We invest with an ownership mindset, seeking companies that can compound Earnings at 15%+ CAGR for long periods with 18%+ core steady state ROE and modest leverage.

That would require a

- large and growing market opportunity.

- Identifiable competitive edge vs peers.

- A management team with the courage to make investments that may pay off in the long term, even if it impacts ROCE in the short term.

- Paying valuations that are broadly reasonable in the context of the longevity of growth, moat and steady state ROCE of the business.

We believe Sansera has all the above ingredients.

- Sansera has the potential to deliver 15-18%+ Sales CAGR and 18-20%+ PAT CAGR over long periods as they are beneficiary of structural trends like

- + 1 tailwinds in Exports, Electric vehicle tailwinds, greater outsourcing and should see exponential growth in high entry barriers Aerospace, Defense, Semiconductor segment (“ADS”) from a small base.

- The management has grown the company 2x the domestic market growth rate and continues to re-invest behind people, capex and new competencies. This is observable in their strong market position across key products, growing customer base and product basket. They are one of the few Indian auto component suppliers to transition to value-added segments such as Aerospace and Semiconductor.

- EV risk to their business is minimal as they are winning EV orders at a higher kit value versus ICE.

- The reported ROCE of the business has declined over time due to investments made in new growth areas, which are not fully utilized. We expect Pre-tax ROCE to improve to 20%+ over 5 years.

- We have initiated a ~3-4% position weight and we will use further price or time corrections to increase our position size.

What do they do?

Sansera is a leading supplier of high precision forged and machined components for OEMs both in India and globally (~69% of Sales is domestic). They have ~88% exposure to the Automotive segment, with the rest from higher margin segments like Aerospace, Defense, Semiconductor, etc.

While they have a basket of 80+ product families1, nearly 2/3rd of their Sales at present come from 3 broad products (Connecting rods, Rocker arms, crankshaft with assembly). Over time, we expect the share of Sales from new products (Mainly ADS segment) to increase as % of mix.

What do their key Automotive products do?

Connecting rods: It is the link between the piston and the crankshaft which allows the piston’s up-and-down movement to be passed to the crankshaft.

Rocker arms: It is the part that controls the opening and closing of the engine’s valves which at the right timing lets fuel/air in and exhaust out.

Crankshaft: It turns up-and-down motion of the piston into spinning motion that eventually turns the vehicles wheels.

Some products within Aerospace segment

Door Fitting: An integral part of the door assembly, which is crucial for maintaining the structural integrity and pressurization of the fuselage.

Outer Fork: A primary structural component of the landing gear that holds the wheel assembly.

Actuation gimbal: A key component in actuator systems that control flight surfaces, landing gear, and other vital mechanisms.

In a later section, we explain why these products are complex to do and enjoy entry barriers.

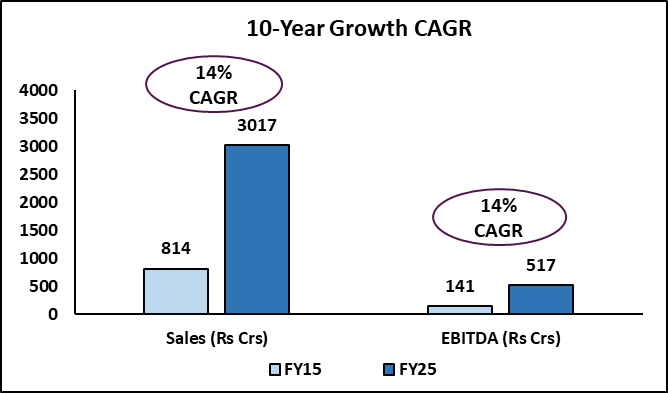

Sansera has demonstrated healthy growth over long periods of time.

Healthy growth has been accompanied by improvement in earnings quality, resilience in business model and management depth

- Business today is well diversified across end industries (2w- is 44%, PV is 19%, CV is 10% and non-Automotive is ~12% of Sales respectively), customers (largest customer is <15% of Sales) and geographies (International is ~31% of Sales).

- Company was founded in 1981 by promoter Mr. S Sekhar Vasan but over time has evolved into being professionally run, led by Mr. B R Preetham as CEO, who has been with Sansera since 1992.

- Sansera has proven credibility with marque OEM brands (Maruti, Bajaj, Toyota, BMW, Volvo etc) which reflects in deep customer trust (Over 60% of Sales are from customers with > decade-long relationship and has never lost a customer2.

- With foray into ADS segment, Sansera has evolved from primarily a critical Automotive engine component vendor to manufacturer of complex high precision parts for high technology industries.

- Post recent fund raise, Sansera has a debt free balance sheet.

Business evolution over time

| Particulars | Decade back | 2025 |

| End industries | Automotive ICE Engine focused | Automotive- 88% of Sales Within this EV/Technology agnostic products are ~15% of Sales Non-Auto 12% of Sales |

| Product families | 50+3 | 80+ |

| Products | Connecting rod Rocker Arms Crankshaft Gear Shifter Forks |

+ Automotive battery housing components EV/Hybrid drivetrain components Braking system components Non-Automotive Aerospace parts (engine casings, actuation parts, lighting, seating, door, aerostructure parts) Semiconductor equipment components Defense components for helicopters, submarine rockets, radar etc Industrial components |

| Technical competencies | High precision steel forging + machining | + Aluminium forging Assembly Complex machining and tooling + clean room for ADS segment Titanium handling (Aerospace) |

| Key customers logos | Maruti Bajaj Auto Honda Toyota etc |

+ Airbus, Boeing, SAAB, Bombardier HAL, Elbit Systems North American Semicon Fab Equipment OEM Tesla, GM Motors, Volvo, Daimler, VW group, Harley, BMW Motorrad |

| Gross block 4 | ~550 Crs | ~3,150 Crs |

| Customer concentration | Largest customer was ~35% of Sales | Largest customer <15% of Sales |

| Geography Mix | Exports -~23% of Sales5 | Exports – ~30% of Sales |

Long growth runway backed by expanding market opportunity and Sansera competencies

We view Sansera primarily as a company of portfolio of competencies rather than an Auto component company given their precision engineering skillsets which has and will continue to be used to enter new categories.

Sansera has the potential to grow aggregate Revenues at mid-teens and Profits at high teens over the next decade as multiple levers for growth are visible, such as:

- Strong Revenue scale up in ADS segment as flywheel should take effect. Management expects strong growth here over the next few years.

- Market share gains in the Export market as Sansera is a beneficiary of + 1 tailwinds.

- Historically grown ahead of domestic industry, outperformance expected to continue.

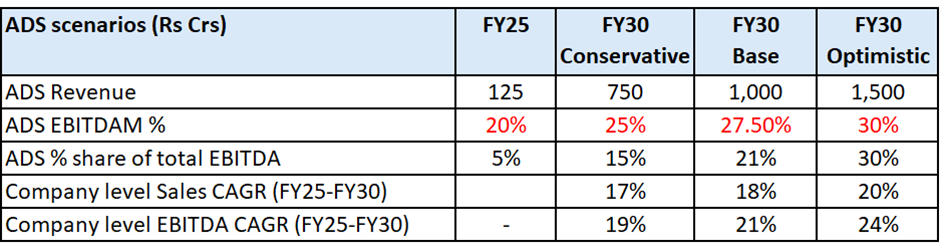

Strong Revenue scale up in ADS segment as fly wheel should take effect

Sansera took a strategic decision to leverage its competencies and diversify revenues by foraying into the higher margin ADS segment nearly a decade ago. ADS takes significant time to build credibility, but once it’s established, it can result in meaningful growth as customers ramp up business.

For a segment that is just ~125 Cr of Sales, Sansera has invested ~200 Cr in Capex till date, hired a dedicated CEO for ADS and has built a large, dedicated 400-member team6 which reflects their belief in long-term scalability of this segment.

The ADS segment accounts for ~125 Cr Sales (~5% of Sales) but is nearly ~25% of overall new business order book, which signals strong customer visibility. In fact, Sansera management has guided for Sales to grow to 280-300 Crs in FY26 and 1,000 Crs by FY 28. While the future is unknowable, below are some data points that support case for non-linear growth.

Aerospace (~80% of ADS Revenue FY25)

- The size of the opportunity is quite large. In Aerospace Sansera currently makes 1500 parts whereas the total market for Aerospace parts (Excluding fasteners) is ~2.5-4 lac parts6.

- India can be a beneficiary as Aerospace component supply chain realigns (West faces headwind from cost disadvantages and succession issues whereas China carries supply chain dependence risk). Boeing supply chain is still 80% sourced 7from US suppliers. Former MD of Airbus India believes there is a 10x growth opportunity over next decade for the domestic industry.

- Sansera has evolved to making larger, more complex parts over time (From seating/lighting to actuation, landing systems, engine casings) which are considered very critical to flight safety.

- Sansera is primarily a tier 2 supplier for leading OEMs like Boeing and Airbus. Recent 160 Cr p.a. “ICTM”8 tier 1 order win from Airbus suggests further deepening of relationship.

- Past constraints (Covid, largest customer Boeing faced internal challenges) which impacted historic growth have now eased (Boeing is now guiding for production ramp up7).

Technical expertise built in Aerospace was subsequently leveraged to enter Defense in FY21 and Semiconductors in FY24.

- Defense segment can be a beneficiary of the indigenisation of defense theme in India and rise in geopolitical conflicts globally. Sansera has a ~30% stake9 in MMRFIC (Manufacturing of sub system for Radars), where there is scope for meaningful growth if they can demonstrate successful trials, as there is a large import substitution opportunity.

- Sansera recently won a $17Mn order (LOI for up to $30Mn in 3 years) for machined parts from a global Semiconductor Fab equipment manufacturer. We anticipate further opportunities as proven success is a strong reference to attract new global customers and because the domestic Semiconductor industry will grow rapidly through import substitution backed by govt support.10

Well positioned to capture + 1 market share in global Auto comp landscape

European Auto Component suppliers face a very challenging period at present (Profits have been impacted due to slowing customer demand, higher inflation, energy costs & interest rates, shift to Electric vehicles, greater Chinese competition thus impacting their ability to invest in Capex) which presents a significant opportunity for Indian Auto component players as India has natural advantage of ~20-25% lower cost, 11availability of talent, well established supply chain and ability to invest.

Sansera has won multiple orders12 by replacing existing West based suppliers or via outsourcing.

- Won GM Motor order by replacing a financially challenged N America based vendor.

- Won Volvo business as their existing supplier went out of business.

- Sansera has won business as global OEMs are now outsourcing components that were done in house earlier.

We believe International Revenues could >20% CAGR growth

Sansera enjoys strong visibility in this segment. Global business accounts for 31% of Sansera’s Sales but a significant ~62% of order book.13 Global market opportunity is quite sizeable and Sansera has also seen an increase in RFQs 14because of global OEMs strategic need to derisk their large supply chain dependence on China given rising geopolitical tensions.

This is also visible in results. For example: In Connecting rods (Sansera’s largest product) their global market share in 4W and CV has increased from ~1% to 2.5-3% 13 and is poised for further growth.

Sansera enjoys trust with marque customers globally (GM Motors, Tesla, Harley Davidson, KTM, Stellantis, Ducati). Europe and Japan 4W markets are unexplored today and In India Sansera works with Toyota, BMW Motorrad, Daimler, VW, which could open global opportunities in the future.

Historically grown ahead of domestic industry, outperformance expected to continue

Sansera has historically achieved Revenue growth at double the pace of the underlying industry and we expect its domestic segment to grow at low to mid-teens Revenue growth over the long run.

- Outsourcing trend- Sansera has benefited from rising trend of OEMs outsourcing complex component production (Examples Yamaha, TVS), with scope for gains as some domestic OEMs (Such as Hero, HMSI, and TVS etc) still perform critical component (Connecting rods and Crankshafts) manufacturing in-house.

- EV is a tailwind rather than a headwind for Sansera (EV Scooter Kit value is ~25% higher versus ICE, multifold increase in EV motorcycles versus ICE) 15 as they are well placed with Aluminium forgings technology (benefits from light weighting tailwinds) and with a dedicated EV/hybrid component mfg site.

- Sansera has widened its product portfolio through the addition of suspension, braking, steering, and chassis components etc.

- Sansera has consistently added new customers over time and there is scope to gain wallet share with recently added customers (TATA Motors, M&M, Force motors, Volvo Eicher).

Sansera is expanding its moat, which can drive margin expansion

Sansera’s moat stems from strong and deep trust with marquee customers which results in strong market leadership in its core segments. Trust has been built on basis of

- Strong willingness to invest (Integrated set up, large engineering team, in house CNC machine building capabilities)

- Deep competencies are needed to manufacture its core products as they form critical parts of the Automotive engine.

- Successful transition from Automotive to high entry barrier ADS segment.

Strong willingness to invest

Sansera has expanded its Gross block16 by ~19% CAGR over the past decade and our customer checks suggest that they are a preferred vendor given end-to-end integrated set up (Design, Forging, machining, heat treatment and some assembly), strong 500+ member engineering team and healthy track record on quality, reliability and delivery.

Their manufacturing facilities are highly automated, involving robotics and company is unique in its ability to build its own CNC machines in-house (~50% of CNC machinery) which gives it a 30% cost advantage.17

They have sacrificed some margin by investing behind tough to do Aluminium forgings (complex dimensions/shapes, strict surface finish aesthetics requirements) which is now winning them EV/hybrid projects in India and globally.

Manufacture critical Automotive components

Within the Automotive component landscape, Sansera’s products are more complex given they are critical, precision components forming part of the vehicle engine.

- These products require high strength to weight ratio as they must withstand thousands of high-impact compression and tension cycles per minute but light enough to minimize reciprocating and rotational inertia.

- Stringent quality standards as material is subject to high levels of stress and even microscoping defects can lead to failure at high RPM. High quality forging is key to ensure good strength and fatigue resistance.

- High machining tolerance standards to ensure good surface finish as there is interaction with other moving parts and to ensure vibration/noise parameters at high speeds is met.

Sansera enjoys market leadership

- Connecting rods (~36% of Sales)- Sansera is the largest 2W and PV Connecting rod manufacturer in India and a top 10 player globally. Currently, Sansera is the only Toyota vendor globally from whom they source Connecting rods.

- Rocker arms (~16% of Sales)- Sansera is the largest 2W and PV Rocker arm manufacturer in India.

- Crankshaft assembly (~15% of Sales)- one of the leading players for 2w segment in India.

Successful transition to higher entry barrier ADS segment

ADS space has high entry barriers due to highly critical nature of products, stringent regulatory compliance, time consuming process to validate products, complex supply chain and need for specialized expertise, dedicated mfg sites, wide basket of low volume/high value SKUs.

Foray into Semiconductors represents a big leap forward given the industry operates at nanometre scales and precision norms are even higher than Aerospace (<5 Micron precision machining given highly complex geometries and intricate features, Class 1000 clean room requirement).

This is an industry that requires a significant gestation period to build customer trust and competencies and offers high margin visibility as cannot be disrupted overnight.

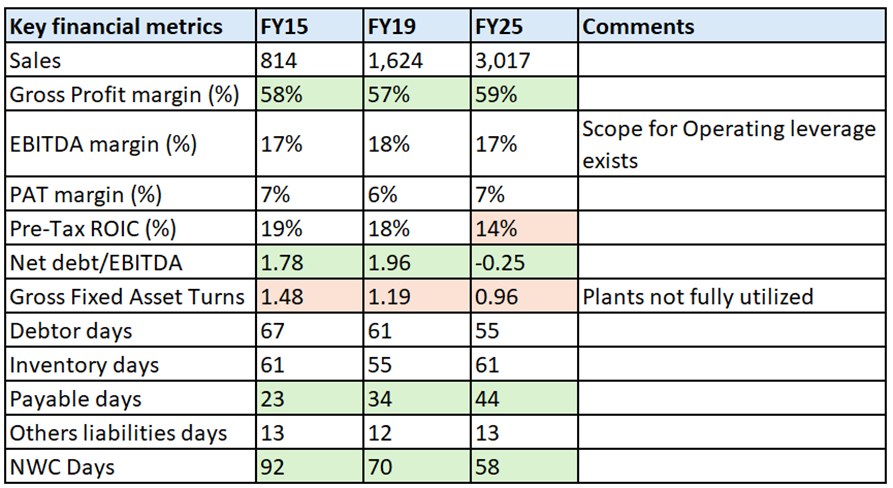

Current financial metrics like ROCE don’t reflect strength of business franchise

In the past Sansera has enjoyed 18-20% Pre-tax ROCE. Current ROCE at < 15% is suppressed as

- Sansera has made Capex investments that are not utilized fully which has resulted in lower GFA turns (Current GFA turns at <1x is well below the long-term average). Current pre-tax ROCE on an N-2 years18 basis is ~18%.

- Sansera has meaningfully expanded its product basket and added new technologies like Aluminium forging in the last few years. Multiple products are currently under development phase and so Operating leverage from mass production is yet to kick in.

*FY19 data has been used as FY20 metrics were impacted by Covid.

We believe Sansera can be ~20%+ Pretax ROCE 5 years out

We expect ROCE to improve from current levels, primarily driven by better margins from exports, improving product mix towards ADS and an increase in asset turns.

- EBITDA margins should improve due to superior product mix (ADS segment is steady state 25-30% EBITDAM 19 and carries low US tariff uncertainty,20 Exports can be 4-5% higher EBITDAM versus company level) and Operating leverage (Improving capacity utilisations, products move from development to commercial scale).

- Sansera has embarked on a significant Capex program (~1,580 Crs over past 5 years), which they should be able to sweat over coming years given healthy customer visibility 21which will in turn drive improvement in asset turns.

- This will be some offset from increase in NWC days as share of Exports increases which will result in higher debtor days given longer shipping time and higher inventory days due to international warehouses for just in time supply to customers.

- We expect steady state PATM to be ~10%+ (led by improvement in EBITDAM, savings in Depreciation and Finance cost % Sales) which should drive improvement in core ROE% to 18-20%.

Where the ROCE could settle in the long run is hard to predict today (Sansera may continue to invest ahead of time in capacities/technologies, may set up North America facility to mitigate tariff impact/Meet USMCA RVC norms 22), however we expect trajectory to be positive as share of ADS segment (which is 25%+ steady state ROCE) increases over time.

| Particulars | Currently | FY30 | Comments | |

| Scenario 1 |

Scenario 2 | |||

| Sales | 100 | 100 | 100 | |

| EBITDAM % | 17% | 18% | 20% | Better product mix (ADS, Exports) Operating leverage, automation |

| Depreciation % sales | 6% | 4% | 4% | |

| EBITM | 11% | 14% | 16% | |

| Finance cost % sales | 2% | 1% | 1% | |

| Other income % sales | 1% | 1% | 1% | |

| PATM | 7% | 10% | 11% | |

| GFA turns | 1.0 | 1.30 | 1.30 | More efficient production runs Increase in capacity utilisations ADS has higher SS GFA turns of ~2x |

| NFA turns | 1.7 | 2.25 | 2.25 | |

| NWC days | 73 | 80 | 100 | Longer Debtor and inventory cycle with Exports Higher inventory days in ADS give wider SKU range |

| Net debt/EBITDA | -0.2 | 0.5 | 0.75 | Minimal use of debt |

| ROCE pre-tax % | 14% | 20% | 22% | Improvement in ROCE and ROE with better Margins and Asset turns ADS Steady state ROCE could be > 25% |

| ROE % | 9% | 18% | 20% | |

We believe our buying price offers reasonable valuations for an initial position

Sansera is a resilient business run by a highly competent management with scope for longevity of growth with improving ROCE.

Trailing valuation multiples (reported PE TTM is ~39x) can be misleading when reported ROCE are sub-par and there exists scope for Profit growth upside from faster growth in the higher quality business (ADS).

If we use normalized margins (10% PATM), our buying has been in the range of ~24x PE TTM range which offers scope for growth and potential re-rating as transformation into a higher quality business is visible.

Our variant perception versus the market is that we believe EV is a tailwind rather than a headwind, ROCE should improve with better capacity utilisations and mix change, and ADS can be a more meaningful share of Profits in the long run.

Sansera is a clear leader and so price, or time correction can be used to further increase the position size given we can potentially go up to 8% weight here.

Please click here if you would like to download the PDF version of this blog

- Sansera IP ↩︎

- Source: Management discussions ↩︎

- This is as of FY-19, Source: Spark Institutional Equities. ↩︎

- Gross block is recomputed to adjust for impact of IND AS 101 which allowed companies to use reported NFA figure as deemed GFA cost at time of IND AS transition. ↩︎

- This is as of FY16, Source: Ace Equity ↩︎

- Source: Management discussions. ↩︎

- Source: Boeing earnings call. ↩︎

- Airborne Intensive Care Transport Module. ↩︎

- Sansera has the right to increase it’s stake up to 51%. ↩︎

- India Semiconductor mission offers 76,000 Crs in fiscal support to incentivize domestic manufacturing. 10 Semiconductor projects with proposed cumulative investment of ~1.6 lac Crs has been announced so far ↩︎

- Management estimate. ↩︎

- Source: Management discussions. ↩︎

- This includes ADS global business. ↩︎

- In FY24 RFQ increased to 20-25 per week versus ~4-5 inquiries per week a year prior. Source: Management discussions. ↩︎

- EV scooter value is ~1,850 versus ~1,450 in ICE. In EV motorcycle content value can go upto 10 K vs ~2,000 in ICE. ↩︎

- Gross block is recomputed to adjust for IND AS 101 impact, which allowed companies to use reported NFA figure as deemed GFA cost at time of IND AS transition. ↩︎

- Source: Management discussions. ↩︎

- NFA is taken on an N-2-year basis. ↩︎

- Source: Management discussions. ↩︎

- Products either have exemption or are shipped to customer locations in India or ROW. ↩︎

- Current order book position is healthy at ~2,000 Crs, nearly double versus 3 years prior. ↩︎

- Under USMCA, auto parts must have 65% of their value from USA, Mexico, or Canada to qualify for preferential duty-free trade. ↩︎