Manufacturing from India for the world promises to be a decadal theme. We favour categories that are strategic to customers supply chains and which are more immune to dumping from China.

- Rising geopolitical tensions between the West and China have prompted MNCs to strategically reevaluate their high dependence on China and seek alternative supply chains for derisking.

- European manufacturing faces structural challenges (low-cost competitiveness, long lead times for environmental clearances). Current macro challenges are driving higher outsourcing to players in low-cost destinations like India.

- Manufacturing may not offer as high ROCEs as IT Services/Consumer. However, they offer 15-20% growth with longevity at 18-20% ROCE. When growth slows down, their ROCEs could further expand as useful life of plants is greater than life over which they are depreciated.

China’s dumping in certain categories alongside current inventory de-stocking challenges has created short term earnings growth challenges. This is leading to cynicism around whether theme has legs. Price volatility could provide attractive entry points.

We are participating in this theme via many names1

| Portfolio company | Key end-user industries |

| RACL Geartech | Auto Components |

| Neogen Chemicals | Pharma, Agri, Battery Chemicals, Semi-Conductors |

| Yasho Industries | Lubricant Additives, Rubber Chemicals, Consumer |

| SRF (Kama Holdings) | Agri, Refrigeration, Consumer, Pharma |

| Shaily Engineering Plastics | Healthcare, Consumer |

| Garware Technical Fibres | Fishing, Aquaculture, Sports, Infrastructure |

| Shivalik Bimetal Controls | Auto, Real Estate, Infrastructure |

We have been investors in RACL Geartech since Oct 2021. The indifferent results in Q1FY25 due to inventory corrections at European clients and a poorer product mix affected EBITDA margins. This caused a steep stock price correction (~30% decline from peak). We used the opportunity to add to our positions.

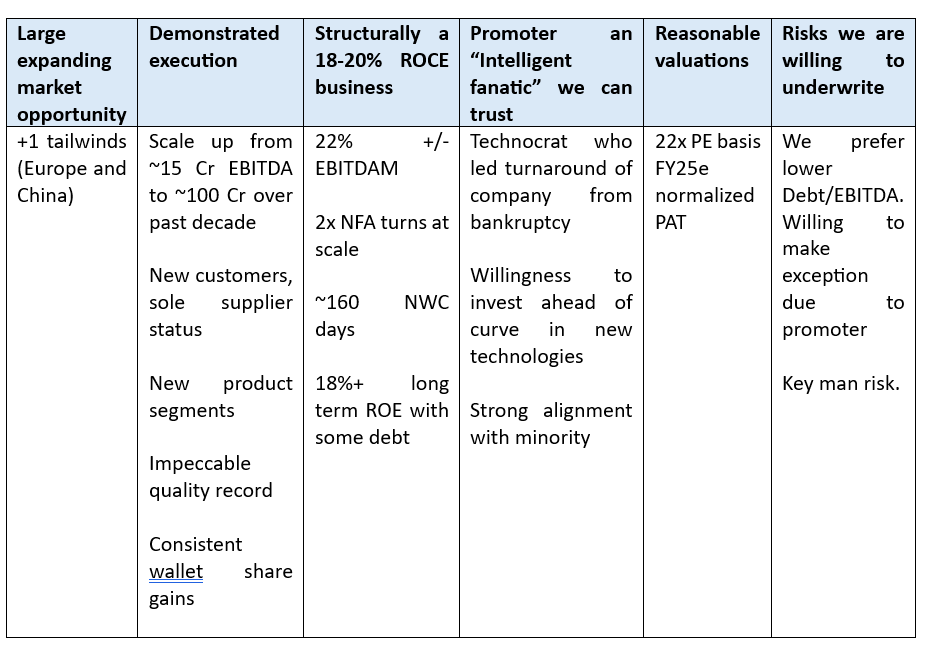

Summary thesis

- RACL Geartech offers growth longevity. There is a large and growing market opportunity. RACL can extend its competencies (precision engineering) into new products and segments (Automotive and non-Automotive) even as it enhances wallet share with existing clients.

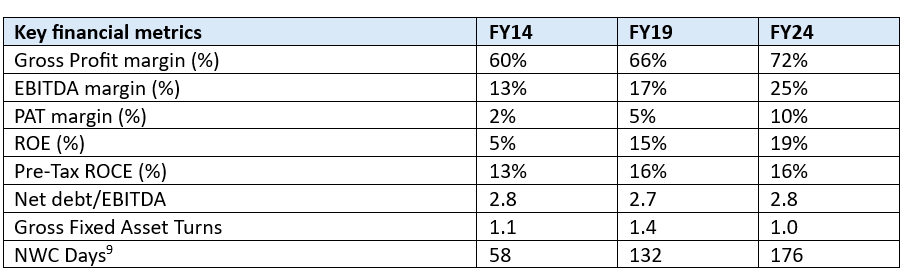

- RACL is a well-run Auto Comp co. which we believe can generate 18-20% steady state ROCE, translating to 18%+ ROE with moderate debt.

- At ~22x FY25e PE basis normalized earnings2, we find valuation comfort as we believe in possibilities of profits compounding at ~15-20% CAGR over a decade, which should result in broadly similar share price compounding. The human mind struggles to process duration and therefore longevity of growth is undervalued. Companies that demonstrate longevity get a valuation premium by markets when credibility is established.

- We believe this is an attractive investment story in an environment where the index is likely to deliver ~10% returns this decade.

Brief background of company and history

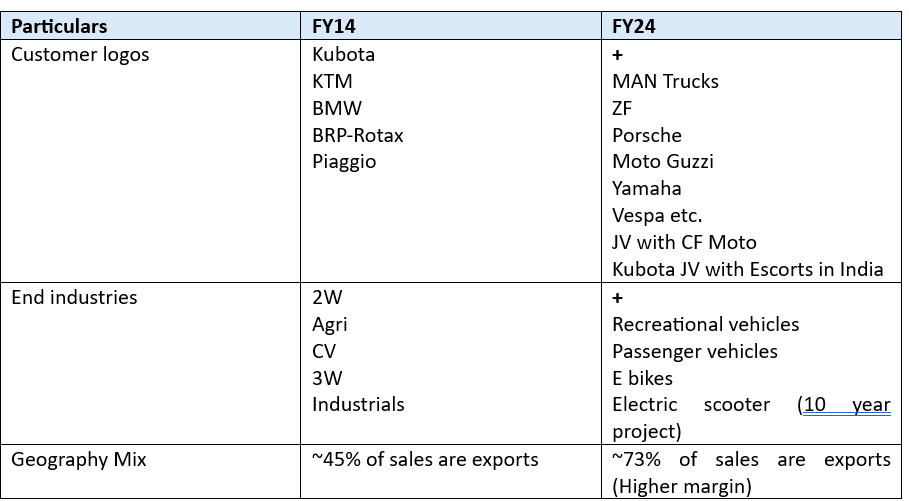

- RACL Geartech is an Auto Components supplier that specializes in manufacturing high precision products like transmission gears,3 shafts etc. RACL is primarily an export driven co (~73% of sales FY24) largely catering today to the auto industry predominantly as a tier 1 supplier (mainly premium 2W bikes, recreational vehicles, tractors etc).

- RACL is led by promoter Mr Gursharan Singh and his son Mr Prabh Mehar Singh. Mr. Gursharan Singh joined the company as a plant head in 1983. The company (formerly known as Raunaq Auto) went bankrupt and was referred to the erstwhile BIFR in 2001.Mr Gursharan Singh orchestrated a management buy-out and successfully took RACL out of the BIFR purview in November 2007. The turnaround was accomplished by a strong dedication to quality, focusing on niche, low volume products, and exiting low margin categories.

- RACL has pursued a strategy that focuses on difficult to manufacture niche luxury products (like export premium 2W vehicles). This has resulted in a higher margin profile than most Auto Component players while also protecting the business from recessionary pull back in demand.

- Its first big export break came from Kubota Japan for tractors in 2004. The Kubota relationship was used to develop technical competencies and build a reputation for quality and reliability before attempting rapid growth.

- Since then, their reputation for quality has added other marquee customers over time like KTM, BMW, BRP Rotax, ZF, MAN trucks.

- At 430 Cr Sales FY24, RACL is quite derisked (no customer > 25% of Revenues, presence across multiple end segments and geographies).

Large and expanding market opportunity

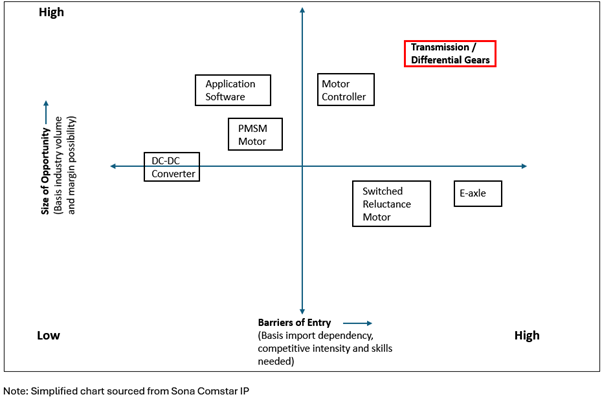

RACL primarily manufactures transmission gears. However, we see it as a precision engineering company with competencies that can extend to new product categories. Over the years, RACL has built strong technical competencies (8 core competencies such as precision machining, forging, heat treatment, design engineering, gear assembly etc) that have been used to expand its product portfolio. RACL has expanded from primarily making transmission gears/shafts to a basket of 11+ products and 900+ SKUs such as chassis, suspension, steering, part lock wheels etc.

Well positioned to capture + 1 market share gains

Auto Comp manufacturing in Europe is facing a very challenging period at present (slowing customer demand, higher inflation & interest rates, shift to Electric vehicles, greater Chinese competition, higher energy costs). A loss in competitiveness is resulting in many Auto companies downsizing, vendors shutting down and OEMs aggressively looking for skilled vendors in lower-cost geographies.

- Volkswagen for the first time in history will be considering closing German factories, having flagged 1 car and 1 component plant as obsolete.4

- Continental (Germany’s third largest supplier) has decided to exit its car parts business.5

As the European vendor base shrinks, it opens a window of opportunity for well-run Indian Auto Component suppliers to gain market share in the global landscape. Consider a few examples

- Germany’s ZF Group to expand India sourcing to 2 billion euros a year by FY306

- Stellantis plans to use India as an export hub to manufacture Electric vehicles.7

There are also some opportunities to gain share from China as global MNCs look to derisk for geo- political reasons. India has an existing Auto Component ecosystem and can benefit from friend shoring. The way global customers look at India is fundamentally changing. Perception takes time to change, but once trust is established in B2B businesses, pace of scale up can be rapid. RACL and other Indian Auto Comp suppliers are seeing a jump in RFQs for both new models as well as existing models. “Maybe not 10, maybe 15 years back. Nobody could imagine that the European customer will buy gears from India. 20 years back no European customer would have even thought to buy even the plastic component from India. So gradually, India is also gaining much respect and command into a global market and if India is gaining interest in the only global market” – RACL Geartech management “(Q1FY24 concall)

RACL is competitively well positioned to capture market share as it has a strong track record on quality/delivery with marquee global customers (no product failures, very low rejections), strong willingness to invest in Cap ex, high ESG standards, 30+ years domain expertise (gears, precision engineering) and offers one stop shop technology solutions. RACL enjoys strong customer trust which reflects in sticky long-term customers and wallet share gains.

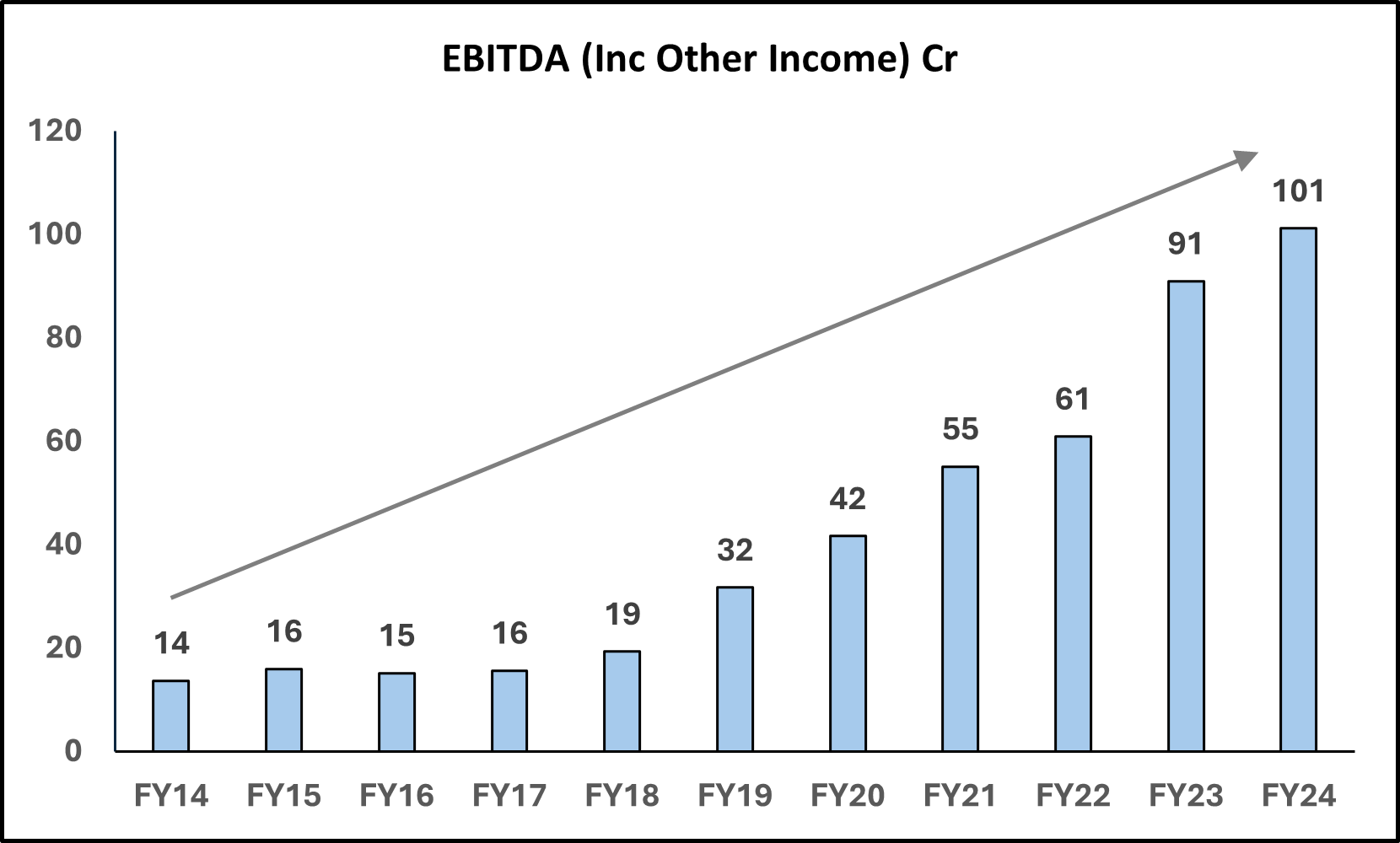

RACL Geartech has a good track record on execution

RACL Geartech has demonstrated good growth accompanied by business model de-risking.

Over the last decade, quality of earnings has improved:

- Superior mix (increase share in higher margin exports, reducing share of lower margin segments like 3W vehicles).

- More value products (increase in share of complex parts, forward integration from loose parts to gear assembly, higher share of concurrent engineering 8which has resulted in improvement in numbers.

- De-risking across products/customers.9

Despite differentiated product, this is not a wide moat business.

RACL core products are differentiated (transmission related parts have more stringent vibration/noise parameters so need high-precision engineering) and should command healthy economics over time.

However, while competition is not intense, there is no unique technology edge that others cannot replicate. Rather, the moats are soft, i.e. customer trust – that goods will be delivered as per agreed specifications and on time. And the incentives are for customers to give higher wallet share to trusted vendors to reduce complexity in their own supply chain and get better pricing in return for scale. Auto is a Just in time business. The fact that marquee global brands will trust RACL, a relatively small Auto Comp vendor located thousands of Kms away, to be a sole supplier speaks highly of the trust RACL has established.

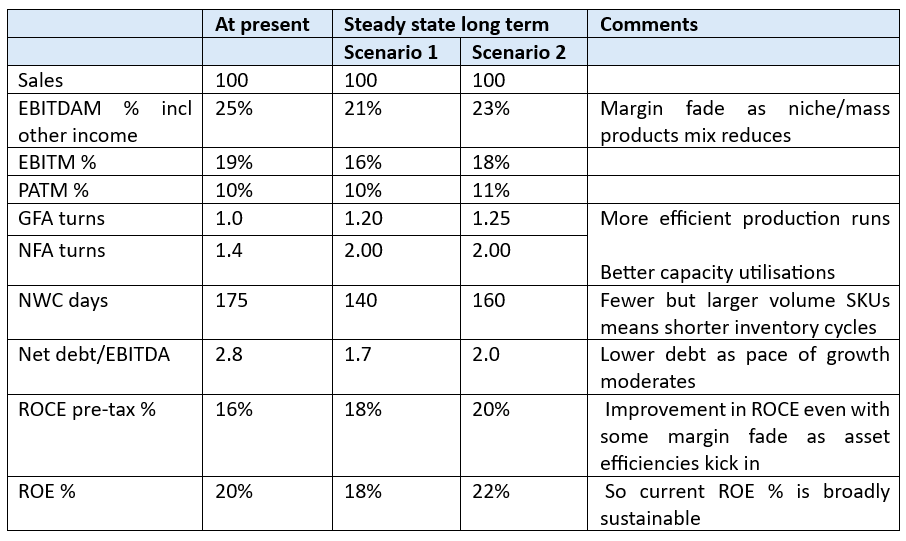

We believe RACL can be a 18-20% ROCE business that could deliver ~18% ROE with some debt

In an industry where product price transparency is high, vendors cannot make super normal profits. Hence, vendors with some technical differentiation should be able to earn 18-20% ROCE, which would translate to ROE of ~18%+.

In the short term, “reported” ROCE can be misleading. RACL promoters are focused on long-term outcomes and hence have been investing ahead of the curve in new technologies. Hence, plants are not operating at optimal capacity utilization today (Gross block has expanded by ~26% CAGR over last 3 years) which we believe they will be able to sweat for higher turns over time.

Promoter an “Intelligent fanatic10” we can trust

In long term investing, the principal bet is always on people. At RACL we are backing a technocrat promoter, with an exceptional track record, who inspires a lot of confidence and trust. A technocrat promoter who leads sales efforts gives immense comfort to customers. The passion for quality and ambition to create a large organization is palpable from consistency of messaging on conference calls. Promoter has shown strong alignment with minority shareholders by keeping managerial salaries low. Transparency with investors is high and management calls out challenges with candour.

RACL Geartech trades at broadly reasonable valuations post correction.

RACL has zero institutional ownership and negligible sell side coverage. So, we cannot point to a specific variance perception we have vs other investors. RACL grew Revenue at 17% CAGR and EBITDA at 26% CAGR in the period FY19-FY24. In the last 2 years (FY24-25e), company has faced temporary growth headwinds (inventory reductions by customers due to weak end demand, slowing EV sales, longer lead time for critical equipment etc). These challenges have led management to lower their growth guidance.

Long term compounding is seldom linear and even high growth companies face short term cyclical challenges. We remain confident on RACLs long term prospects: the + 1 opportunity exists, RACL enjoy strong customer credibility and continues to win new projects even in a challenging environment. Even if the end industry goes into a recession, as there are market share gains at play, company is well positioned to grow.

Basis normalized profit margins and the mid-point of their revised FY25 guidance of 460-490 Cr Revenue, RACL trades at ~22x normalized PE. We find this attractive in the context of ~18% ROE and longevity of growth of a small base.

Why do we believe in longevity of growth?

Trust scales exponentially over time once a reputation for quality is developed. No customer will risk integrating an untested supplier strategically into a supply chain as the cost of a failed product/stalled manufacturing line is significantly higher than any cost savings. However, it is not worthwhile to have a supplier irrelevant in your larger scheme of things. Hence, while trust is established slowly, it scales exponentially via larger share of business from existing customers and the credibility extends to new customers.

Consider RACL history.

- Kubota initially started in 2004 with 2 SKUs and 1 location. This grew to 110 SKUs across 110 locations by 201911

- Historically RACL has added a large customer every few years, with whom they have expanded wallet share over time.

- RACL has recently won its maiden order as a tier 1 supplier for passenger cars (German OEM customer), which bodes well for long term scalability of this segment (Passenger cars is ~10% of Sales) as new business can be won on referrals once credibility is established.

Are debt levels at present too high?

RACL investor calls always have minority shareholders urging the management to raise some Equity to reduce debt. We prefer companies that have low debt. We seek resilience and debt amplifies fragility.

However, we are willing to make exceptions in specific situations and manage the risk of higher debt by position sizing. If we want to hold companies for long periods of time, we need to think like business owners. An analyst worries about volatility of short-term earnings which are amplified by debt. An owner wants to optimize ownership if debt can be serviced in the event of a shock.

Taking an owner’s perspective, RACL’s current debt levels (~282 Cr vs FY24 EBITDA of ~100 Cr) are not a significant concern.

- B2B businesses with strong growth runway but moderate ROCE require debt to fund Cap ex. The only option for promoters is to either reduce growth rates or dilute Equity. If we think as business owners, neither of these options is in our interest.

- Auto Components is not a business with high tail risks where profits can implode (US FDA ban, or steep price fall as in generic Agri Chemicals).

- In the last decade, RACL has rarely see a sharp fall in earnings and was able to grow profits even during Covid without availing any loan moratoriums.

- They work with very marque global OEMs, some business lines are recession proof, and the business is well diversified (customers/geographies).

We don’t see rapid adoption of EVs as a threat

- RACL primary product at present is transmission gears. EVs also need transmission gears which are almost the same value per vehicle as ICE (fewer parts but higher value per gear). RACL is present in categories such as high CC bikes, recreational vehicles and tractors where scope for EV is still a distant possibility. Finally, RACL is not limited to gears and will continue to leverage skillsets to expand into newer products which will further diversify business mix.

Is there key man risk?

- One cannot avoid key man risk in Small Caps. They are the nucleus around which the company is built. RACL story has been no different. The differentiated products that RACL has cannot be designed by one person alone, clearly there is professional depth which is not visible to outsiders. We believe with larger scale there is greater ability to expand management depth. We are already seeing progress (current CFO who joined recently is ex Citi). These tail risks cannot be wished away but need to be managed by position sizing.

Please click here if you would like to download the PDF version of this blog

- Positions which are >2% of Solidarity AUM ↩︎

- Normalized means steady state annual margins adjusted for quarterly fluctuations. We think RACL is a 22% EBITDAM and ~10% PAT margin business. ↩︎

- The transmission or gearbox adapts the engine output to suitable speed and torque to be transferred to the wheels. ↩︎

- Reference Reuters, here ↩︎

- Reference FT, here ↩︎

- Reference ET, here ↩︎

- Reference India Today, here ↩︎

- Work with customer from design stage where RACL gives value add inputs on best practises for commercial manufacturing. ↩︎

- Higher share of exports translates to longer NWC cycle due to larger inventory in transit. ↩︎

- Intelligent Fanatics are the world’s greatest business builders. They create companies and organizations that dominate and stand the test of time. Charlie Munger was the first person to use the term Intelligent Fanatic. ↩︎

- Company con calls ↩︎