In an earlier blog, read here, we discussed the importance of seeking Asymmetric outcomes.

What are conditions under which one could find Asymmetric outcomes? One needs:

- Large and growing market opportunity that creates opportunity for rapid profit growth at acceptable ROEs (18%+)

- A promoter that will continue to invest for growth but not be imprudent with risk taking. Is enhancing organization’s capabilities.

- Broadly acceptable entry valuations.

- Patience – you need time to allow compounding to work and progress is seldom linear.

We believe Yasho Industries fulfils all these conditions at present.

What does Yasho do?

Yasho is a Specialty Chemical company that makes.

- Consumer chemicals: Food and Aroma chemical are categorized under this segment are ~18% of Yasho’s topline. We believe this segment is about 6-8% EBITDA margins.

- Industrial chemicals: Rubber chemicals, Specialty chemicals, and Lubricant additives are categorized under this segment and are ~82% of Yasho’s topline. We believe these are specialty products where EBITDA margins are 20%+.

Using a Pharma analogy, one can think about Yasho as an intermediate supplier that supplies products to API Manufacturers and Formulators. Yasho focuses on segments where Amine chemistry is the basic building block.

Yasho manufactures ~150 products across the 2 segments at present and generates > 60% of its sales from the export market, primarily US and Europe.

The promoters are technocrats with the third generation also in the business. The company was founded by Mr. Vinod Jhaveri, Chairman and Executive Director, in 1985 and is currently headed by his son Mr. Parag Jhaveri, Managing Director and CEO. Mr. Parag Jhaveri did his MSc in Chemistry from Mumbai University. Mr. Dishit Jhaveri (son of Mr. Parag Jhaveri) is also an MSc in Chemistry and heads the R&D department. Mr Yayesh Jhaveri, younger son of Mr. Vinod Jhaveri, was earlier CFO but now looks after procurement, logistics, supply chain management and production planning.

Yasho has significant growth opportunity in Industrial Chemicals

“+1” is a significant opportunity for Manufacturing cos in India and especially Specialty Chemicals. Every company realizes the urgent need to de-risk supply chains as there are increasing geopolitical and trade conflicts between China and other large nations. Europe has seen a structural energy shock as cheap gas through pipeline from Russia is no longer available. European suppliers are responding by closing unviable plants and product lines. This sows doubts in customers’ minds and leads to a search for new reliable suppliers in other geographies. We discuss this in more detail in a subsequent section.

India is very competitive as a sourcing destination in Specialty Chemicals with ~15-20% lower on a delivered cost vs European suppliers due to lower labour and compliance costs with comparable quality standards.

Indian suppliers are slowly, but surely, gaining respect for quality. The “+1” trend will play out across many product segments where there can be no compromise on quality or delivery timelines.

Here is a quote from the Q1 FY24 conference call from RACL Gear Tech, a portfolio company in Auto Components that is also benefitting from the “+1” trend. “Nobody could imagine. Maybe not 10, maybe 15 years back. Nobody could imagine that the European customer will buy gears from India. 20 years back no European customer would have even thought to buy even the plastic component from India. So gradually, India is also gaining much respect and command into a global market.”

There is a large Opportunity for Yasho to take share of global supply chains in Industrial Chemicals.

Starting market shares are low.

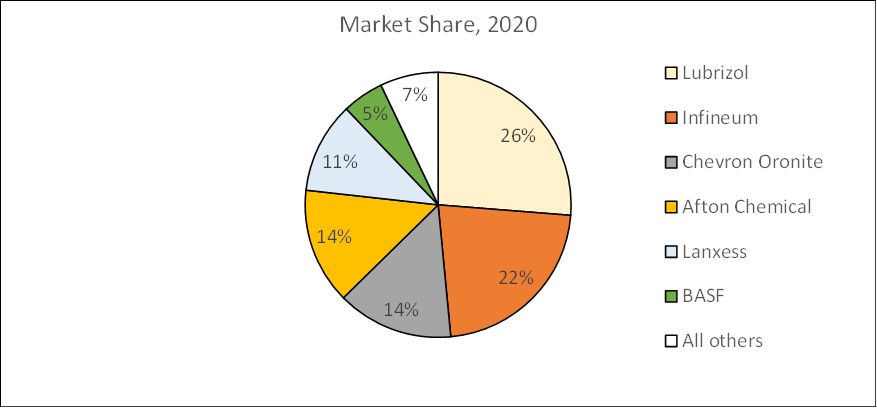

- Lubricant Additive 1 is a USD 15 B market where Yasho has <0.1% market share.

- Rubber Chemicals is a USD 5 B export opportunity where Yasho has <1% market share (China at 27%).

- Plastic Additives/stabilizers 2 which are a USD 500M export opportunity where Yasho has <1% market share (China 8%). 3

In summary, the market is large enough for Yasho to grow multi-fold from <USD 100 M revenue today.

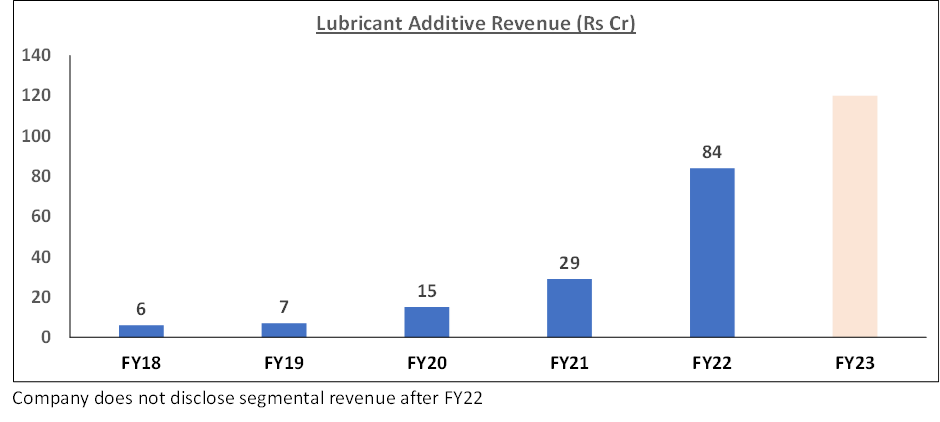

The segment of interest to us is Lubricant Additives which we believe will define the next stage of growth.

The Asymmetric growth opportunity in Lubricant Additives.

As the name suggests, these are inputs for manufacturing Lubricants used in moving parts of an industrial machinery or an automobile component.

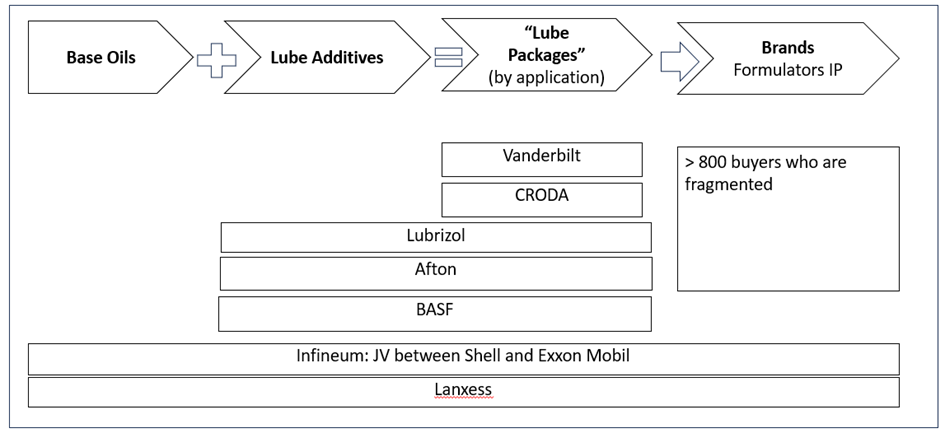

Key players in the Lubricant Value chain are as follows:

- “Package” suppliers have proprietary technology on product formulas which will give superior results for various end uses. E.g. Vanderbilt, CRODA

- The “package” suppliers could buy Base Oils (from refineries) and different additives to make the end products and in turn sell these to end brands.

Brands could have their own proprietary blends and could buy Base Oils and additives from different suppliers or buy the formulas from “package” suppliers.

The Lubricant Additive industry is very concentrated with 6 suppliers having >90% market share. 4 There are no large Chinese players.

The entry barriers to Lube Additives are very high.

- Quality of additives (purity requirements) are stringent and key to performance of the lubricant. Product failure could lead to accidents, resulting in loss of human lives and failure of expensive equipment.

- There is no incentive for end brands or package suppliers to change vendors, especially as the Additive is a small share of the product costs.

- Lube Additive suppliers do not share technology. The edge is the process knowhow (proportion of raw materials to mix, sequence, temperature). This knowledge has been developed and accumulated over time and retained within the team as “soft knowledge”.

- Players intending to enter need to invest in product development and testing time periods are as high as 3 years. The time taken to identify a product niche, master quality, build credibility with customers, acts as a moat. 10 years after entering Lubricant Additives, Yasho only has ~84 Cr Revenue in this segment in FY22. 5

On the other hand, Buyers are very fragmented. 6 There are over 800 brands selling lubricants and about 10 of them have about ~50% market share with the balance shared between the others.

What makes things interesting is that many Lube Additive players compete with their customers as they have interests across the value chain. This is the opportunity for Yasho as small brands lack supply security and this has been exposed due to multiple supply chain disruptions in the last few years.

| Date | Supply chain disruptions |

| Sep 2019 | Fire broke out at Lubrizol’s additives plant in Rouen, France. |

| 2020 | Covid pandemic related disruptions |

| July 2022 | Flooding causes AFTON to close facility and declare Force Majeure |

| Dec 2022 | Extreme cold weather in Texas renders shutdowns of several oil refineries and petrochemical plants |

Yasho has a proposition for many segments.

| Potential segment | Yasho value proposition |

| Lube Additive player | Outsource low value product range and keep high value products in house when profitability is a key challenge, especially in European plants |

| Package supplier | Buy Lube Additives from non-competing source |

| Distributors | Buy Lube Additives from non-competing source to supply to smaller brands |

| Small brands | Buy Lube Additives from non-competing source |

Covid disruptions provided Yasho a foot in the door.

Due to supply chain issues during Covid and subsequently in 2021 and 2022, many chemical manufacturers declared force majeure 7 on their contracts with customers. Yasho’s credibility got enhanced as it kept its delivery commitments.

We believe Yasho could grow earnings at 20-25%+ for long periods of time.

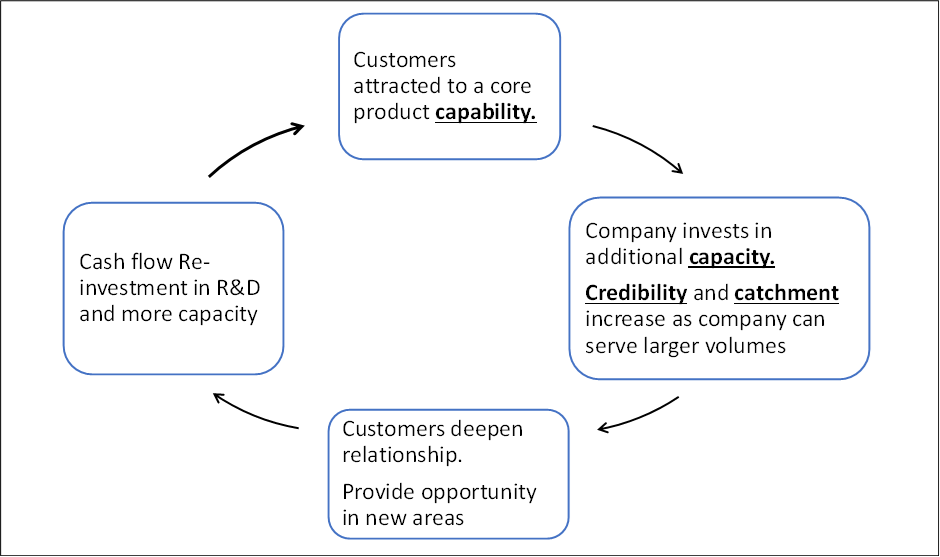

For any B2B company, credibility is the hardest to establish. No customer will give long term volume commitments unless they have seen a working plant which can deliver quality at scale. Hence, one needs to invest ahead of time to demonstrate commitment, reliability, and ability to deliver at significantly higher scale.

However, credibility scales exponentially once trust is established. It makes no sense for customers to cultivate a strategic supplier and then give it a non-material share of their business as that creates needless complexity without de-risking. Enhancement of capacity also attracts new customers who see a new supplier with ability to supply large volumes. Hence, existing credibility, and re-investment of cash flow feed for capacity and new product development feed on each other to create exponential growth from greater wallet share of current products, entry into new products and as new customers gain confidence to work with you basis experience of their peers.

We believe Yasho could evolve in a similar fashion in Industrial Chemicals.

- Yasho has credibility with customers as can be seen from its blue-chip customer list (Lanxess, Michelin, Huntsman) and that it has always operated close to peak utilizations. This credibility enjoyed a further boost during Covid when it could ship products when its competitors struggled.

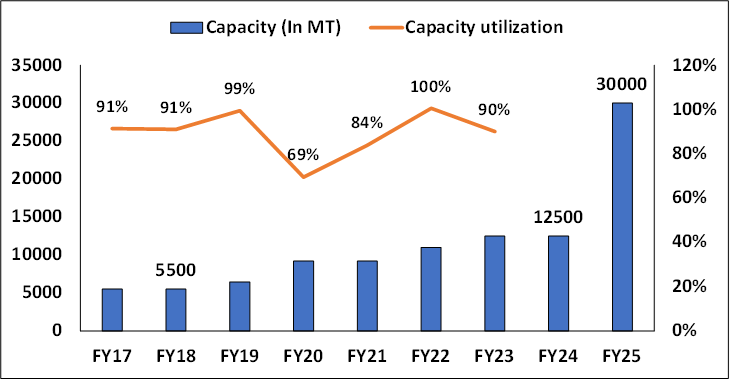

- It currently faces a capacity constraint which is now being eliminated. Yasho is doing more Cap ex in the period FY 22-FY 24 (400 Cr) than it has done cumulatively in the first 25 years of its existence (GFA FY 23 is 280 Cr).

- There is a visible step up in R&D efforts for future products. The R&D team has been strengthened from 6 people in 2019 to 38 people in 2023. They have recently hired a professional CFO which shows intent to upgrade talent in line with company scale.

Yasho has good credibility with customers reflected in its history of execution.

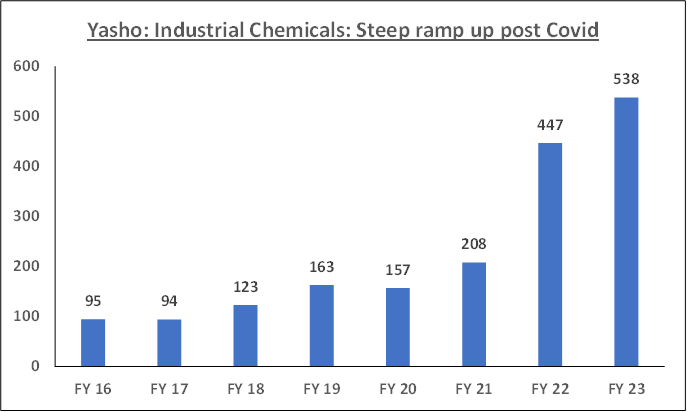

It has historically operated at peak utilizations despite increasing capacity by >120% in last 5 years. Industrial Chemicals (Lube Additives, Rubber Chemicals, Specialty Chemicals) have grown at over 25% CAGR in the last 7 years with a steep jump up in Revenue post Covid reflecting the de-risking tail wind.

This growth could have been even faster if Yasho did not face capacity constraints.

Industrial products are validated by site. One cannot supply from new locations without extensive product testing which costs time and money. Hence, Yasho may not have been able to interest customers who wanted to source large volumes as they would find Yasho’s existing location at Vapi unsuited for their needs as capacity utilizations peaked and there was no space at that site to expand capacity.

The capacity constraint is now eliminated as a new plant comes on stream in Q4 FY24.

A 45 Cr QIP in 2021 provided Equity capital to undertake a significant capacity expansion. A 42-acre plot of land was bought in Pakhajan (Dahej) which is sufficient for 10x current revenue. Capacity is being built in phases with Phase 1 of 17500 MT which will expand total Yasho capacity from 12500 MT to 30000 MT. This new plant goes on stream in a few months.

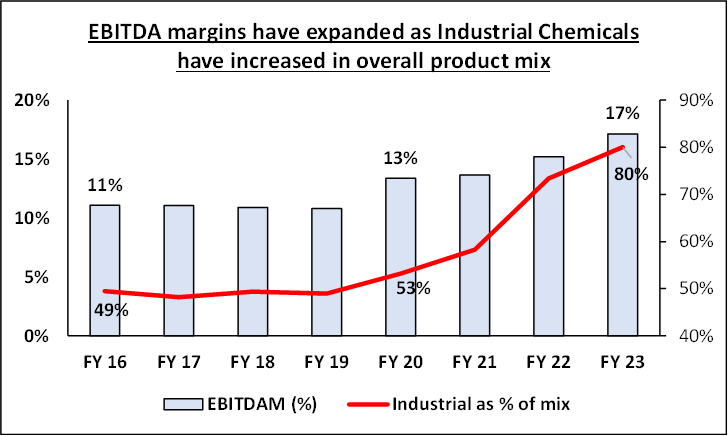

Growth could be accompanied by margin expansion 8and better Asset Productivity.

We expect Gross Margins to expand over time from ~38% at present.

- About 18% of Yasho revenue at present is from Consumer chemicals which are commodity, with low entry barriers and are significantly lower margin than Industrial Chemicals.

- We expect share of revenue from Consumer Chemicals to reduce over time both as Vapi capacity is used for Industrials and as the new plant will only produce Industrial Chemicals. Hence, a better product mix will support better margins.

As Yasho grows in scale, it can backward integrate into certain raw materials which are subscale to manufacture in house at present.

The overhead and distribution costs as % of Sales should also reduce over time.

- ~60% of Yasho export sales are through distributors at present who supply to smaller brands. As Yasho gains credibility with customers, direct customer contacts can eliminate intermediaries and add to margins.

- Finally, there should be some Operating leverage on fixed costs.

Hence, we expect the aggregate margin profile of the company to climb higher over time.

Fixed Asset turns will initially dip, but then improve over-time.

- Phase 1 will have ~400 Cr Cap ex that could generate ~550-600 Cr Revenue

- Phase 2 will need 150-200 Cr Cap ex for the next incremental 500-600 Cr Revenues as common infrastructure would not need addition. (~200 Cr Cap ex in Phase 1 is on common facilities (Effluent treatment plant, Utilities, Admin block). 9

Hence, at 40-42% Gross Margin, Yasho could be a 20-22%+ EBITDA margin business that generates 25% pre-tax ROIC. ROIC of well-run manufacturing companies improves over time as plants get older and growth slows. As plants get depreciated, ROIC expands. Spot ROIC should always therefore be seen alongside the vintage of old and new plants in GFA and how much GFA is on common infrastructure.

This is a team that inspires confidence.

Operating profit has grown consistently over time and continually re-invested in Cap ex.

Management has demonstrated resilience over time in the face of adversity. They have a long-term vision but are also very granular in their thinking. We like that they are not giving outrageous vision projections and refusing to talk about capacity plans beyond Phase 1 of the current expansion. Our channel checks with customers and people in the eco system delivered strong references. And with ~72% holding, promoters have skin in the game.

Valuations and position sizing.

While we are confident of direction (strong growth in Yasho profits), we cannot model trajectory as there are multiple variables at play.

- On the one hand, there is a need for customers to secure supplies.

- On the other hand, the developed world is facing recessionary conditions combined with de-stocking of inventories and competitors are dropping prices to fill up plants. Customers will also need to validate quality from the new plant.

One cannot know which variable will overwhelm the other in the short term. It is for this reason that while we believe that while strong PAT growth is possible, the path to get there could be non-linear and will be unpredictable.

DCF is not useful when companies are in the early stage of their growth life cycle and have a large market opportunity. Short term growth rates and terminal value are impossible to predict. If a business is poised for non-linear growth, 1 Yr forward PE multiples are woefully inadequate.

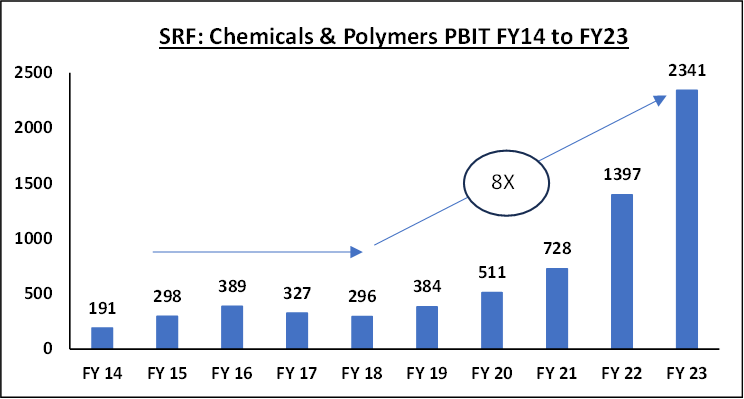

For an example of growth with non-linearity, consider the example of SRF Chemical division.

- Performance was indifferent between FY15-FY18 as the Agro cycle was weak. Despite that, SRF kept expanding capacity because of promoter belief in the importance of demonstrating credibility, commitment and looking beyond the short term.

- When the cycle turned, EBIT grew from 296 Cr in FY18 to 2341 Cr in FY23 (8x in 5 years), aided both by promoter vision and additional boost due to de-risking from China.

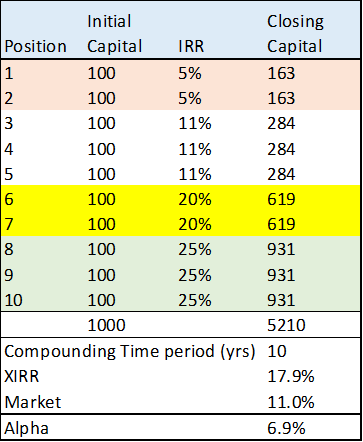

For companies with prospects of non-linear growth, we find it useful to think about fair entry prices using scenarios of medium-term targets, exit multiples at those points, and then position size basis the phase of maturity a company is in.

We believe Yasho could be a ~175-225 Cr/500-600 Cr PAT company in in 5/10 years (vs ~65 Cr today). If they execute even at the lower end of this range, 30x FY23 PAT is a good entry price to pay. This is our base case hypothesis on which we have taken about a 5% entry position. As one gets confidence that the thesis is on track, one can increase the position size and continue to play for Asymmetric upsides. Emerging Leaders with Asymmetric upsides are lower probability bets than Clear Leaders as they are more vulnerable to events beyond their control and management teams are untested at scale. However, they provide much higher upside if they work. One needs intellectual arrogance (“we believe this can be 10x in 10 years”) combined with the humility that you will not get all calls right. Adequate diversification, position sizing and willingness to make appropriate course corrections (“strong opinions weekly held”) should ensure a good outcome for the portfolio in aggregate if one has done their research well and then lets the few big winners run.

Risks we are aware of

Do Lubricant Additives face Terminal value risk due to EVs?

Of the USD15 B Lubricant Additives market, the Automotive segment is ~60%. CVs face lower EV risk than Passenger vehicles. There are applications of Lubricants in EVs as well. Existing stock of Passenger Vehicles will still be on roads. Other Industrial Verticals of Yasho are also growing well and we expect the company to de-risk over time as they extend credibility to new product segments.

Leverage on Balance Sheet

Capacity expansion has been done just when the world looks more challenged economically and geopolitically. Yasho Balance sheet is extended at present as it has taken on Long term Debt to fund Capital expansion. FY23 Debt/EBITDA at ~2.6 is high and will be ~ 5.0 by March 24 before reducing in FY25 as higher production from expanded capacity translates to profits and cash flow. Under normal business conditions, Yasho should not have a problem servicing Debt. Interest (~45-50 Cr) and Principal repayments are ~25 Cr a year for FY25 and FY26 against expected EBITDA of ~100-115 Cr in FY 24 from the old Vapi facility. The new facility will contribute additionally basis pace of ramp.

While the future is unknowable, a deep demand shock barring an event like Covid is a very low probability event.

- Yasho has a strong track record of high-capacity utilization in prior years. Despite global inventory de stocking, volumes in H1FY24 were the same as H1FY 23 as ~60% of business volume is long term contracts.

- Lubricant Additives being consumables are not very sensitive to economic downturns and we estimate the share of contribution of Lubricant Additives to total EBITDA is increasing exponentially.

This is a risk we are willing to take and is to be managed through position sizing. These are unavoidable risks for promoters every time they embark on large scale capital expansions and the trade-offs are always between raising equity too early or living with higher Balance Sheet risks basis confidence in business resilience.

Please click here if you would like to download the PDF version of this blog.

Disclaimer

The information or material (including any attachment(s) hereto) (collectively, “Information”) contained herein does not constitute an inducement to buy, sell or invest in any securities in any jurisdiction and Solidarity Advisors Private Limited (Solidarity) is not soliciting any action based upon information. Solidarity and/or its directors and employees may have interests/positions, financial or otherwise in securities mentioned here. This information is intended to provide general information to Solidarity clients on a particular subject or subjects and is not an exhaustive treatment of such subject(s). This information has been prepared based on information obtained from publicly available, accessible resources and Solidarity is under no obligation to update the information. Accordingly, no representation or warranty, implied or statutory, is made as to the accuracy, completeness or fairness of the contents and opinion contained herein. The information can be no assurance that future results or events will be consistent with this information. Any decision or action taken by the recipient based on this information shall be solely and entirely at the risk of the recipient. The distribution of this information in some jurisdictions may be restricted and/or prohibited by law, and persons into whose possession this information comes should inform themselves about such restriction and/or prohibition and observe any such restrictions and/or prohibition. Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. Neither Solidarity nor its directors or employees shall be responsible or liable in any manner, directly or indirectly, for the contents or any errors or discrepancies herein or for any decisions or actions taken in reliance on the information. The person accessing this information specifically agrees to exempt Solidarity or any of directors and employees from, all responsibility/liability arising from such misuse and agrees not to hold Solidarity or any of its directors or employees responsible for any such misuse and free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors.

- Lubricants such as engine oil, brake oil, grease, etc. find application in Industrial machinery and Automobiles. Of the USD 15 B Lubricant additive market, ~60% are used in Automotive and balance in Industrial applications. ↩︎

- Stabilizers are additives added to plastics to afford protection against heat, UV, and mechanical degradation of the polymer during processing and use. ↩︎

- Source: McKinsey – The Indian Chemical industry – unleashing the next wave of growth. ↩︎

- Source: Kline Group ↩︎

- The company stopped reporting product revenue in the Industrial segment from FY23. ↩︎

- Source: Fuchs Investor Presentation ↩︎

- https://www.icis.com/subscriber/icb/2021/03/19/10619109/force-majeure-chaos/ ↩︎

- It may interest partners to note that PBIT Margins for SRFs Chemicals division have expanded from 16-18% in FY16-FY 18 to about 27% In FY 22 ↩︎

- These numbers are basis management guidance on quarterly calls but are not out of line with what other well run Chemical companies guide for in Asset turns with similar margins. ↩︎