Neogen is the only company which we continue to purchase even at valuations > 50x TTM PE.

We make exceptions only when a company is at a very early stage of the growth cycle, where there are visible opportunities/triggers for high growth longevity, and we are investing in top decile promoters.

Summary thesis

- Promoters have demonstrated resilience. Their story inspires confidence and trust.

- Neogen total addressable market is continuously expanding. Neogen was already strong in Bromine and Lithium based compounds, it commenced Advanced intermediates and CDMO business in 2018 and is now entering Salts and Electrolytes for Li-Ion EV Batteries.

- We estimate domestic Electrolyte opportunity could be worth ~15000crs by FY 30 where Neogen is well positioned. Exports of Lithium Salts is an additional opportunity. China controls 95% of global supply at present.

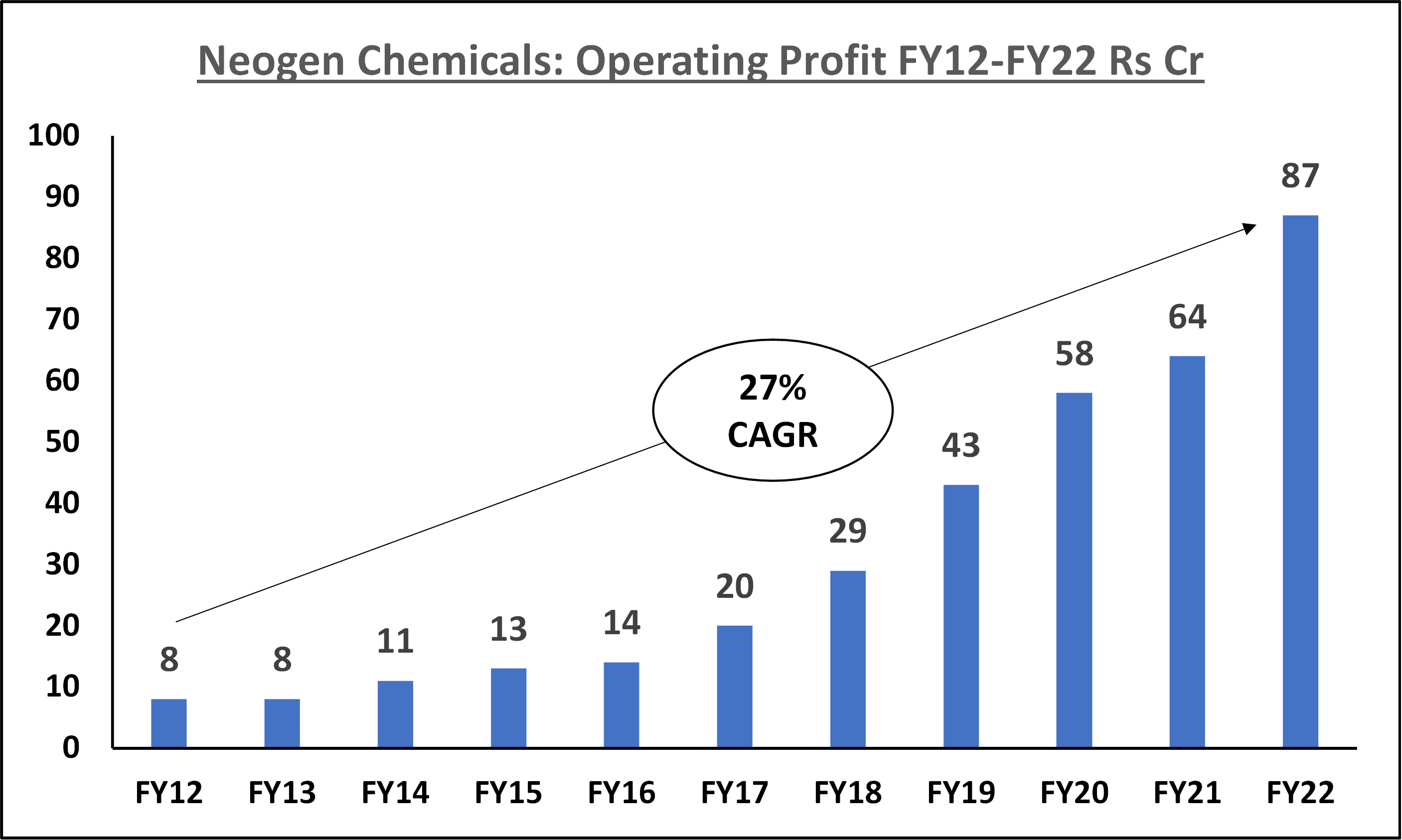

- Neogen has executed well growing Operating profits at ~27% CAGR in the last decade.

- Promoter credibility, historical track record, and the opportunity to grow earnings at 25%+ CAGR for the next decade make this an attractive business for us.

- Valuations are expensive basis near term financials; however, valuations basis short term financials are misleading as they miss longevity of growth.

- Our position size has significant buffer for us to buy more on declines, or over time.

Specialty Chemical/CRAMS was already a strong growth story for India. Covid and global geopolitics has resulted in an additional impetus due to the strategic imperative of MNCs globally to de risk supply chains from China.

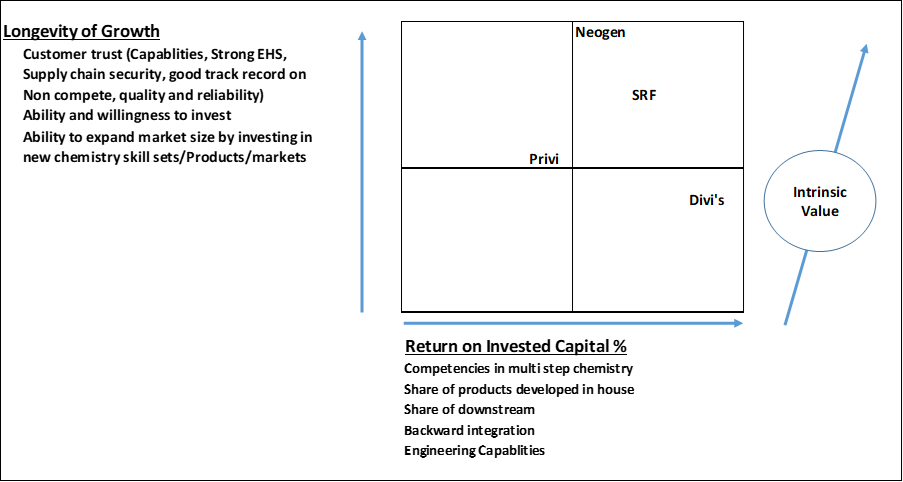

Our framework to assess which Specialty Chemical/CRAMS companies to invest in is presented below. The names of companies we own are listed as well 1

- We look for companies well positioned for growth longevity: technical competencies, culture of EHS compliance, reliability and promoter willingness to invest in the business.

- Where we believe ROIC can expand over time – entry into more complex chemistries, forward and backward integration, using engineering skills to enhance productivity.

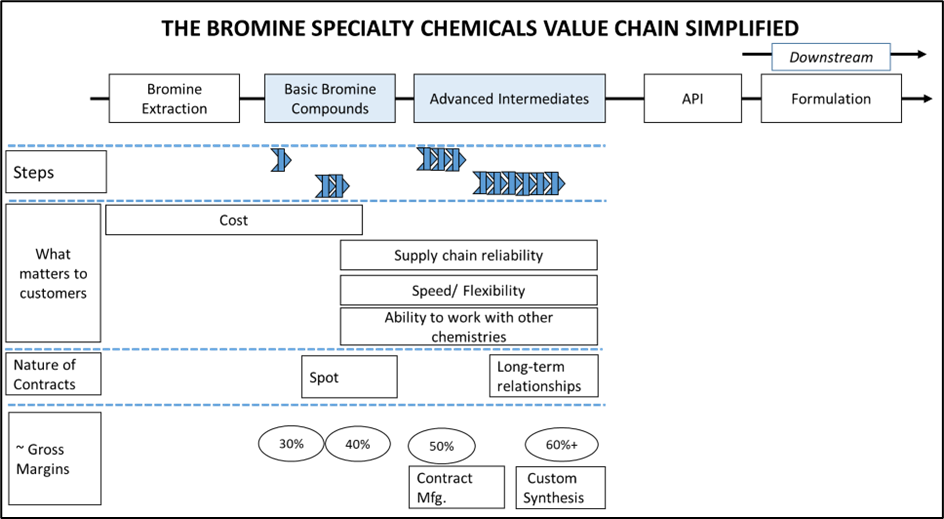

Neogen is a Specialty chemical company which historically made Bromine and Lithium based intermediates mainly catering to the pharmaceutical, agrochemical and other functional chemical verticals. In 2018, Neogen developed competencies in multiple step chemistry thereby expanding their offerings to more value-added products.

Neogen was founded by Dr Haridas Kanani (Chemical Engg. IIT Mumbai), a first-generation entrepreneur to extract Bromine from the Rann of Kutch in the 1970s. A flash flood destroyed his plant. He took up a salaried job and repaid all dues over the next decade, post which he once again set out to make Basic Bromine compounds in the 1980s. The company is now run by him and his son Dr Harin Kanani, (PhD chemical Engg. University of Maryland, USA & BTech Chemical Engg. IIT Mumbai). Process technology for all their products have been developed in house2 and around 12% of the workforce are employed in R&D.

India has a natural cost edge in Bromine vs China as it enjoys an inexhaustible supply of Bromine from the Rann of Kutch. China has extracted bromine from ground water which has led to ground water depletion and closure of several Bromine plants. As Bromine is hazardous to transport and requires specialized containers, higher transportation costs render China uncompetitive in Basic Bromine compounds. There are 8-10 players globally in Specialty Bromine and Neogen is the Indian market leader.

Neogen’s strategy is to sign up a customer with basic products and over time upsell more complex value-added products. 30%+ of sales today comes from value-add products vs ~ 10% few years ago3.

As a molecule undergoes various steps before becoming an API, the value of the molecule increases as it travels downstream. While basic Bromine compounds earn ~30/40% Gross Margin, more complex compounds which require multiple steps or require a combination of Bromination with other chemistries could be as high as ~50/60%. Bromine is highly corrosive, usually never forms a part of the end molecule and needs to be recycled/disposed. Hence, it’s a win-win for customers and vendors if more steps can be completed within an existing facility which provide savings on both transportation and inventory holding costs.

Neogen has executed very well with Operating Profits expanding ~11x over the last decade.

Neogen has a very large opportunity from the exponential growth expected for Lithium-Ion (Li-Ion) batteries in EVs, supported by Govt incentives for battery localization. The link below explains the working and components of a a Li-Ion Battery.4 The demand for Li-Ion batteries is estimated between 80-160 GWH by 20305. Batteries such as Sodium Ion have low energy density and therefore will be more useful for stationary applications (renewable energy).

Neogen has a meaningful opportunity in two products where it is well positioned.

- Lithium Salts for exports. At present China supplies ~95% of the global demand for Salts and the world is looking to strategically de risk from China.

- Electrolytes for Indian market. Salts + Solvents + Additives = Electrolyte. Unlike Salts, Electrolytes are not economical to ship long distances due to logistical challenges – Electrolytes are corrosive, have significant solvent content and require special drums for transportation.

The Salts/Electrolyte opportunity is very large compared to Neogen revenue at present.

- Lithium Hexafluorophosphate (LiPF6) is the most widely used salt in Electrolytes in Li-ion batteries today.

- About 15% of the total Cost of a Li-Ion Battery today is Electrolytes. Based on rough maths, about 80 GWh of Lithium Ion will translate into an Electrolyte opportunity of about 15,000 Cr by FY 30.6 This estimate would change basis the GWh estimate, technology developments, and basis prices of Lithium.

- ~95% of Salts consumed for Electrolytes globally are produced in China today. Exports of Salts from India could be a huge opportunity – even if China is cheaper – as the world is looking for supply diversification. The global market for Salts will be ~50x India market size.

- The key point to note is that Neogen is ~700 Cr Revenue FY23e. Neogen has significant prospects for growth from current base.

Neogen also has an opportunity in Cathodes as they are ~30% of the cost of a EV Li-Ion Battery and different Cathode chemistries require between 8% (LFP) to 14% (NMC811) Lithium content. However, we are not clear whether Neogen has a differentiated value proposition in Cathode today. This could change as competencies can be developed or partnerships developed. The Cathode opportunity is not included in our market sizing estimates.

Neogen is well positioned to capture a share of the domestic Electrolyte opportunity.

- As Lithium Hexafluorophosphate (LiPF6) will be the dominant Electrolyte, players who will be well positioned to win will be either players with a Lithium or Fluorine background.

- Sale of Salts/Electrolytes is a B2B business. The performance of the Electrolyte is core to success and hence approval cycles will be lengthy. Moreover, as is standard practice with Automotive OEMs, they will work with fewer players and offer high volumes to get the best prices. Hence, an early mover has an advantage because once partnerships/tie ups have already been formed, a late mover needs to bring something disproportionately better to the table to displace an incumbent.

- In any Specialty Chemical business, there is a learning curve which affects your cost position. Fluorine is a very reactive gas and not easy for new entrants to master. There are only 3 serious players in Fluorine in India today (SRF, Navin Fluorine and Gujarat Fluorochemicals)

- Neogen has the advantage of 30-year track record of making high purity lithium salts and hence has a head start in Electrolytes. The key challenge in Lithium processing is reducing metal impurities to few parts per million as impurities impact performance of the battery. Additionally, electrolytes performance is very sensitive to moisture content. All of these can be mastered by a new entrant – however, they involve a learning curve.

- A key challenge today is ensuring a reliable supply chain for Lithium as it is in short supply. Neogen has a sourcing edge at present as they have 30-year relationship with Lithium carbonate players and ~50% of Lithium carbonate quantum imported in India is sourced by Neogen7. While this sourcing advantage will normalize over time as Lithium availability increases, Neogen has a head start in being able to show case firm supply chain commitments vs new entrants.

- Neogen and Gujarat Fluorochemicals seem to be moving faster than others with pilot plants being announced.

- Global competitors in Salts/Electrolytes should want to tie up with strong players in India rather than set up plants independently – both because they have larger markets to focus on vs India8, and because India is a complex market from a regulatory and environment perspective for a new MNC to navigate that does not already have a footprint in India. The largest players in Salts are Chinese players who will have a geopolitical challenge operating in India.

It will be a fool’s errand to precisely forecast profits as there are multiple variables at play. However, using conservative assumptions, we believe profits would be large enough to justify an investment at current prices.

- The market size would depend on the pace of EV adoption in India. Neogen market share will depend on technical superiority of products, cost position vs other competitors, import duties.

- It is not clear what the final margin profile of this business will be. Automotive component companies earn anything between 10-25% EBITDA margins depending on the technical complexity of the product.

- Assuming 80 GWH market size, 25% market share for Neogen and 15% EBITDA margin, domestic Electrolytes could be a 500-600 Cr EBITDA business by FY 30. Export of Salts could be large, but it is hard to put a number here when China has over 95% of global Exports at present and the world is actively looking to de-risk from China.

- The base Bromine and Lithium derivatives business is a 100 Cr EBITDA business today growing 20%+. Assuming this grows at 15-20%+, the base business could be a ~300-400Cr+ EBITDA business by FY30. So, Neogen could be a 1000-1500 Cr+ EBITDA company by FY30 ignoring the Cathode opportunity and any other growth avenues that may emerge.

- As this is new territory, we assume that the ROCE will be broadly like their current business. We expect some Equity dilution along the way as internal cash flows will not be sufficient to fund the cap ex. If the EBITDA outcomes outlined above are achieved at current ROCE levels, this would result in very good outcomes for shareholders despite dilution.

Risks

Availability of Lithium. While there is a Lithium supply shortage at present, new Lithium mines will be discovered/speeded up and lithium recycling will gain traction. Any challenges to Lithium supply could result in delay in EV penetration and affect the market size estimates.

Developments in Battery technology. Lithium-Ion batteries are the front runner amongst all options and seems most likely to be used in Electric vehicles9. However if any superior technology becomes mainstream in future, it will impact Neogen’s prospects if they are unable to adapt.

Competition from Chinese/Japanese players. They have technology, are very backward integrated and have sourcing security. Our base case is that global players would prioritize larger markets. However, if they decide to pursue India aggressively, it could have implications for Neogen’s domestic market share. No Chinese/Japanese player has announced entry into India yet.

Perspective on current Neogen valuation

Neogen currently trades at ~65x TTM PE and ~33x TTM EV/EBITDA. We believe entry valuation multiples basis near term financials works well in businesses with linear profit trajectories (FMCG, IT Services, Banking, Asset Management). However, ascertaining fair price for entry is trickier when businesses have non- linear growth prospects and management teams have demonstrated strong execution. Excessive focus on near term valuation multiples when there are prospects for non-linear growth could cause one to miss out or sell out too early from winners of the next decade.

As an example, one would not have envisioned Neogen’s Specialty Bromine foray ~8 years ago. Even though we have been investors in Neogen since its IPO 3+ years ago, there was no understanding of the Electrolytes/salts opportunity when we initially invested. We still don’t know what Neogen can do in Cathodes. And there are other adjacencies that Neogen could enter in the future, which one can’t envisage today.

Over the long term, Earnings compounding will be the primary driver of returns. Hence, when one has a credible case for non- linear growth, an alternate approach could be to look at valuation multiples a few years out when growth is more steady state and reverse calculate potential returns. If a company is very early in its growth life cycle, one can afford to over-pay a bit as growth will cover valuation errors, and one can buy more at lower prices. Consider Divi’s Labs in CRAMS in 2004 or SRF in Specialty Chemicals in 2014. Even if one paid 2x the multiple they traded at, one would still have a good outcome. One should therefore not only look at valuations on entry, but also the range of potential Earnings growth outcomes and size of position taken.

However, we must recognize the pitfalls of this approach. If the estimated growth does not materialize, one will have very poor outcomes as multiples will also collapse. There are very few companies who have grown PAT at 25%+ CAGR over a decade. And you can never know for sure, whether the company you have identified will not lose their way. Hence, one must break valuation discipline in very rare cases and constantly check that the thesis is on track.

Neogen is the only company which we continue to purchase even at valuations > 50x TTM PE. We make exceptions only when a company is at very early stage of growth cycle, where there are visible opportunities/triggers for high growth longevity, and we are investing in top decile promoters. Further, we never take full positions in such companies so we can add to these positions over time and cap aggregate positions of very high multiple companies at 10% in the portfolio.

Please click here if you would like to download the PDF version of this blog.

- We own SRF indirectly via Kama Holdings. ↩︎

- Management disclosures ↩︎

- Management disclosures ↩︎

- https://dragonflyenergy.com/inside-lithium-ion/ ↩︎

- BCG estimates ~70-80 GWh by 2030, India Energy Storage Alliance estimates 160 GWh by 2030. ↩︎

- 15000 Cr market size assumes ~0.95 MT Electrolyte required per GWh of Lithium Ion (Neogen IP). Electrolyte priced at USD 20/kg (https://www.osti.gov/pages/servlets/purl/1501862) & 3% per annum Rupee depreciation. Current LIPF6 prices basis exports from China are USD 33/kg. These should reduce over time as more Lithium supply comes to the market. Neogen will earn a processing spread over the price of Lithium Carbonate. Hence the price of Lithium does not significantly affect Neogen profits unless very high Li prices make EVs unattractive. ↩︎

- Source: Import statistics ↩︎

- Global demand for EV Batteries is expected to be 3500 GWH vs 80-160 GWH for India by 2030 ↩︎

- https://www.omazaki.co.id/en/electric-car-batteries-and-their-characteristics/ ↩︎