Star Health is a Health Insurance company primarily 1 focused on the retail segment. This is a business we would like to own for long periods of time.

- It offers a product which has a tangible value proposition – Health insurance is something we think everyone should own.

- Dominant leadership position in a large and growing market with a long runway for growth.

- Attractive business fundamentals supported by high repeat purchase, agent stickiness and ability to correct pricing errors through product repricing.

Potential to grow PAT ~18-20%+ for next decade while earning 16-18% Accounting ROE and 25%+ Cash ROE with a “win-win” for the entire ecosystem.

Retail Health insurance offers a long runway for growth

The Retail Health Insurance industry has grown premiums at ~20% CAGR over the last decade. It could continue to grow premiums at 15%+ CAGR for long periods of time from increase in penetration, higher unit price per policy through price increases and increase in sum assured per family as incomes increase. The category remains under-penetrated with only ~4% Retail Health insurance penetration and a large share of healthcare expenditure being incurred out of pocket (~55% in India versus 18% global average). While the Covid pandemic has resulted in losses to the industry due to higher claims, it has been a long-term tailwind as it created greater awareness on the need to own health insurance.

Dominant market leadership through largest agent base and best cost structure

Retail Health insurance is largely an assisted purchase product due to nuances around exclusions. Most customers also want an agent to help with claims in the event of hospitalization. Not surprisingly, about ~75% of industry premiums are through agents, unlike Life Insurance where Banking channels play a larger role (~55% of premiums for private life insurers). Regulations permit agents to represent at-most one SAHI2. Star enjoyed first mover advantage within SAHI & recognized the importance of agents early and leads the industry today with the highest number of agents.

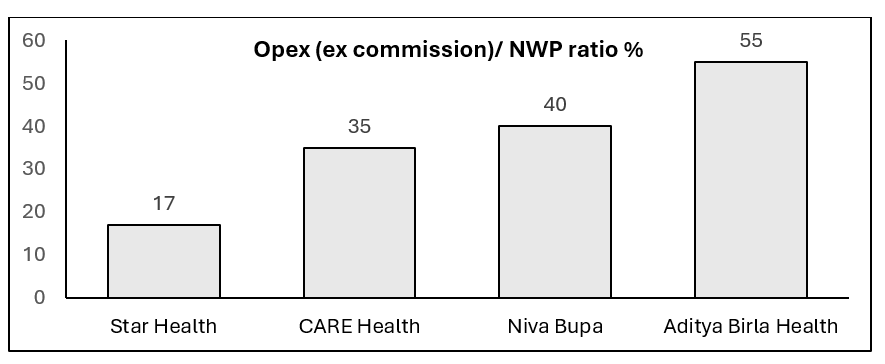

Star has ~3x the market share of its nearest competitor in Retail Health and has increased its market share from ~13% in FY14 to ~32% in Q1FY23. Market leadership gives Star scale benefits and cost leadership (lowest Operating Expenses/premiums) over its competitors.3

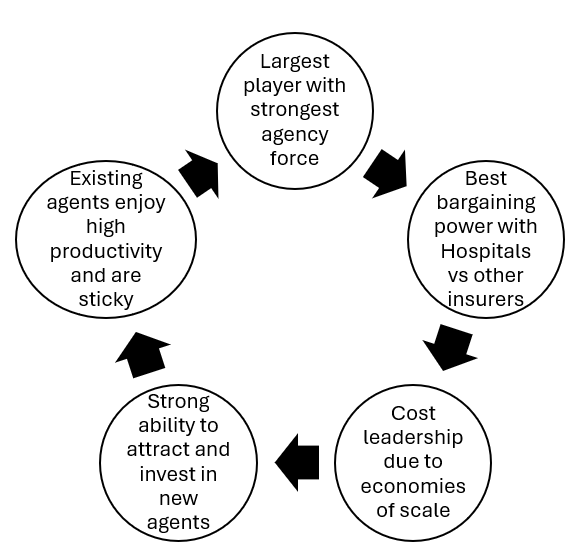

The largest Agency network and cost leadership results in a virtuous cycle that should help defend and grow market share.

- Star has the largest hospital network amongst peers which is attractive to customers and agents and enables the most competitive rates with hospitals for procedures.

- Scale gives the ability to invest in an in-house claims team which can further help reduce Claims vs use of TPAs4

- Star agents enjoy 50% higher productivity 5vs the next best SAHI Niva Bupa (1.78 lacs vs 1.19 lacs in 2022) which aids agent stickiness.

- New draft regulations around expense management are more stringent 6and should continue to benefit larger and more cost-efficient health insurers like Star.

Hence, Star should be able to generate superior ROEs vs peers even if its claim ratios are a bit higher.

The steady-state economics of this business are very attractive

A Health insurance company makes profits from two streams – Underwriting profits and investment management of float and proprietary capital. Underwriting premiums are generated through the sale of insurance policies. Expenses mainly consists of Claims. Other expenses are commissions (Upfront & renewal), other expenses like employee costs, branch costs, technology & brand spend etc. An insurer makes underwriting profits when the premium earned is greater than its expenses.

Investing in a Health insurer is a leap of faith that economics will sustain as different expense lines evolve over time.

- Claims for each cohort tend to increase over time as exclusions wear off and propensity of medical issues increases with age. This is compensated by inflationary price increases inbuilt into product pricing and ability to increase prices for certain products which have higher claim ratios. Better risk management tools, fraud analytics and better product mix will also help.

- Operating expenses reduce with time. Customer stickiness tends to be high, with customers rarely porting. Star had a 94% renewal rate in 2022. Hence, customer acquisition costs/premium decline over time as renewal commissions are lower than first time commissions. Fixed cost operating leverage reduces expenses/customer over time.

- We believe that Accounting underwriting profits for a well-run Health Insurer will sustain at about 2-4% of Gross Written Premiums over time.

An insurer generates investment income from Investment float7 and proprietary capital of the insurer. Investments are mainly in Fixed income instruments, with small exposure to Equities which results in a blended annual yield of ~7-7.5%.

We believe a typical Stand-alone Health Insurance player will operate at ~14-16% steady state Accounting ROE. Star being the dominant market leader with scale benefits should be higher at ~16-18%, even adjusting for higher claim ratios vs peers.

However, accounting ROE understates the true cash profits of the business. Accounting norms require Expenses (commission and other expenses) to be booked fully upfront in the year they are incurred, whereas revenue (Net Earned Premium) is recognized on an accrual basis (I.e. premium is recognized as revenue pro rata to the number of days policy was active during that year). Due to the mismatch in the timing of booking of revenue and expenses in the P&L, reported accounting profits end up getting suppressed as revenue is understated vs expenses, especially during periods of high growth. Simply, for an Insurer growing at about 20%, typically Rs 90 of every Rs 100 premium earned in a year will be recognized as revenue while almost all expenses need to be booked. If one adjusts for this anomaly and looks at the business on a Cash basis, we believe the steady state Cash ROE of this business is ~25%+. What matters is Cash profits and not Accounting profits.

With its leadership of a large and growing market that provides opportunity to grow PAT at ~18-20%+ for next decade, 25%+ Cash ROE, Star Health is a very attractive business to own at current prices from a 5–10-year perspective.

Risks

The key risk we see is of the regulator not allowing price increases despite rising claim ratios. However, the regulator wants to increase penetration and should not frown on 14-16% sectoral Accounting ROEs. Hence it should not grudge companies a fair price increase over time if claim ratios go out of hand, to encourage companies to maintain healthy solvency requirements and to continue to invest, especially as the industry is still very underpenetrated.

There are some concerns that Life Insurers may be allowed to offer Health Insurance and hence competition may increase. Under present regulation, Life insurance players aren’t allowed to participate in Retail Health Indemnity8. We don’t see a material impact on Star in case they are allowed to participate. Health Insurance, unlike Life insurance, has higher claim frequency and so requires a more intensive back-office approach for claims management, requires empanelment with Hospitals and tends to be more agents driven in sales vs more Bank channel-dominated approach in Life Insurance. Hence, Life Insurers will be structurally disadvantaged on cost structure vs Star.

Please click here if you would like to download the PDF version of this blog.

- Share of Group Health was ~10% of Gross Written Premium in 2022. GWP is total premium raised. ↩︎

- Current regulations permit agents to partner with 1 SAHI, 1 Life insurer & 1 General insurer. ↩︎

- Source: Spark Capital. NWP is net premiums retained by Insurers on their books after reinsurance. ↩︎

- An in-house team has more skin in the game, better fraud analytics and ultimately lower costs and faster turn -around times. In-house claim processing costs is 1% of Net Earned Premium vs 3-4% for a 3rd party TPA. ↩︎

- Source: HDFC Sec IC. ↩︎

- Draft guidelines mandate that total expenses must be capped at 30% or average of actual expense ratio of past 3 years, whichever is lower. Violation of guidelines would result in additional solvency requirements. ↩︎

- Investment float is the amount available to an insurer for investments as premiums are received upfront however claims are paid off in the future. ↩︎

- In retail Health indemnity, insurers reimburse the cost of medical treatment incurred by customer, subject to the policy cover, exclusions etc. ↩︎