We published our investment hypothesis on RBA which operates Burger King India (BK India) and Burger King and Popeyes franchises in Indonesia on Pg 7 of our Q1FY23 Letter.

Over the last few months, we received some relevant questions on Quick Service Restaurants (QSRs) as well as RBA from partners and other colleagues in the Investment industry. This note attempts to answer these questions. Please read the thesis above before reading further.

- Would the Indian palette be a head wind to scale up of Western QSRs in India?

- How do you ascertain fair value when the franchise is loss making?

- Why did we invest in BK India (i.e., RBA) and not McDonalds (i.e., Westlife Foodworld) which seems to be a stronger franchise?

- Are we aligned with RBA’s foray into Indonesia by acquiring the Burger King franchise and now bidding for and winning the Popeyes franchise?

- If RBA is getting sold by PE owners, aren’t we better off waiting before entering?

Would the Indian palette be a head wind to scale up of Western QSRs in India?

- The product innovation teams of Western QSRs adapt their menus to suit local tastes (e.g. India has a variety of spicy options on the menus, options built around preferred local food items like “butter chicken burger”, “paneer burger”, “masala whopper” etc.).

- Tastes are an acquired habit. ~50% of our population is less than 30 years old. As this demographic grows up consuming western styled food, Western QSRs will gain market share, including from the unorganized sector.

We share three interesting anecdotes to support the above arguments.

- One of our colleague’s mother runs a school bus service. On the last day of each academic year they arrange a treat for all students who ride their buses. Around 6 years back, the students started asking for burgers instead of vada pavs or a samosa.

- Our first office in Mumbai was in Kurla, adjacent to the Phoenix Mall. On numerous occasions we would observe our office boy and his wife enjoying an outing at a Western QSR.

- In restaurant visits, we have observed teenagers from poorer sections of the society visit these restaurants in small groups and share meals that suit their budget. Outings at QSRs are very aspirational.

Hence, Western QSRs should do very well.

- Eating out is a structural growth story. The number of meals per month consumed out of home increases with GDP growth and rising per capita incomes.

- This is an affordable category people want to explore.

- QSRs such as Burger King and McDonalds should be beneficiaries. Their value for money offering combined with a nice eating out experience in a contemporary setting serves as an affordable treat.

How do you ascertain fair value when the franchise is loss making?

RBA reported a net loss this year. This was not an unexpected outcome. When an enterprise is in gestation phase and is sub scale, one cannot use profitability metrics to gauge fair value. Even basis trailing EV/OCF or EV/EBITDA (pre-IndAS 116 basis) valuation metrics would look very high optically. Trailing metrics are more suitable for linear growth stories (Banks, FMCG, IT Services).

To ascertain fair value today, we

- Value the BK India business basis broad estimates of Operating Cashflow it could generate in FY28 and discount back to today to ascertain acceptable entry prices. We prefer Operating Cashflow as a valuation metric to PAT as the depreciation in this business is significantly higher than the maintenance capex.

- For Indonesia, we ascribe a range of Rs 1200-2000 Cr in FY 28. The total investment in Indonesia (acquisition plus primary infusion) by RBA till date is ~Rs 1250 Cr. Hence, we are not assuming any significant upside for Indonesia yet till the narrative gets translated into numbers (which one can see in India).

- Hence, the primary driver of our hypothesis is performance of BK India with some option value for Indonesia.

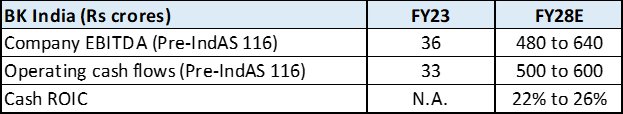

Our expectations are that BK India will generate about Rs 500-600 Cr Operating Cashflow by FY28.1 The rationale is explained below.

A successful QSR needs to get the following right:

- Menu appealing to local tastes and consistent product innovation.

- Value for money.

- Location.

- Quick service.

- Clean + contemporary look and feel of restaurants.

While these seem simple, they are difficult to execute. Hence, one does not see many pan-India QSR brands at large scale.

BK India has executed well on the above parameters. They have scaled from no presence in India to ~400 stores in 9 years with reasonable unit economics. The brand “Burger King” has found consumer acceptance, loyalty of some consumers and is always a part of the consumer consideration set. Of your CIOs two daughters, one is partial to Burger King, and the other to McDonalds.

- Scale and increasing brand acceptance start generating a virtuous cycle as growth is accompanied with higher margins and cash flow. Location is very critical for QSRs as it is often an impulse purchase, and you compete with other options. When the company started in 2014, it was difficult to secure good sites at competitive rates as it was an unknown brand in India and lessors were hesitant. This resulted in higher lease rentals vs. established QSRs, and it was tougher to secure long duration lock-ins. However, today BK India is as competitive as any other QSRs, and lessors seek them out as a brand to work with.

- The Company spends 5% of its sales on marketing (minimum spend as per franchise agreement). As sales increase, the absolute spending increases non-linearly and is helpful in creating further pull and increasing throughput and revenue per restaurant.

Overall, these aspects give us confidence that the BK brand can scale up well over time.

QSRs have significant fixed costs at both, restaurants, and corporate level. As the no. of restaurants reach a critical scale and the revenue per restaurant increases, a large share of the incremental revenue flows through to profits driving exponential profit growth. The same should play out at BK India.

Since BK India is sub-scale and still in investment mode, it needs a strong Balance Sheet which can support capex for store additions when profitability is yet to reach steady state. BK India has net cash of ~Rs 160 Cr at end of FY23. This, combined with expected profits (even though below normalised level) and negative working capital gives us comfort that the business will not need additional equity infusion as it scales up over next 5 years.

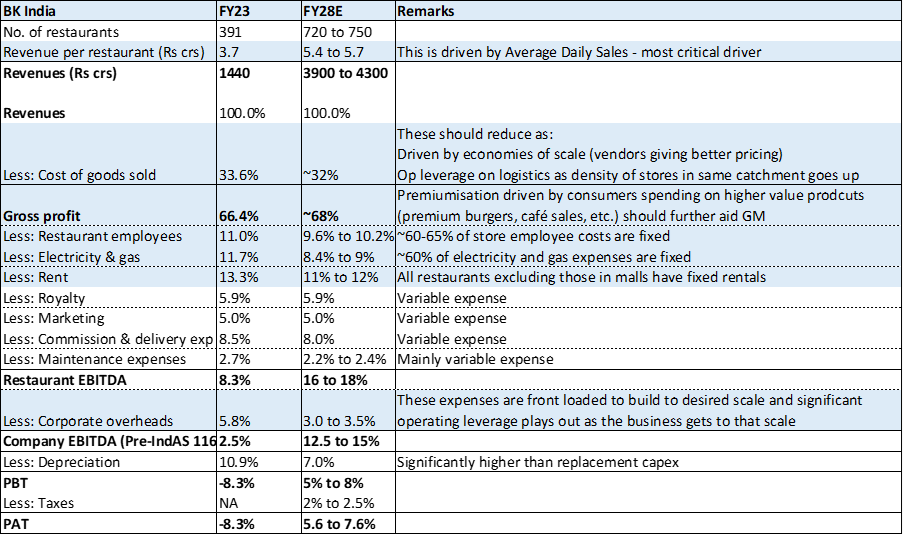

The table below is our hypothesis on how Operating profits for BK India should scale as it reaches critical scale. 2 As restaurant count increases from 391 at end of FY23 to ~720 by FY28, and revenue per restaurant increases from Rs 3.7 Cr to 5.4 Cr, Operating Cashflow grows exponentially from ~Rs 33 Cr to ~Rs 500 Cr.

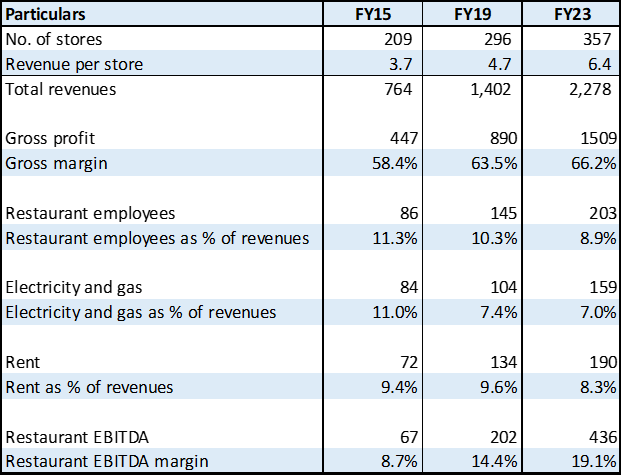

The Company’s outlook mentions that they will have 700 restaurants by FY27. We have built buffers and work with an assumption that they will operate 720 restaurants by end of FY28. But are the restaurant margin expansion assumptions credible? This margin expansion has played out for Westlife Foodworld (McDonald’s) as it scaled revenue per store.3

What valuations would we ascribe to the franchise 5 years out?

For a QSR which is a national brand, has room to grow ~15% for a decade and the potential to add more brands given healthy cash generation, at a Cash ROIC of about 22-25% (with room to expand up to 30% over time), we would be willing to pay 20-25x Operating Cashflows of FY28.

It may interest partners to note that Westlife trades at 50x Operating Cash Flow and 45x EBITDA basis FY23 numbers (pre-IndAS 116) at present. These are rich valuations and illustrate what the market is willing to pay when there is confidence on execution. Hence, we would not be surprised if the market ascribes even 30x Operating Cash flow to BK India if they execute well.

Why did we invest in BK India (i.e., RBA) and not McDonalds (i.e., Westlife Foodworld) which seems to be a stronger franchise?

We always bet on an industry first, and then choose players within an industry. This industry can have multiple winners. Partners are aware we own both ICICI/HDFC in Banking.

Westlife, which operates McDonalds in South and West India is a very well-run business which we would like to own at a certain price, in addition to RBA.

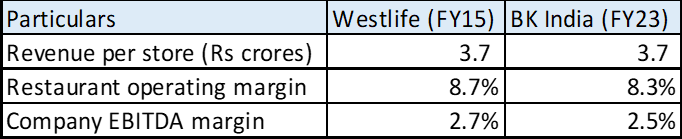

There is no doubt that Westlife has superior economics and is a stronger brand vs BK India today. It has higher revenue per restaurant (Rs 6.4 crores vs. Rs 3.7 crores) and profitability (Pre-IND AS 116 EBITDA margin of 13.2% vs. 2.5%). However, both franchises are at different stages of their evolution.

- Westlife has been in India for over 25 years while BK India has been in the country for less than 9 years. Hence, BK India’s brand strength is weaker than McDonald’s and will take time to build.

- A restaurant typically reaches its steady state revenues and profitability over ~4 years. BK India’s rapid scale up in last 4 years (187 to 391 restaurants) means many of their restaurants are still not mature. At the end of FY23, ~59% of Burger King’s restaurants were less than 4 years old compared to ~25% for Westlife.

- Despite this, the margins of both businesses are not very different when one compares the two at same stages of their life cycle – at similar revenue per store.

- Corporate overheads, which need to be built upfront to support a certain pace of growth, at BK India today are similar vs. Westlife at same stage of evolution even though their restaurant addition plan over the next 3 years is more aggressive vs. Westlife’s plan of restaurant addition in FY15 for next 3 years.

RBA also has some advantages over Westlife.

- RBA has pan India rights for Burger King vs Westlife which has rights only in South & West India for McDonalds. RBA should be able to set up more restaurants vs Westlife.

- Westlife will need to pay a higher royalty to McDonald’s over time vs RBA and that should negate some of their margin advantage at present which is driven by higher throughput per store given McDonalds is a stronger brand today.

However, the valuation differential between the two franchises is extremely high at present (Westlife is ~6X trailing EV/Sales vs. about ~3x trailing EV/Sales for BK India 4, explained by:

- Superior economics of Westlife at present.

- More permanent ownership at Westlife vs RBA (owned by Private Equity).

- Investors not favouring RBA entering Indonesia vs. focusing only on Indian operations.

Hence, all considered, we would like to own RBA today and will buy Westlife at a lower price.

Are we aligned with RBA’s foray into Indonesia by acquiring the Burger King franchise and now bidding for and winning the Popeyes franchise?

We prefer focus and depth. If we were promoters of BK India, we would have focused on the India opportunity and not taken up the distraction in Indonesia, especially given the size of the prize in India and since Indonesia involved a turnaround of the Burger King franchise.

However, we need to be aligned on 90% of the decisions of the management team we are betting on as long as the 10% of decisions where we disagree aren’t such that one is betting the franchise or where we are in vehement disagreement (in which case we would exit).

This team has a very good execution track record in India and Indonesia has good secular growth tailwinds like in India. We entered post the IPO euphoria, post the equity dilution done to fund the Indonesian acquisition.

While Burger King Indonesia turnaround has been slower than expectations (weak recovery for the industry post Covid hasn’t helped), Popeyes Indonesia has some positives:

- Indonesia is predominantly a chicken eating country and Popeyes is a strong brand globally catering to this category.

- Unlike BK Indonesia where legacy problems needed to be tackled, this business is a fresh start which allows the team to build it in the right way.

- The initial Popeyes restaurants are clocking very high revenues and profitability. While incremental restaurants may not deliver such high revenues, in general, it seems this brand has the potential to operate at high revenue per store and earn healthy profits.

- If they scale this up well over the next 5-10 years, there is significant option value here.

- The Indonesian operations have a floor valuation at which RBA should be able to exit as QSRs are businesses with strong investor interest.

We don’t ascribe a very high value to the overall Indonesia prospects narrative as we wait for the narrative to reflect in numbers. Our investment thesis on RBA is mainly premised on India scale up. We ascribe ~Rs 1200-2000 Cr market cap to Indonesia 5 years down and any exceptional execution will be upside. As mentioned earlier, the total investment in Indonesia (acquisition plus primary infusion) by RBA till date is ~Rs 1250 Cr.

If RBA is getting sold by PE owners, aren’t we better off waiting?

If one is playing the long game, waiting for an even better entry price by risking a significant longer-term upside makes no sense to us. You are then optimizing for short term outcomes.

It would make sense for us to wait for an event only if the company depended on a primary equity raise to fund this growth.

We addressed this question in the recent note we wrote – The Shadow Of Private Equity Ownership On Our Buying Decisions

Please click here if you would like to download the PDF version of this blog

Disclaimer

The information or material (including any attachment(s) hereto) (collectively, “Information”) contained herein does not constitute an inducement to buy, sell or invest in any securities in any jurisdiction and Solidarity Advisors Private Limited (Solidarity) is not soliciting any action based upon information. Solidarity and/or its directors and employees may have interests/positions, financial or otherwise in securities mentioned here. Solidarity may buy securities in companies owned by its clients. This information is intended to provide general information to Solidarity clients on a particular subject or subjects and is not an exhaustive treatment of such subject(s). This information has been prepared based on information obtained from publicly available, accessible resources and Solidarity is under no obligation to update the information. Accordingly, no representation or warranty, implied or statutory, is made as to the accuracy, completeness or fairness of the contents and opinion contained herein. The information can be no assurance that future results or events will be consistent with this information. Any decision or action taken by the recipient based on this information shall be solely and entirely at the risk of the recipient. The distribution of this information in some jurisdictions may be restricted and/or prohibited by law, and persons into whose possession this information comes should inform themselves about such restriction and/or prohibition and observe any such restrictions and/or prohibition. Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. Neither Solidarity nor its directors or employees shall be responsible or liable in any manner, directly or indirectly, for the contents or any errors or discrepancies herein or for any decisions or actions taken in reliance on the information. The person accessing this information specifically agrees to exempt Solidarity or any of directors and employees from, all responsibility/liability arising from such misuse and agrees not to hold Solidarity or any of its directors or employees responsible for any such misuse and free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors.

- Our blog The Shadow Of Private Equity Ownership On Our Buying Decisions mentions operating cashflow range of 450-500 Cr and 700 restaurants by FY28. This was to illustrate the lower end of our expectations. ↩︎

- FY23 break-up of key line items and remarks on various line items are basis Solidarity Analysis and discussions with industry experts on different QSR models. Company doesn’t report this data separately.

In this note, we calculate revenue per restaurant as revenues for the year divided by number of stores at the end of the year.

Under the new accounting standard, the reported EBITDA and Operating Cashflow (OCF) is overstated due to certain reclassifications of lease expenses. We adjust these line items to show what the true picture and labelled the same as Pre-IndAS 116 EBITDA and Pre-IndAS 116 OCF. ↩︎ - For FY23, since the annual report is not yet published, we have made assumptions on electricity & gas and rent costs.

Starting FY23, Westlife restated its gross margins, but we have used the gross margin comparable with previous periods as provided by the Company. ↩︎ - This is implied valuation for BK India after ascribing a value of Rs 1200 crores to Indonesia business. ↩︎