We invest primarily with an “ownership mindset” (~90-95% of portfolio).

- Businesses that have a long runway for growth as they are benefitting from secular tail winds.

- A strong competitive edge reflected in industry leadership positions.

- Are run by disciplined management teams aligned with interests of minority shareholders.

However, ~5-10% allocation is kept for “Special Situations”.

- Companies that currently don’t fit our core approach but offer highly asymmetric risk/rewards.

- The underlying price is at a significant discount to the fair value of the business, which we don’t think is justified.

- A trigger for re-rating is visible.

Special Situations create more stress. Then why bother with them at all? We believe it is important to expand our opportunity set and circle of competence. Hence, we are willing to experiment with small allocations in alternate styles. It may interest partners to note that ICICI Bank, our largest position at present, first entered our portfolios as a Special Situation.

This note explains:

- The difference in Special Situations vs investing with an ownership mindset.

- Summary thesis on MAN Industries.

- Drivers of growth and triggers for re-rating.

- Reasons for our variance perception on governance.

- Rationale underlying position sizing of MAN.

Appendix which outlines our perspective on key points related to governance.

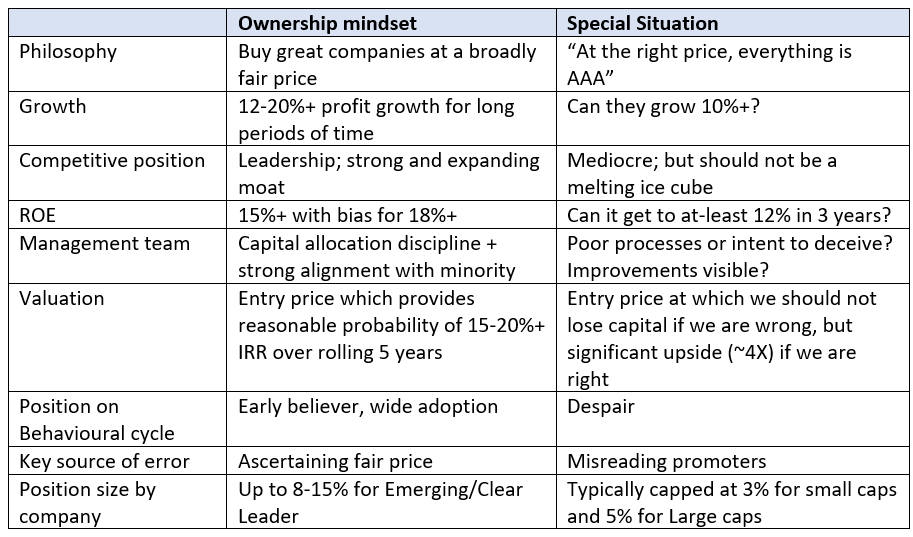

How is investing in Special Situations different from investing with an ownership mindset.

The questions one asks in a Special Situation and the position sizes one takes are very different from companies where we invest with an ownership mindset. A few examples.

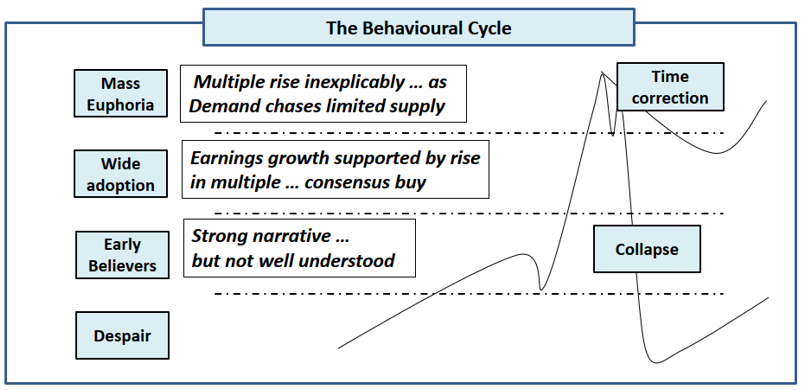

Special situation companies will typically be in the despair phase in the market behavioural cycle.

Summary thesis on MAN industries

- MAN Industries is trading at very pessimistic valuations (~5x PAT for FY 24e, ~3x Cash PAT FY 24e). It is trading lower than no growth valuations for a company with low debt and a normalized ROE of 12%.

- The company has had a troubled history of promoter family disputes with each side accusing the other of poor governance. The market is therefore rightly concerned on governance and chooses to stay away. Institutional shareholding is ~2%.

- We have a different perspective from the market on governance at MAN. We believe the company is a victim of internal family disputes and governance issues are primarily procedural violation of securities laws and no money has been siphoned from the company. While a lot needs to be done to strengthen how the company is run, we believe the current promoters are making honest attempts to communicate transparently to regain credibility.

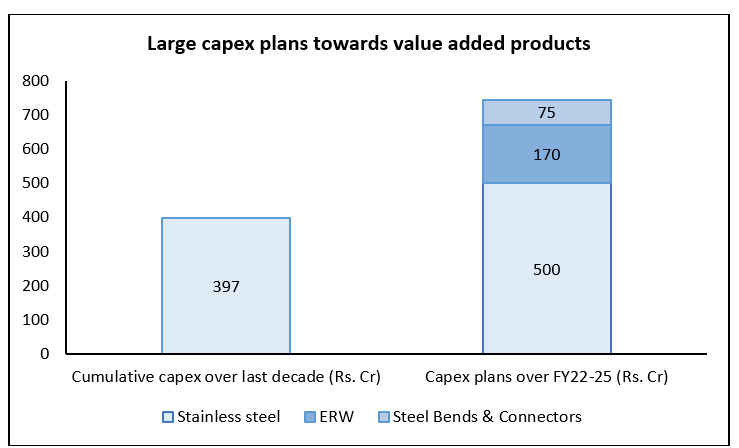

- Core Carbon Steel SAW Pipes is not a very attractive business (SAW pipes are commodity, there is over capacity in the industry, MAN is not the domestic market leader1 and the avg ROE over last decade has been ~10%).2 They are however, investing ~500 Cr for growth in more value-added products. Note, this capex is more than MAN current market cap.

- The cap ex in more value-added products, the transparency in promoter communication, resolution of SEBI issues, cash inflows into the company from sale of non-core assets should be triggers for re-rating.

- In our base case, we see ~4x upside over next 5 years if we are right with very limited downside risk if we are wrong.

- Market perceptions take time to change. However, when perceptions do change, re-rating can be swift. Our 3% position weight cap permits us to be patient.

Market opportunity

- Steel Pipes is a large and growing market. There are tail winds of City Gas and Water pipelines in India and an increase in Cap ex in the Middle East to feed a gas hungry Europe.

- Natural gas pipelines enjoy structural growth tailwinds as India intends to increase share of natural gas in its energy mix from 6% to 15% by 2030.

- Large opportunity for Water pipelines (Jal se Nal, River linking projects) in a water starved country like India.

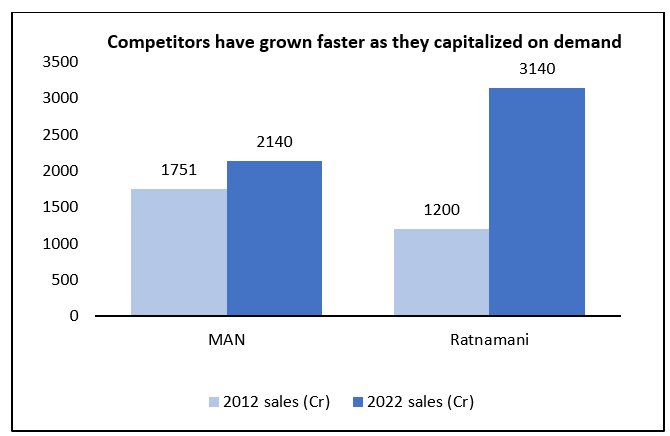

MAN historical growth has been poor

- MAN has had a lost decade due to promoter disputes.

- Over the last decade, total cash generated has been ~Rs. 870 Cr of which only ~Rs. 400 Cr3 has been reinvested in the business.

While growth has been poor, MAN has low net debt levels today as it used Operating cash flows to pay down debt (Over last decade cumulative OCF generated was ~Rs. 870 Cr of which ~Rs. 180 Cr was utilised to repay debt)

MAN has started investing in growth

- The current promoter family is firmly in control of the company basis High court ordered settlement.

- MAN has embarked on a large capex program towards more value-added products with higher margins. Unlike SAW pipes, ERW and Stainless-Steel pipes command higher margins.

- Unlike SAW industry which is facing over capacity problems, ERW and Stainless-Steel pipes are growing sectors. MAN sees foray into these products as an expansion of its product portfolio and can leverage existing customer relationships to sell these products. For Stainless steel pipes, while there is some customer overlap in Oil & Gas, MAN would need to develop customer relationships for industries like pharma, fertilizers etc where it doesn’t have presence today.

- One is taking a leap of faith that management team will be able to successfully execute this large Capex program. Success in new segments will only be known with time, however management is investing behind growth and has hired specialists to help scale this segment.

- The business also will benefit from Operating leverage as employee costs as % of revenue will reduce with scale. Hence, we believe the company will grow with some margin expansion over the next 5 years.

| Segment | EBITDAM (%) | Current status |

| SAW pipes | 10-11% | No capex plans currently |

| ERW pipes | 14-15% | Commercialized, doing trial runs |

| Steel bends & Connectors | 30%+ | Will commercialize in Q4 FY23 |

| Stainless Steel pipes | 20-22% | Under construction |

Solidarity variance perception vs the market on governance

- Management has made errors in the past (Not disclosed SEBI Audit issues promptly, issued warrants rather than doing a Rights issue, Promoters purchased MAN shares when trading window was closed, had losses due to inappropriate hedges).

- In the past promoters had borrowed money from subsidiaries which has been returned. Our belief is that while there have been missteps and instances of weak processes, there is no attempt to mislead or siphon cash from the company. This belief is key to our investment thesis.

Why do we carry a variant perception versus the market on governance?

- One should not ascribe lack of integrity to motives when family conflicts are involved.

- A consortium led by SBI continues to support the company’s Cap Ex plans and has conducted special Audits on the company. They would not do so if their audits revealed cash was siphoned from the company. It should be highlighted that incremental loans have been sanctioned post the SEBI audit and management has disclosed on exchanges that the lead bank has shared its audit report with SEBI.

- Management has been consistently doing quarterly calls with candid explanations around historical issues and giving timelines in which they will be resolved.

- The company has very low debt levels on balance sheet.

- Related Party Transactions have meaningfully reduced over the last decade to negligible levels today.

When one invests in Special Situations, the bet is always on “direction of travel” – that teams will improve their disclosures over time. We see progress on key issues which support the case for a valuation re-rating. Please refer to the Appendix for more details.

Range of IRR outcomes is very favourable from current prices

- Strong downside protection if we are wrong.Today, MAN has very low debt levels.4 Hence, Capex can be funded while ensuring leverage ratios are comfortable.

- Company is available at <5x PAT FY24. Promoters issued warrants at 65/share and bought shares from the market at 70/share vs current CMP of ~90/share.

- MAN currently owns non-core Real Estate worth ~ 125-150 Cr5.

- Upside of ~4x in 5 years if we are right (base case)

- If Cap-ex plans are executed timely, our base case estimate is ~4500 Cr Revenue by FY28 vs ~2150crs in FY22 (13% CAGR)

- At ~11-12% EBITDAM, we believe MAN will generate 225-250 Cr PAT by FY28. We assume a PE at exit of ~8x, akin to what a no growth company should get. That would imply a Market Cap of ~1800-2000 Cr vs ~500 Cr today.

- Additional upside from valuation re-rating

- MAN is not a leader today which is clear in the large gap in EBITDAM% between Ratnamani (16%) and MAN (9-10%) which also reflects in large valuation discount vs Ratnamani today.

- If MAN can demonstrate success in its value-added journey, the valuation multiple could further increase. Ratnamani’s 5 years average TTM PE has been ~27x.

Position sizing this bet

- While the potential upside is large, the position size needs to reflect that MAN is a microcap, the risk of investing in a stock with a troubled history, our ability to correct errors and the time it may take for the market to build trust.

Our small position size (3% cap) gives us significant holding power and ability to be patient.

Appendix

| SEBI Forensic audit | Current status | Solidarity perspective |

| SEBI appointed a forensic auditor to review MAN Financials over FY15-21. Scope of Forensic audit.6 Review provisioning of bad debts/genuineness of Debtors. Related Party transactions Merino shelters non-consolidation. Accusation of diversion of funds and manipulation of books of accounts. | Filled for settlement with SEBI- awaiting their response. Mgmt. doesn’t expect large penalty. – Q3FY23 call. | We believe violations are mainly procedural. Transaction audit done by consortium of lenders in 2021 gave clean chit, same report shared with SEBI7 by Banks. Banks have sanctioned 165crs funding for ERW project post their audits – May 2022 call. |

| Merino Shelters – Non-consolidation | Current Status | Solidarity perspective |

| Company advised not to consolidate by lawyers as brother has contested High Court settlement and ownership of Merino Shelters. | Agreement with Piramal has been signed. Amount due to Piramal is 70 Cr of which 15 Cr has been paid. The expected transaction closure date is 31st March 2023. – Q3FY23 call. | Settlement between brothers filed in High Court gives Merino ownership to MAN Industries. Merino is a non-core Asset which can provide some upside to the company. After settling all the claims, company expected to receive 55-80 Cr. |

| MAN Infra shares yet to be allocated to shareholders of MAN Industries | ||

| Issue | Actions taken by MAN Industries | Solidarity Perspective |

| Post the demerger of MAN Infra from MAN Industries, the shareholders of MAN Industries were supposed to receive shares of MAN Infra in the ratio of 1:1. But MAN Infra has not allotted the share. | As per Q2 FY22 concall, MAN Industries has complied with all the formalities for the allocation, has closed the book and has handed over the register to Bombay High Court, as well as, to the MAN Infra. The onus of issuing shares lies with MAN Infra. | Allotment of MAN Infra shares is not in MAN Industries control. |

| Karnataka Land – Non core investment | ||

| Issue | Current Status | Solidarity perspective |

| Man Industries had land in Karnataka. | Karnataka land has been sold; Man has received 40 Cr net of taxes – Q3FY23 call. | Positive development as non-core Assets are reduced and cash deployed in the core business. |

| Other Governance issues | Solidarity perspective | |

| Multiple Related Party transactions. | RPT transactions has reduced over the years to very negligible levels today. Mgmt has disclosed that there are no loans outstanding to promoters from MAN Industries or its subsidiaries. | |

| Legacy trade receivables not provided. MAN took 90cr cumulative write offs in FY21 & FY22. | Accounting needs to be more conservative. This is an area that needs more work. Some legacy receivables still remain outstanding as they are in arbitration. Write offs could comprise MAN industries position. Future write-offs if any, will impact reported accounting profits, but not cash flows as these are non-cash items. | |

| Purchased shares from open market when the trading window was closed. | Management admitted inadvertent mistake and paid the penalty. | |

Please click here if you would like to download the PDF version of this blog

The information or material (including any attachment(s) hereto) (collectively, “Information”) contained herein does not constitute an inducement to buy, sell or invest in any securities in any jurisdiction and Solidarity Advisors Private Limited is not soliciting any action based upon information. Solidarity and/or its directors and employees may have interests/positions, financial or otherwise in securities mentioned here. Solidarity may buy securities in companies owned by its clients. This information is intended to provide general information to Solidarity clients on a particular subject or subjects and is not an exhaustive treatment of such subject(s). This information has been prepared based on information obtained from publicly available, accessible resources and Solidarity is under no obligation to update the information. Accordingly, no representation or warranty, implied or statutory, is made as to the accuracy, completeness or fairness of the contents and opinion contained herein. The information can be no assurance that future results or events will be consistent with this information. Any decision or action taken by the recipient based on this information shall be solely and entirely at the risk of the recipient. The distribution of this information in some jurisdictions may be restricted and/or prohibited by law, and persons into whose possession this information comes should inform themselves about such restriction and/or prohibition and observe any such restrictions and/or prohibition. Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. Neither Solidarity nor its directors or employees shall be responsible or liable in any manner, directly or indirectly, for the contents or any errors or discrepancies herein or for any decisions or actions taken in reliance on the information. The person accessing this information specifically agrees to exempt Solidarity or any of directors and employees from, all responsibility/liability arising from such misuse and agrees not to hold Solidarity or any of its directors or employees responsible for any such misuse and free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors.

- MAN enjoys 15-20% market share amongst domestic players in SAW. (Source: PC report). ↩︎

- ROE is impacted by SAW industry overcapacity at present. MAN current utilisation levels are below optimum. ↩︎

- This includes Maintenance capex p.a. of ~10-15crs and capex for Coating facility in 2018. ↩︎

- Currently net debt is ~60 Crs versus normalized EBITDA of 200-250crs. ↩︎

- Net proceeds (Net of payout to Piramal) expected from sale of Merino shelters is 55-80crs. ↩︎

- https://www.bseindia.com/xml-data/corpfiling/AttachLive/804CF046-6287-4187-9020-6A7530AC3509-165847.pdf ↩︎

- https://mangroup.com/pdf/Disclosure%20under%20Regulation%2030%2025022022.pdf ↩︎