While our core approach to investing is to buy “disciplined compounding stories at a fair price”, it is equally true that “at the right price, all assets are AAA” (except where one suspects governance issues). We will buy companies in “Special Situations” when they trade at a meaningful discount to fair value. ITC meets our Special Situations criteria.

ITC has multiple business lines.

- A low earnings growth tobacco business where it is the undisputed leader (75% market share) and which throws out ~ 9500 Cr of Free Cash flow a year.

- A ~ 15000 Cr FMCG business with many marquee brands, that is seeding new categories and therefore is still not at peak margins. However, at 8% margins, it is self-sustaining.

- An agricultural supply chain which it has been building over 20 years and provides strong cost benefits to the FMCG business.

- A packaging business which lends support to the FMCG business.

- And multiple other non-core businesses (e.g. Hotels) which are not core or synergistic, and are not contributing much to value, but have consumed significant Capital.

ITC is a business with significant moats. Its ~30000 Cr cash pile, free cash flow generation and entrenched competencies in the agricultural supply chain and retail distribution provide a great platform for growth longevity in FMCG and related categories.

We have not owned ITC in the past for the following reasons.

- We dislike conglomerates because it is very difficult to be a leader in multiple business lines. However, human psychology never lets you admit this and as a result there is sub optimal Capital allocation discipline. Hotels has 25% of Capital Employed and has contributed less than 1% of aggregate EBIT over last 5 years. There has been excessive adventurism in tough categories where ITC has no right to win, for example Fashion.

- Very poor equity ownership amongst the senior management team. Its therefore unclear how much their thinking is driven by need to grow vs grow in a manner that creates value for shareholders (leadership, ROE, Capital allocation discipline). The two need not be correlated.

- We had owned United Spirits for a long time and did not want to own 2 sin businesses from a ESG risk in the portfolio, despite ITC having amongst the highest ratings on ESG.

ITC enters our portfolios as part of our “Special Situations” category.

While our core approach to investing is to buy “disciplined compounding stories at a fair price”, it is equally true that “at the right price, all assets are AAA” (except where one suspects governance issues). We buy companies in “Special Situations” when we are not convinced to own them under our leadership compounding buckets, however, they trade at a meaningful discount to fair value.

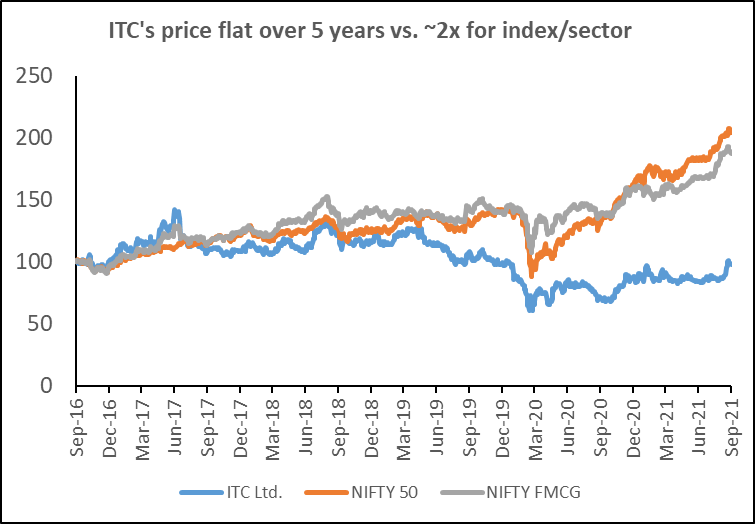

- ITC has underperformed the market for the last 5 years and at our entry price offers ~5% dividend yield. Hence it is like a Bond with an upside kicker. It provides strong downside protection and significant opportunity to boost growth from its FCF generation and ~30000 Cr cash pile.

- Its cigarette franchise has implied valuations lower than peers in the developed world despite potential for ITC to gain share from the illicit market.

The starting point for great returns is often deep cynicism/pessimism which then meets a trigger that causes value to unlock.

There are triggers that have led us to reconsider our stance.

- ITC management has guided to pay out 80-85% of PAT as dividends and conceded in recent communication the openness to re-examine its Corporate structure.1 Further, they have guided that incremental growth in the Hotel business will be under a Capital light model.

- Recent incidences of minority shareholder activism which resulted in a surge in stock prices.

- ITC management is engaging with analysts to hear counter view-points.

These create a credible hypothesis that one can expect more disciplined Capital allocation in future. One should also be open to a view that the future could be different from the recent past – “see what everyone is seeing, but imagine what no one else is thinking”.

One can outline 3 scenarios of the future over the next 5 years.

Pessimistic scenario where we see a credible path to 9-11% IRRs

- Management’s historical approach to building the company does not change.

- ESG concerns on tobacco result in no re-rating.

- The company pays out 80-85% of PAT that provides 4-6% dividend yield and about 5-7% Earnings growth.

Base case scenario where one could potentially earn 15-18% IRRs as the valuation multiples re-rate as there is more credibility on Capital allocation discipline.

- Cigarette business earnings growth picks up to high single digit over next 5 years and valuations of the cigarette business expand to trade in line with global peers.

The Hotel business is sold or demerged some-time over the next 5 years and overall multiple re rate as the market sees management delivering on better Capital allocation.

Optimistic scenario: This scenario requires more imagination of possibilities and a belief that good management teams learn from peers and wherein one can imagine an IRR road map in excess of 20%

- Some volume growth in cigarettes as ITC gains share from unorganized sector.

- There is more focus on select categories where it has “right to win”, larger categories become more profitable with scale and there is more disciplined experimentation in new categories. ITCs cash pile is used to do meaningful M&A in FMCG where it buys regional brands and uses its distribution muscle to scale them. Hence, the FMCG business grows ~15%+ and increases EBITDA margins to ~16-18% from ~9% today in the next 5 years.

- Partners may note that Britannia’s FY 22 operating margins are expected to be ~17% and this translates into ~6% margin increase over 7 years and its revenues are ~25% higher than ITC’s food categories which form 80-85% of ITC’s overall FMCG business.

- The conglomerate is re-structured and non-core businesses are spun off.

Risks that will cause us to change our stance.

- Aggressive regulations by Govt in tobacco that can cause material volume declines.

- Additional material non-related diversifications.

- No margin expansion witnessed in FMCG.

In summary, ITC offers base case prospects of 15-18% IRR and a chance of significantly higher returns under certain conditions. This is very attractive in context of where aggregate valuations in the market are at present.

Enclosed is a brief note to explain our thought process underlying this investment.