In this note we explain why Yasho’s elevated Debt at present is a considered risk and why we retain faith on a company that is executing well amidst a challenging environment.

~23% of Yasho Revenue comes from the US. It has faced a tariff shock as customers have delayed orders. This happened at a time when Yasho just finished a very large Capacity expansion which resulted in high Balance Sheet leverage (a conscious choice, as we explain below). The tariff shock has delayed the plant ramp-up. The delay, keeping in mind high leverage, has perhaps alarmed investors, some of whom have dumped the stock, which has corrected ~35% in the last six months.

Why do we have a portfolio position with very high leverage?

Debt creates fragility and we prefer no Debt or low Debt companies. However, often, low Debt companies are also those who may not be able to grow 20%+. We are willing to make exceptions in select cases where:

- The upside can be Asymmetric (rather than linear). In an earlier blog we explained what a company with an Asymmetric upside can do to a portfolio’s overall return. Read here.

- Premature Equity dilution is not in long-term equity shareholders’ interests, including ours.

- We trust promoter judgement when it is backed by a strong execution track record and customer credibility.

- We believe default on Debt repayments is a low probability event.

- There is no promoter Equity pledge which can create a death spiral.

Finally, we manage the risk of high Debt positions by position sizing at an aggregate portfolio level. ~65% of our non-Financial Services portfolio carries Nil or marginal Debt

| Net Debt/EBITDA | % of Non-Financial Portfolio | Hypothesis |

| Net Cash | ~58% | Linear upside expected with 13-18% earnings growth with longevity |

| <1x | ~7% | |

| ≥ 1x and < 2.5x | ~18% | |

| ≥ 2.5x | ~17% | Asymmetric upside: 25-30%+ earnings growth for long periods of time |

Managing optimal capital structure in companies on a very strong growth path requires trade-offs

Capital intensive businesses which are on a very high growth path need to keep funding Cap-ex. There are 3 options for the promoters: either they slow down growth, accept short periods of elevated leverage, or dilute equity prematurely before full potential is reflected in the stock price.

A promoter who believes in the long-term potential of their business may prefer to tolerate slightly higher Debt than ideal (rather than premature dilution) if they are confident that a base cash flow will ensure no default. The earnings volatility with higher Debt (an investor concern) is perhaps not a primary concern for them as they focus on the long game and Terminal Value and recognize the trade-of they have accepted.

Let’s examine this from the perspective of Yasho Industries.

For the sake of brevity, we will not discuss what Yasho does. Partners may read our earlier note on Yasho here.

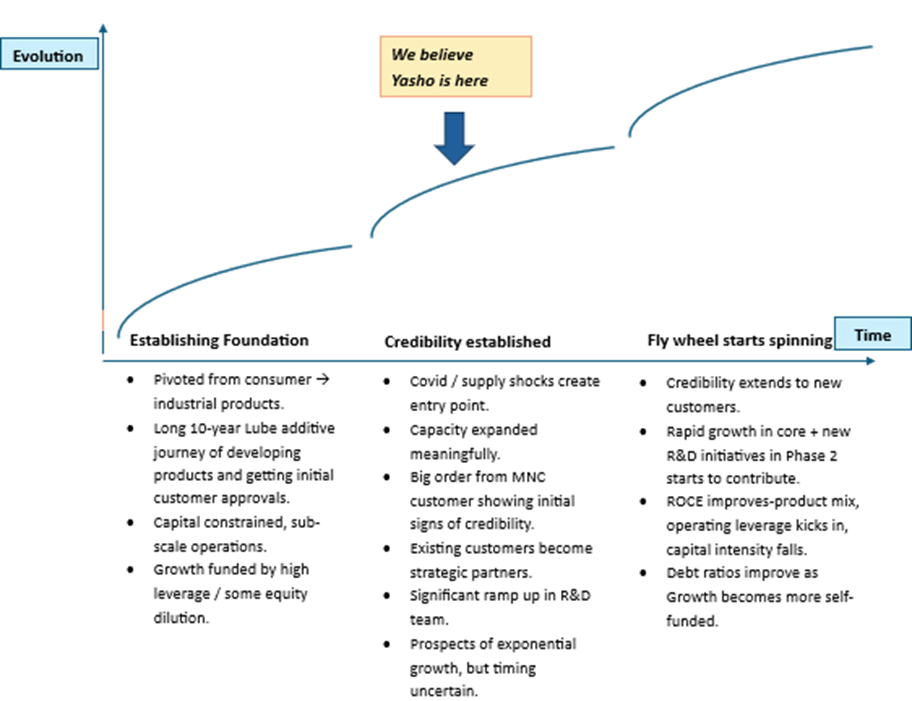

Our hypothesis on the B2B flywheel

In B2B businesses, it takes time to establish credibility. Customers need to believe in consistency of quality, reliability of delivery schedules, ability of management to install capacity ahead of growth etc.

However, once credibility is established, scale-up can be rapid. Customers not only increase wallet share in existing products but award new products as well. Credibility can be extended to new customers in the same industry. Well-run companies re-invest cash flows into new product development and additional Cap-ex to create a virtuous cycle. Companies can remain undervalued as earnings models may not capture this progression.

While Earnings have been delayed by 12-18 months due to tariffs we believe Yasho is at the cusp of a strong breakout of growth

- They have executed well in a tough environment (~30% volume growth in H1FY26, ~50% Pakhajan plant utilisation within ~1.5 years and maintained EBITDAM at ~18%) and so should strongly benefit once environment improves.

- It has done the hard work of acquiring many Blue chip MNCs customers and has won product approvals in Lubricant Additives which can take anywhere from 12 to 36 months.

- Despite tariffs Yasho continues to win new business in USA and is actively pursuing opportunities in other markets (Europe, Middle East, Asia etc).

- It is seeing initial signs of credibility from MNC customer. Not only has a customer signed a large 15 year order but it also funded the Cap-ex for the same.

- Yasho has meaningful headroom to grow post its capacity expansion (Peak Sales ~1200 Cr).

- Yasho has crossed a threshold of meaningful scale (>100 Cr EBITDA) which now allows it to invest more meaningfully in R&D talent for new product development. It has recently commissioned a new R&D lab with ~Rs 23 crore of investment.

Hence, there is a reasonable probability, that the growth flywheel can start spinning faster.

Why could Yasho not take the safer route of more linear Cap-ex growth?

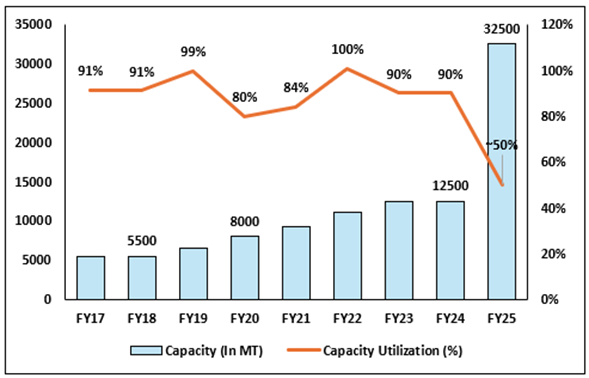

To unlock the next phase of growth, Yasho undertook a Cap-ex of ~Rs 500 Cr over FY23-FY25 from a Gross Block of ~250 Cr. This expanded its capacity by ~2.6x (from 12,500 MT to 32,500 MT). This was funded largely through Debt.

This could not have been done through incremental investments and needed a large upfront Cap-ex:

- A significant portion of the spend (~Rs 250 crores) was required to build shared infrastructure (Utilities, Effluent treatment).

- Minimum critical production capacity lowered per unit cost and added to competitive edge.

- A large upfront Cap-ex also signals to buyers the willingness to invest and be a partner in their long-term strategic plans. The current land parcel is sufficient for 100000MT capacity.

Why do we remain confident in Yasho’s ability to deliver strong growth and manage Debt servicing?

Yasho operates in a large and growing market (~USD 15bn+ TAM across products). And is seeing significant opportunities in Lubricant Additives, where it is a < USD 50 Mn player in a very large USD 10 Bn+ industry, giving it ample room to grow.

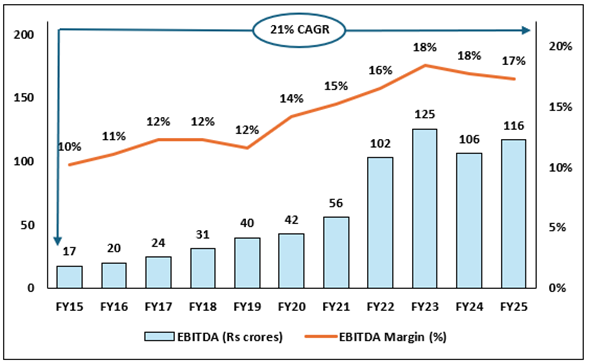

The company has executed very well in the last decade.

- The company has compounded EBITDA at ~21% CAGR while margins have steadily expanded (from 9% in FY15 -> 18% in TTM Q2 FY26), driven by a rising share of higher-value industrial products in the mix.

- Has historically demonstrated the ability to sweat its assets well and run at peak utilizations. Growth was constrained in FY23-FY24 due to capacity constraints.

- The business today is in a structurally stronger position – ~4x larger scale, ~18% EBITDA margins vs ~10% a decade ago, and much stronger customer credibility.

Note: FY25 is Solidarity estimate.

Yasho continues to execute well in FY 26 despite the weak macro environment and tariff shock.

- Volumes grew ~30% in H1 FY26 vs. H1 FY25.

- Within ~1.5 years of commissioning, the new plant is operating at ~50% capacity utilisation.

- Maintained EBITDA margins at ~18% 1despite low sales growth.

The market’s concerns on Debt Servicing are rational.

- While they raised some Equity (~Rs 125 crores in Dec 2024), the Net Debt/EBITDA ballooned during construction and has stayed high (Currently at ~4.4x).

- EBITDA trajectory has been pushed back by 12-15 months due to the tariff shock.

However, we believe Debt servicing is comfortable, despite delays in ramp.

- Term loans have a back-ended repayment schedule with low repayments in the initial years (~Rs 9 crores in FY26 and ~Rs. 32 crores in FY27) and step up in later years.

- Even if we assume a ~Rs 90 crores EBITDA from the old Vapi plant (vs. FY23-FY25 average of ~Rs. 108 crores, factoring in the US impact) and a gradual ramp up in the new Pakhajan plant, interest and principal payments can be comfortably serviced.

- Inventory was built to service orders which were delayed due to tariffs. As these orders start flowing to the US/new markets, cash will be released.

A large strategic outsourcing deal that was recently signed supports the growth break out hypothesis.

- Yasho has recently signed a 15-year agreement with a global MNC for the supply of lubricant additives, with an annual contract value of ~Rs. 150 Cr starting end-FY27. Notably, the customer is also funding the capex for the dedicated facility, which is uncommon in such arrangements and reflects a high degree of confidence in Yasho’s capability and execution. It also signals shortage of quality suppliers.

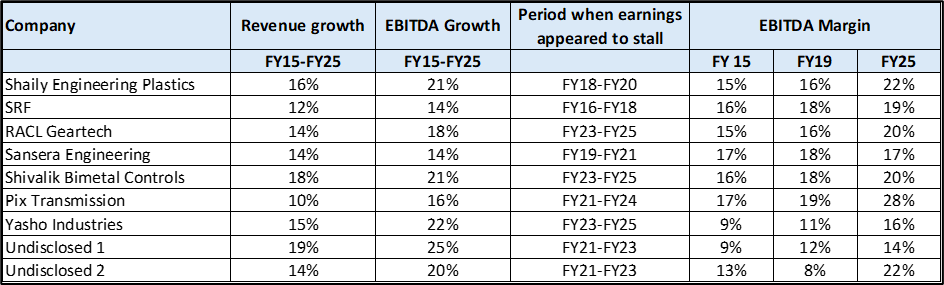

- Our experience of owning B2B businesses suggests that the first large order is typically a “starter order” to test quality/delivery at scale. Once comfort is established, the business can scale up meaningfully over time. For example, Shaily Engineering sales with its first major strategic customer have grown >10x over last 12 years.

- As explained earlier, these wins attract other global customers through borrowed credibility. Consider a few examples, Privi Specialty today supplies Aroma Chemicals to all the top 10 global fragrance companies, who control ~80-90% of global market; Blue Jet Healthcare supplies critical intermediates to 3 out of top 4 global contrast media players, where top 4 control ~75% of the global market. SRF works with all the 4 innovators companies in Agro-Chemicals.

We believe Yasho is now on a similar trajectory if it can continue to execute well.

Progress in business is seldom linear. Most companies face unexpected turbulence where progress appears to stall. One needs to look at Operating metrics in such periods to take cues – customer wins, capacity additions, new product development etc. If these are tracking well, companies tend to revert to growth trajectory and become better businesses over time.

We believe Yasho is currently trading at attractive entry valuations at present.

- Despite capacity and capital constraints, Yasho grew operating profits at 20%+ CAGR over the last decade. Now with capital constraint released, capacities in place, product approvals and strong customer wins, we believe Yasho is far better positioned vs. the past.

- While it’s difficult to model growth when companies are on a non-linear growth phase, we believe Yasho could be a ~Rs 1,700-2,000 crores Revenue company (~20-25% CAGR) with ~18-20% EBITDA margin and ~18-22% pre-tax ROIC by FY30 from an estimated ~800 crores Revenue in FY26e.

- Assuming ~300-400 Cr EBITDA by FY30e combined with a 15-20x EV/EBITDA multiple, the company could be valued at ~4,000-7,500 Cr Market Cap by FY30 versus ~1600 Cr Market Cap today. This presents the opportunity of an Asymmetric upside in the next few years if our hypothesis plays out.

Please click here if you would like to download the PDF version of this blog

- Management guides for 17-19% EBITDA margin band. ↩︎