for ICICI Pru Life, Embedded Value growth has been broadly predictable and consistent while valuations tend to fluctuate basis prevailing sentiment.

Valuations today are very attractive across the board compared to historical benchmarks. Some names like HDFC Life & ICICI Pru are trading close to or below valuations of March 20 (Covid bottom).

| MCAP/EV | |||||

| Company Name | FY18 | FY20 | FY22 | H1FY23 | EV CAGR FY18-22 |

| HDFC Life Insurance | 6 | 4.3 | 3.8 | 3.5 | 19% |

| SBI Life Insurance | 3.5 | 2.4 | 2.9 | 3.0 | 18% |

| ICICI Prudential Life Insurance | 3 | 2.2 | 2.3 | 2.0 | 14% |

| Max Financial Services | 2.3 | 1.4 | 2.3 | 2.0 | 17% |

Note: H1FY23 Mcap is taken as of closing 16th Dec 2022

What returns could one earn from here over next 5 years? The future is unknowable. However, let’s examine what return scenarios could be for the next 5 years using very simple assumptions and ICICI Pru as an example. Assuming EV growth of 12% CAGR over FY23-28e (Lower than 14% EV CAGR over FY18-22) and valuation multiples continue to remain depressed, one can still earn ~14% IRR and so one is unlikely to lose capital even in pessimistic scenario. ICICI Pru historically has faced growth challenges due to constraints imposed by Primary banca partner 7and high ULIP exposure which faced cyclical challenges. However ICICI Pru today is much more derisked from both product and distribution perspective and well poised to grow. In Base-Bull scenario there is a roadmap to healthy 22-27% returns through a combination of growth improving and valuation re rating to fair levels.

ICICI Pru Life 5 year IRR scenarios

| Scenarios | 5 yr EV Growth | Exit MCAP/EV FY 28e | IRR: FY 23- FY 28e |

| Bear | 12% | 2.00 | 14% |

| Base | 15% | 2.50 | 22% |

| Bull | 18% | 2.75 | 27% |

Risks

Risk of higher corporate tax rates: Life insurers currently enjoy lower corporate tax rates as the Govt tries to incentivize higher insurance penetration. Currently there is no tax revision proposal in place, and we think it’s a low probability risk in the near to medium term. If and when tax rates normalize, there will be some impact on stock prices.

Asset Liability mismatch in guaranteed return products

Insurance companies sell some Guaranteed return Products which could create an Asset Liability Management risk for them if interest rates were to structurally decline in the economy as returns are guaranteed upfront while premiums are collected over time. One must note that this is not a concern at present as Interest rates in India are on a rising trajectory and Insurance companies claim that they hedge a very large portion of this business.

Impact from loss of exclusivity

ICICI Pru Life and SBI Life are subsidiaries of ICICI Bank and SBI respectively and currently enjoy an exclusive bank distribution relationship with their parent. 8In a situation where they are no longer subsidiaries, there is a risk of the Bank partner going open architecture (eg HDFC Bank at present) and resetting the pricing arrangement. The impact on margins is uncertain today, as it depends on ability of insurer to de risk over time, negotiations between Insurer and bank and insurers strategy on how much to pass on to customer.

LIC trades at a discount to private peers, Would we consider investing in LIC?

While LIC enjoys a trusted brand and strong agency network, we believe it is competitively disadvantaged versus private peers due to its Govt ownership. It has demonstrated poor product innovation (mix is dominated by Participatory products, with negligible share from growth categories like Protection etc.) and that has translated into a consistent market share decline over the years and poorer financial metrics vs private sector peers. Govt. intervention in LIC decisions can be seen from its decision to acquire ~51% stake in IDBI bank in 2019 – a move which can be interpreted as a bank bail out with no strategic benefit to LIC.

Basis our understanding at present, we will not consider LIC as an investment opportunity. We think long term and are not looking to trade for short term gains.

Summary

- Life Insurance companies offer a decadal 15%+ compounding opportunity through a combination of growth and brand & distribution led moats.

- Valuations are currently in favour – in some names, at all time lows.

- Price decline cannot be explained by fundamental factors.

- We are positive but may not add beyond our current allocation because risk management is paramount.

- Retail Insurance penetration in India as per ICICI Prudential is 12%, on the assumption that addressable population is individuals with annual income > 2.5 lacs (as per IT Dept data). ↩︎

- Source: Ambit report 26-10-2020 ↩︎

- SBI Life, HDFC Life, ICICI Pru and Max Life have benefited from access to SBI (Exclusive), HDFC bank, ICICI Bank (Exclusive) and Axis bank. ↩︎

- Insurance companies purchase Reinsurance to manage for tail risks from major claim event. ↩︎

- The MD of HDFC Life in a recent interview mentioned 10-25% in product price compensates for 40% increase in Reinsurance rates as re-Insurance as a thumb rule is ~50% of cost structure. ↩︎

- Source: Investec ↩︎

- ICICI bank accounted for ~50% of APE in 2019, and has been unwilling to sell Non Par and Par products. ULIP exposure was 80% of APE in 2019. ↩︎

- Share of APE from Anchor bank is 18% for ICICI Pru and 60% for SBI Life (Source: Investec) ↩︎