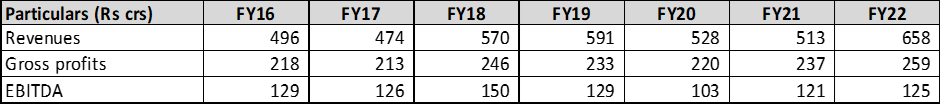

The lack of Earnings growth for Mayur in the last few years coupled with no immediate triggers has resulted in a reasonable valuation today.

We continue to own Mayur despite a few years of no operating earnings growth because its poor financial performance can be principally explained by the environment. The business is evolving well on operating metrics and its valuations are attractive. We also have a variance perception on key person risk. While Mr Poddar is the visionary and face of the firm, the business growth and resilience are not as dependent on the promoter as the market believes.

Over the last 7 years, the company has reported flat operating profit growth, but this was due to factors outside its control:

- Demonetization hit the footwear industry (46% of Mayur sales in FY16) disproportionately, Mayur chose to stay disciplined on profitability and working capital and chose to let go of business rather than drop margins. As the industry was recovering from demonetization, Covid lockdowns impacted revenue.

- The Automotive vertical, went through a downcycle in India starting mid FY19. 4-wheeler sales in India in FY22 were lower than FY18. By end FY20 when it seemed the auto cycle would start reviving, Covid-19 impacted demand which was worsened by chip shortages and supply chain issues.

- New programs won by in the Auto segment (domestic and exports) as well as Poly Urethane (PU) foray didn’t scale up as expected due to these disruptions.

- FY22 saw unprecedented cost pressures due to RM and logistics inflation which can be passed on only with a lag.

However, the lack of earnings hides the strong operational performance of the business. They have signed up marquee customers in Automotive and have a large opportunity in PU. These should aid growth in the coming years as the business environment normalizes. Global customers have significant potential for growth as credibility builds and programs are rolled out to multiple geographies.

| 2017 | 2022 | Comments | |

| Products | PVC | + PU | India imports 4000 Cr of PU Leather from China. The domestic addressable market for Mayur is 2000 Cr. |

| New segments | AutoFootwear | Global brands selling bags, purses, shoes, are major users of PU; are seeking supply chain diversification from China. | |

| New automotive logos and programs | Domestic: TataMahindraMarutiHonda | + VolkswagenMGHyundaiKia | |

| Exports FordFiat -ChryslerGM | + MercedesBMW |

Despite the headwinds for many years, Mayur has maintained its profitability, and has continued to invest in future growth. These are the hall marks of a resilient franchise.

The company remains Debt free with ~Rs 190 crores of cash on balance sheet, despite two buy backs.

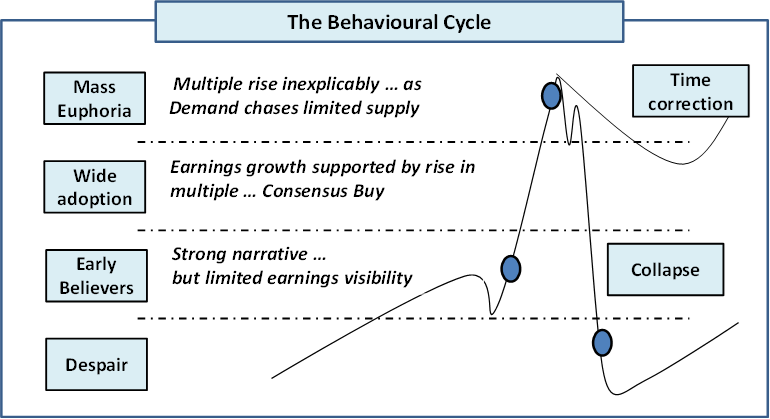

The lack of Earnings growth in the last few years coupled with no immediate triggers has resulted in, not surprisingly, a reasonable valuation today as the markets tend to chase momentum. Businesses which have had a few years of low/nil earnings growth and lack immediate triggers for growth are usually shunned by investors and hence provide good entry points for long term investors. The inverse is also true where businesses which have performed very well in the recent past trade at very optimistic valuations thereby reducing future potential returns even if earnings growth is reasonable. We discussed this “Behavioural Cycle” on Pg 7 of our Q2FY22 Letter.

We don’t see the risk of multiple de-rating in Mayur from current prices. When the Auto Cycle turns or the PU plant ramps to full capacity is anyone’s guess. But when it does, all the operating initiatives taken by the company will translate into strong Earnings growth. And as Earnings rebound, the stock price will inevitably follow.

Please click here if you would like to download the PDF version of this blog.