Summary

We believe opportunity exists for Pix to compound earnings at ~15%+ this decade.

In a very over-valued market, our entry points over the last 2 years have been in the range of 17-20x TTM PAT. We believe entry priced paid are reasonable for a business with a long growth runway, leadership of a niche in India, and a high pre-tax ROIC1 of 26-32%.

Pix is still sub-scale in exports but should reach critical scale in 2-3 years, which will add more stability and a kicker to earnings. With more predictable ~15% earnings growth and >25% ROIC profile, valuation multiples could expand to ~25x. Pix offers good upside/downside prospects, especially in a very over valued market where value is hard to find.

Industrial consumables are good businesses to own.

Industrial consumable businesses are a “FMCG proxy” as demand tends to be largely non-discretionary in nature for their customers. Consider a Cement plant which cannot afford any downtime. Hence, critical equipment which has a lot of wear and tear will be replaced during regular preventive maintenance. The replacement demand tends to be steady. Hence, the baseline profits of industrial consumable businesses tend to be more resilient than sectors such as Capital Goods where earnings have more cyclicality. Most industrial consumable businesses we have studied, also tend to be high ROIC. Hence, these characteristics make them good businesses to own.

Company background

Pix manufacturers mechanical power transmission belts2

These belts find application in industrial machinery, agriculture, automotives and some consumer appliances. Watch the Pix Corporate Video, How industrial belts work? and Pix agricultural belt solutions to understand the role of belts.

The promoters entered this industry as traders in early 1980s and then put up a plant to service the Agriculture market in Russia. Over time, they expanded the business to other geographies. What is particularly impressive is their focus on the replacement market with products sold under their own brand.

This strategy results in lower growth, but more resilient growth with high margins and ROIC. Classical example of “resilience over speed”, which is the hall mark of Solidarity portfolio choices.

Today, Pix is among India’s top 2 mechanical power transmission belt manufacturers with leadership in the domestic Industrial and Agriculture replacement market. It has chosen not to participate in the Indian Automotive OEM market due to the lower margin this segment offers. It also supplies products in over 100 countries with USA, Germany, UAE, UK and Thailand being the key markets. The company has a granular customer base with top 10 customers contributing <35% of overall revenues. 3

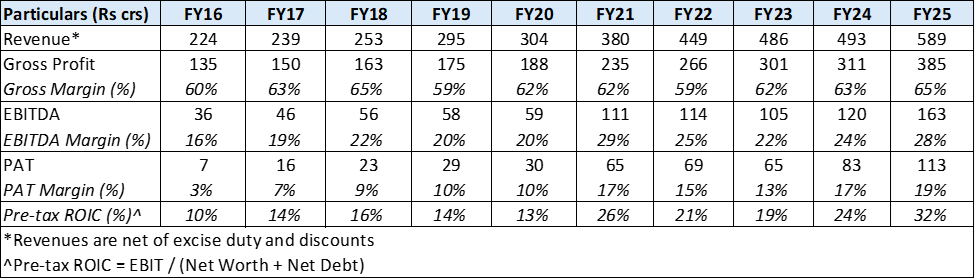

The company’s financials reflect disciplined execution.

Pix has a wide moat in a high entry barrier industry.

Pix has a healthy pre-tax ROIC of 26-32% at present which have expanded with scale. These reflect a wide moat which makes it difficult for new entrants.

- It will take a lot of time to build customer trust and replace an entrenched supplier. Belts are a mission critical product – the cost of downtime is very high compared to cost of the belt.

- It is tough to build a wide distribution network for the replacement market. Distributors want to work with companies which have an extensive range of SKUs to minimize complexity. Pix has ~80000 SKUs as requirements vary across customers and applications. Customers will not deal with a supplier who doesn’t have a wide product basket to compete.

- It may take a competitor 8-12 years to replicate the tooling needed to get a similar SKU range.

- There is a balance of pricing power between customers and manufacturers. Gates Corporation (the global leader) indicated in a recent conference call that they expect to pass on any impact of US tariffs to the end customer.

- Rapid growth comes with risks. Given all SKUs can’t be stocked adequately, turnaround time for replenishment becomes critical. A failure to meet delivery commitments for a large customer could result in steep penalties in addition to the risk of getting blacklisted for future orders.

All the above characteristics have resulted in a favourable industry structure globally with top 5 players controlling ~70% market share 4of the industry. Our understanding is that no new Indian player has entered this industry in the last 25 years.

We believe Pix can grow earnings 15%+ for long periods of time.

The domestic business is ~40% of Revenue and will grow ~6-8% as Pix has a high market share in the replacement market, which will grow in line with Industrial growth. Given its margin focus, Pix is unlikely to invest in capacity to serve the domestic Auto OEM segment.

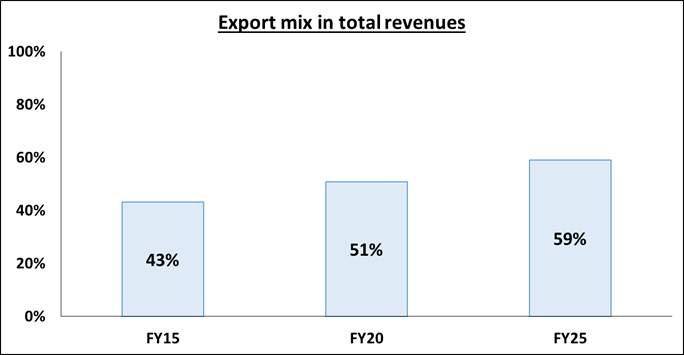

Exports are ~60% of Revenue and should grow ~15-20% as Pix is a small player gaining market share in a large addressable market (USD 5-10 billion by different estimates).

- The Covid supply shock has led customers to seek alternate partners to de-risk supply chains.

- The largest global player (Private Equity backed) has been exiting certain product range to focus on more profitable products giving Pix an opportunity to target customers in the US and offer itself as an alternative credible supplier.

We believe exports should pick up pace as Pix has reached a critical revenue size and a virtuous cycle may come into play.

- Export revenues have grown at ~12% CAGR over the last decade.

- Given the mission critical nature of product, trust is built slowly. Customer gives only a small share of demand initially to test vendor reliability. However, once trust is established, it scales exponentially. Customer gives higher share and more SKUs. Peers of existing customers see benefits and new sign-ups happen.

- As Pix scale increases, it will qualify to serve customers whose minimum revenue threshold it is not meeting today.

- Management seems to have been a bit diffident in pushing on growth as not delivering on commitments would have damaged credibility and impacted scale up. As they experience success in large customers, they will gain confidence to invest in larger capacities and pitch for higher wallet share. Strong balance sheet (FY25 net cash ~Rs 160 crores) and OCF generation means they can step up investments whenever they are ready.

With aggregate revenue growth in ~13% range, profits can grow at 15%+.

- There will be operating leverage on fixed costs.

- Investments in solar power will lead to meaningful savings in fuel costs which are ~6% of sales at present – which can either be used for market share gains or margin expansion.

Promoters are playing the long game and have shown focus and resilience.

The promoter family has focused on power transmission for 50 years. Amarpal Sethi (Chairman & MD) is a first generation entrepreneur having spent > 50 years in this industry. He founded this business with his brother, Late Pratipal Sethi. Sonepal and Rishipal Sethi (Joint MDs) from the next generation have been with Pix for 30 years and 20 years respectively.

They have a focus on bottom line and cash flow. They have refused to do contract manufacturing and serving OEMs which could grow revenue but at poor ROIC. Rather, they are building the business granularly by selling in their own brand in replacement market (higher ROIC, more stickiness but slow grind).

Valuations

Basis our ~15%+ earnings growth narrative with 25%+ ROIC and a long growth runway in a high Terminal Value business with no disruption risk visible, we believe fair value should be ~23-25x trailing PAT. Perhaps higher if earnings growth exceeds 15%. Industrial consumable businesses which have resilient earnings and high ROIC could get a premium valuation as markets value earnings resilience.

In this context, our buying price of Pix over the last ~2 years in the range of 17-20x TTM PAT is attractive to fair depending on where the valuation multiples finally settle and how well the company executes.

There are some leaps of faith we are taking.

- Exports will pick up pace from the ~12% growth of the last decade.

- A global tariff shock will not impact the business as most global players have significant manufacturing outside the US.

- Family stays together as they have done in the past.

- They have invested a small amount (~Rs 5 crores) in Equity instruments from their treasury book. This is not something we endorse but are willing to live with. Surplus cash should be returned to shareholders.

Please click here if you would like to download the PDF version of this blog

- Pre-tax ROIC = EBIT / (Net Worth + Net Debt) ↩︎

- These belts are used to transmit power from one part to another. The belt drive consists of an endless belt which is wrapped tightly over two pulleys called the driving and the driven pulley mounted on their respective shafts. The motion from the driving pulley is transmitted to the driven pulley by the frictional resistance between the belt and the surface of the pulley. ↩︎

- CARE rating rationale dated 18 March 2025. ↩︎

- https://www.futuremarketinsights.com/reports/industrial-variable-speed-belts-market ↩︎