Solara has a strong Pharma API 1 and an emerging CRAMS 2business. It has recently announced a merger with Aurore, a privately owned company in the API/CRAMS space. Pharma API is a USD 180B industry globally of which India has ~ USD 4B share. The developed world has been outsourcing manufacturing and India now has the additional tail wind of the developed world wanting to de risk from China (USD 35B).

Barring Fermentation based products, India has a chance to capture a larger share of the global API market. We believe the API industry should continue to do well and that Solara/Aurore could become the #2/#3 pureplay API and CRAMS company in India after Divi’s Labs. As this is a regulated industry with significant risk of supply chain disruption, cost is not the primary consideration when choosing partners. The need for reliability in supply base means well run companies should be able to generate 18-20% ROE.

Solara ticks many boxes on what it takes to win in API.

- Regulatory and ESG compliance track record: clean track record except one “Official Action Indicated” at its Cuddalore plant which was not linked to quality issues in their plant but to a global issue with impurities in Ranitidine.

- Non-compete business model: Solara is a pure play API company that does not compete with its customers in formulation and has relationships with many Big Pharma customers.

- Scale and supply chain redundancy. Customers want to work with larger players in an industry that is heavily regulated by the US FDA. Solara has 8 plants, and all its key products have dual filing

- Product dominance: Solara has a strong position in some products (Ibuprofen, Gabapentin), good customer credibility (some customers paid advances to block capacity in its new Ibuprofen plant). Over 60% of revenue comes from long term contracts.

- Focus on lowest cost position: Investments in a new more automated plant at Visakhapatnam and continuous focus on backward integration in a few products to maintain lowest cost position. Merger with Aurore will provide additional cost synergies.

- Wide product basket: A wide product range that reduces compliance headaches and supply chain complexity for customers and enables cross sell. Solara has over 60 products and files for 10-12 new products every year. DMF filings have increased from 130+ at end of FY18 to 180+ currently. Aurore brings an additional 40 products into the offering

- Downstream migration: Solara’s CRAMS business is <10% of its total business at present and the company is investing to increase its share in the overall mix. CRAMS is a more value-added component vs API.

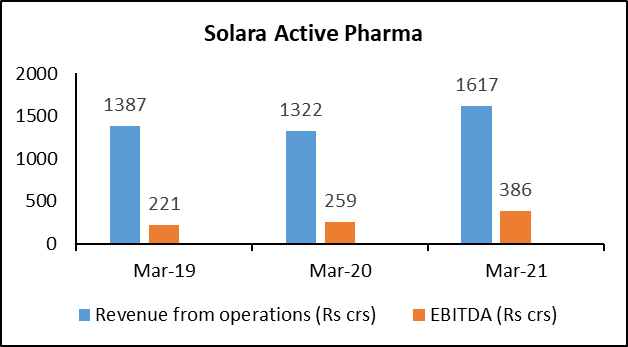

Solara has improved its financial performance over the last few years.

- Revenue CAGR (FY18 to FY21) is ~16%.

- EBITDA margin has expanded from 15% in FY19 to 24% in FY21.

And is stepping up R&D investments.

- Increasing R&D pipeline of new DMFs to 30/40 a year from about 10/12 at present

- Investing in new technology platforms

- CRAMS business is expected to grow >50% this year (though on a low base)

Merger with Aurore will create a stronger franchise.

- Aurore and Solara have complementary products and geographies. This increases possibility of cross sell of products into each other’s customer base. For example, Aurore has a much stronger presence in CRAMS in Asia Pacific and APIs in less regulated markets.

- Aurore has a more advanced CRAMS franchise.

- The business will be run by a promoter with skin in the game, track record of building API companies and interests aligned with minority investors for value creation

- Merger will bring revenue and cost synergies and more focused product development. Management has alluded to 150-200 Cr synergies.

We believe Solara-Aurore can continue to grow EBITDA at 15%+ for the next decade

Our numbers assumption is the merged entity can generate ~1100-1200 Cr EBITDA by FY27 from ~525 Cr (combined) in FY21 through a combination of growth and cost synergies and a larger API platform should be valued at about 12-15x EBITDA.

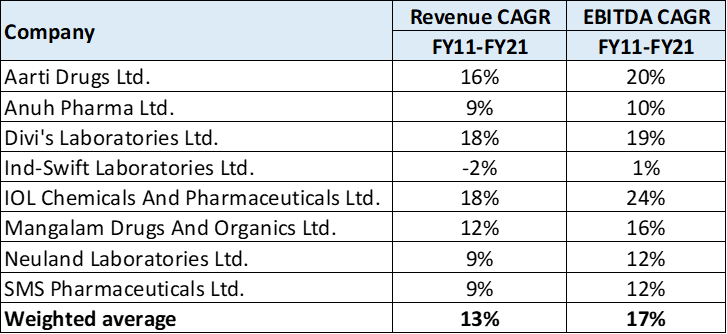

We believe these are reasonable assumptions as the Indian API industry has grown revenue at ~13% and EBITDA at ~17% over the last decade. “China+1” is now an additional tail wind and most players have stepped up capital expenditure reflecting their confidence in prospects.

With stronger tail winds, and the investments being made to strengthen the franchise, Solara-Aurore are well positioned to grow even faster than the last few years. Under an optimistic scenario, If the CRAMS business can become meaningful, currently ~10% of revenues, there should be a meaningful upside to our growth and profit expectations as CRAMS is a higher margin and return on capital business

So what has gone wrong since we first bought?

- The company reported poor Q2 results as sales of its key product, Ibuprofen (needed for pain and fevers) declined as Covid reduced demand. Lock downs meant fewer injuries and masks resulted in fewer people catching fever, even as customers had over bought earlier to stock up on inventory.

- The focus on regulated markets resulted in Solara ignoring less regulated markets for Ibuprofen and hence was not able to divert production to other markets. This resulted in both a drop in revenue and pressure on margins as sales in less regulated markets were made at lower prices.

- This was made worse by the fact that the management had committed the cardinal sin of over-guiding and under delivering. High expectations were met with a negative surprise.

In hindsight, we overpaid at our first entry price of about 1500/share. However, at current prices of about 1100/share, valuations at ~11x FY 21 Operating Profits/Enterprise Value are attractive. Inventory correction issues are not structural and will be solved over time. The stock price correction provides us an opportunity to add to our position.

Some of our best returns have come from positions which have corrected 20% after our initial buy. The learning for us from past experiences is not to buy too much too soon in a position when short term financials can be weak. Markets tend to wait for certainty and multiples re rate only when there is more visibility of earnings. We have a 4-5% position at present and intend to add to this position gradually over time or if we get significantly lower prices from here.

Please click here if you would like to download the PDF version of this blog.