IndiaMART share price declined ~17% post Q2 FY25 results.

In this note we explain potential reasons for this steep correction and why we have used this opportunity to add to our positions.

Summary message

- Despite healthy profit and cash flow growth, the sell-off in IndiaMART was driven by continuing lack of momentum in addition of paid suppliers and muted customer collections in Q2 FY25. The market perhaps believes IndiaMART is at a mature stage on its growth life cycle.

- We believe IndiaMART is still early in growth life cycle with significant room both for user growth and ability to monetize its platform (higher FCF1 via upsell, cross-sell and margin expansion.

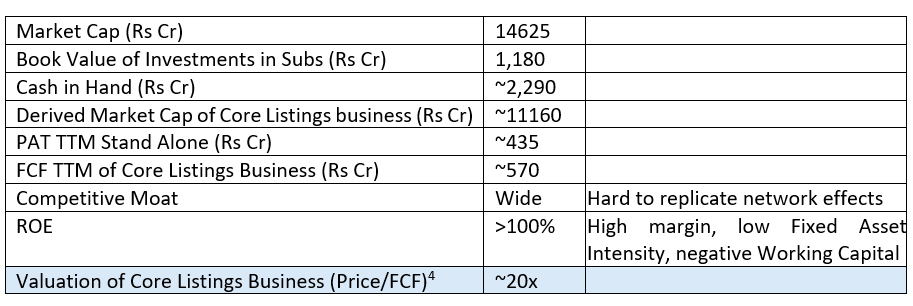

- At 20x FCF TTM for its core listings business, valuations are very attractive even if the business is mature stage of life cycle. These valuations imply 7% FCF growth to perpetuity2 which is significantly lower than what we believe is possible. There are few businesses in India with the ROE profile and moat of IndiaMART.

- We have used the steep price decline to increase our position size to 7%.

What does IndiaMART do?

- IndiaMART is the leading B2B listing platform in India that allows buyers to discover suppliers of products and services in India.

- IndiaMART makes money via subscription fees. The platform is free for buyers to post their lead requirements whereas suppliers are allowed to list for free but can pay subscription fees to get more visibility and access to buyer leads. IndiaMART offers tier-based packages – Silver (monthly/annual) at entry level, and Gold & Platinum which are premium packages (annual and multi-year).

- IndiaMART has been incubating new businesses that are adjacencies to its core business (Accounting software, Logistics enablement etc), that are needed by its core SME customer base. These have immense option value in future as SMEs in India have begun to pay for technology. IndiaMART with over ~80 Lac suppliers on its platform has immense ability to cross-sell these offerings.

Read our earlier note on IndiaMART here, where we have explained the business model in detail.

Important disclosure

- We disclose position names for transparency and context.

- We reserve the right to change our minds and may not be able to inform you if we do.

- Please read detailed disclosure at the end of this document.

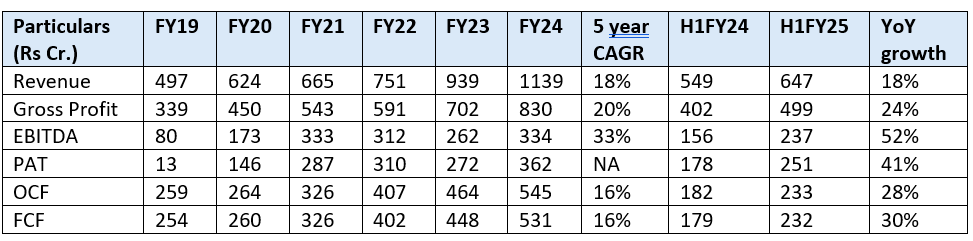

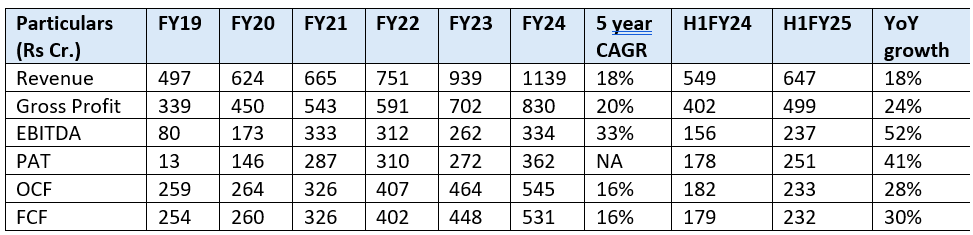

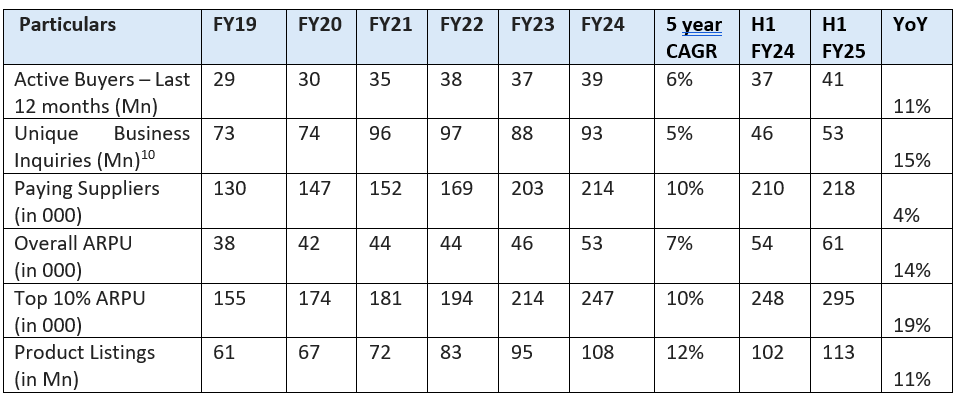

IndiaMART Historical Financials – strong track record of execution

IndiaMART Valuations at present3

What are market concerns?

- For the past few quarters, the entry level customer category (Silver) has seen higher than usual churn. Management is slowing down new customer acquisition till it solves the core issue leading to higher churn. Hence, “Net” paying supplier additions has been low.

- Growth in collection from customers was weak in Q2 FY25. The market is worried whether the platform is losing its pricing power with its core “Gold and Platinum” customers.

- Hence, the market in its collective wisdom perhaps believes that the company has reached mature growth stage in its core business and hence deserves lower valuations.

- Or perhaps, some shareholders believe short term earnings momentum is not in favour and capital is best re-allocated elsewhere.

Solidarity perspective

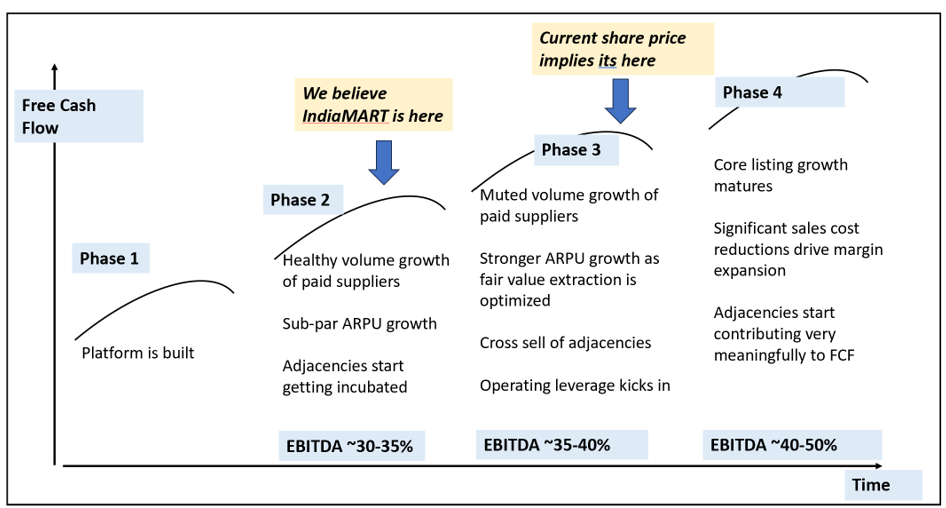

Platform businesses evolve over phases. Their true earning power increases with time.

- Phase 1: Platform is built and gives significant value to users to encourage adoption.

- Phase 2: The platform starts extracting value for itself while investing aggressively in Sales to grow users (where we believe IndiaMART is at present).

- Phase 3: Platform starts optimizing for value extraction when core user base is saturated.

- Phase 4: Platform reinvents itself or dies (power is abused and users’ revolt).

We believe IndiaMART is in Phase 2 of its growth cycle with a strong value proposition and a longer FCF growth runway than implied by current valuations.

- The SME market size in India is very large and there is scope for more paying users.

- Buyers are coming and staying. Repeat buy is strong.

- The top users of the platform are willing to pay good fees for value. Churn here at ~1% per month suggests strong value proposition and stickiness.

- Scope for additional monetisation and margin expansion.

- Management is investing ~14% of Revenue to grow Sales.

Our hypothesis is that slower user addition and higher churn in Silver customers is an issue that requires business model calibration and hence can be fixed over time. As the management is deliberately curbing new supplier addition till the issue is resolved, the “net” supplier addition is getting impacted. IndiaMART management mentioned on the last earnings call that it “has faced similar challenges in the past such as the years FY 12, FY13, FY17 and FY19”. Lack of operating variables data in public domain prior to FY16 means we cannot independently verify this. However, basis data shared with shareholders in quarterly presentations, ARPU4 growth YoY was muted in FY17 and FY19.

Even if user growth is now more mature stage if life cycle, there are multiple levers for IndiaMART to enhance platform monetisation over time.

- Average Revenue Per User expansion by increasing pricing basis value delivered.

- Margin expansion through additional sales cost reduction.

- Free supplier monetisation. ~ 78 Lac suppliers that are listed on the platform pay no fees.

- Value add solutions like data analytics, marketing solutions.

- Cross sell other solutions in adjacencies being incubated once product market fit is established.

Hence, IndiaMART is very attractively priced for a very high ROE business which enjoys strong moats.

- A strong customer value proposition exists, competitive position and FCF is strong. Both Buyer and core Gold and Platinum customer related metrics are healthy.

- We believe FCF can grow 15%+ CAGR over this decade. Assumptions of 5-6% paid supplier CAGR, 6-7% ARPU CAGR, some margin expansion, and optionality in adjacencies are not unreasonable. If this hypothesis is true, fair value should be ~35-40X FCF vs ~20x today.

- Even if paid supplier growth slows, IndiaMART should still deliver ~12%+ Free cash flow growth (“FCF”) from expansion in ARPU, profit margins.

- At 20x FCF TTM current valuations are very cheap as they imply core listings business is saturated and will grow at ~7% FCF CAGR to perpetuity and that there will be no value creation from the multiple strategic investments made.

We have increased our position weight as we are willing to take longer term views and are backing a management team that has executed well in the past and communicates with high transparency.

In the next sections, we elaborate on each of these points.

We don’t believe yet that core business is in the mature phase of growth life cycle.

Market opportunity exists to grow paid users.

IndiaMART has ~2.2 lac paid suppliers at present. Management believes they can get to ~5 lac paid suppliers over time.

Are these targets credible or moon shots? Conditions to support these targets exist.

- There are ~1.4 Cr GST registered SMEs in India of which ~40 lacs are registered on IndiaMART.

- There are 60 Lac businesses in India that use Tally (accounting software) today.

- 1688.com, a similar business model in China, had ~2.7 lac paid subscribers in 2007 which grew to ~9.6 lacs by 2017 and is ~10 lac paid suppliers at present. While every business model has its country specific nuances, it does show room for growth.

IndiaMART management team has credibility earned through a strong performance track record.

Promoters have skin in the game (>49% ownership) and are still investing~180 Cr in Sales costs5 today. At ~14% of Revenue, this is a significant commitment that reflects belief and a desire to optimize for longer term outcomes rather than the short term. Management calls out challenges without any “the worst is behind us” commentary.

The market opportunity, past track record and candidness make us believe that the ~5 Lac paid supplier target is a credible hypothesis.

We believe current issues will get resolved with time.

- The slowdown in user growth is not a competitive issue. IndiaMART has built a strong network effect which creates a virtuous cycle which is hard for a competitor to replicate: ~4.1 Cr active buyers, ~80 lac supplier store fronts with ~11 Cr product listings across ~98K categories.

- Slowdown in pace of growth has happened multiple times before and has been successfully resolved.6

- Our channel checks suggest the key issues are need for more selective customer targeting, education of new Silver suppliers on how to use the platform for a higher speed of response to leads generated, and need for more nuanced match making.

- Management is taking active steps to fix issues – taking Sales teams in house for better customer selection, better matchmaking of leads with relevant suppliers, close hand holding of Silver suppliers during initial period etc.

- As management is not aggressively signing up new paying suppliers until the churn issue is fixed, this further dampens “net additions”.

The value proposition of the core listings platform continues to remain strong.

- Buyer inquiries are growing without the use of advertising; repeat buyer rates remain healthy at ~55%7.

- All profits accrue from the core users of the platform8 (Gold and Platinum customers). Business metrics in this category remains healthy (5 years ARPU growth has been 10% CAGR for Platinum customers, Gold and Platinum customer churn rates are ~1% per month).

- Cash flows remain strong and resilient. Operating cash flows has grown from ~180 Cr to ~235 Cr H1 FY24 vs H1 FY25.

Key business metrics remain healthy9

There is scope for additional platform monetisation over time

- Over ~78 Lac suppliers on the platform pay nothing at present and still enjoy some benefits.

- The platform is highly value accretive for the core customers (Gold and Platinum) and there exists scope to better monetize this via ARPU increases.

- 1688.com saw ARPU increase of ~20% CAGR over 2015-24. This was done via price hikes and value add solutions like storefront mgmt., marketing support, data analytics etc.

- We see early evidence of monetisation potential (IndiaMART has selectively introduced differential pricing, Q2 FY25 ARPU increase for top 10% customers was 19%).

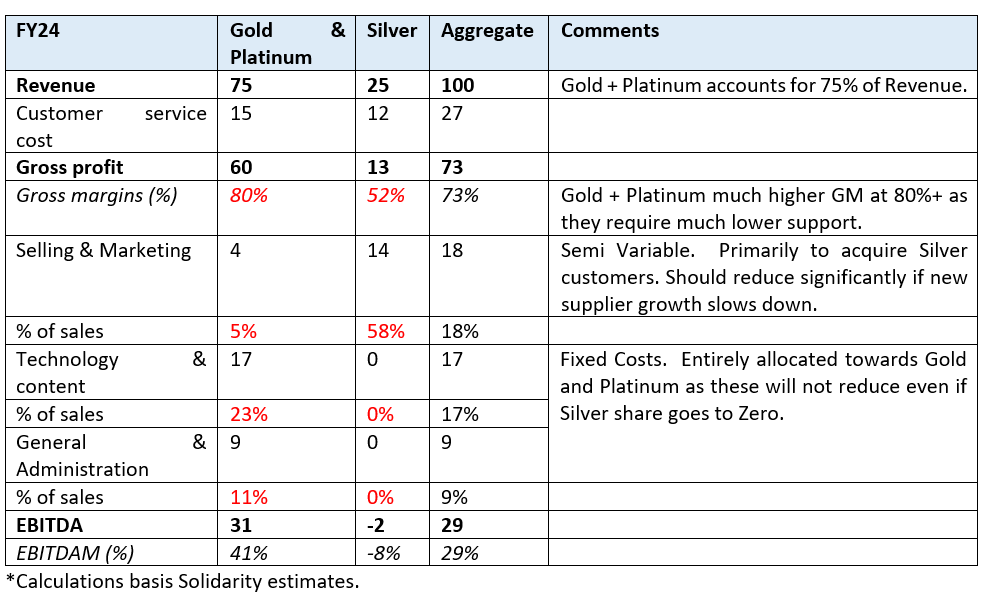

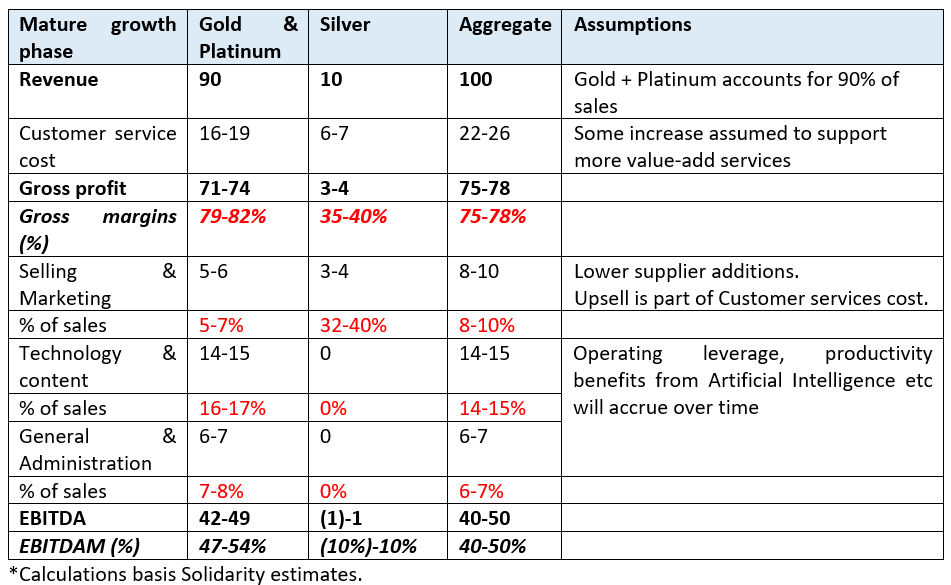

As volume growth slows, we expect EBITDA margins to expand.

We estimate that Gold and Platinum customers (~75% of revenues) contribute all the profits today and current margins are supressed due to losses in Silver category. This is not abnormal – customer growth in Silver is important as it acts as a funnel for Gold/Platinum via upgrades.

In mature growth phase, EBITDA margins could be in the range of 40-50%+ with even better cash conversion vs today.

- Gross profit margin should expand with higher share of Gold and Platinum, price hikes.

- Customer acquisition cost should reduce as it closely links with Silver supplier additions.

- Some savings on tech and general admin costs from AI driven productivity and operating leverage.

Business is negative NWC due to upfront cash collected from customers. Higher share of Gold and Platinum Revenues means higher share of longer duration packages which would result in even higher FCF/Revenue.

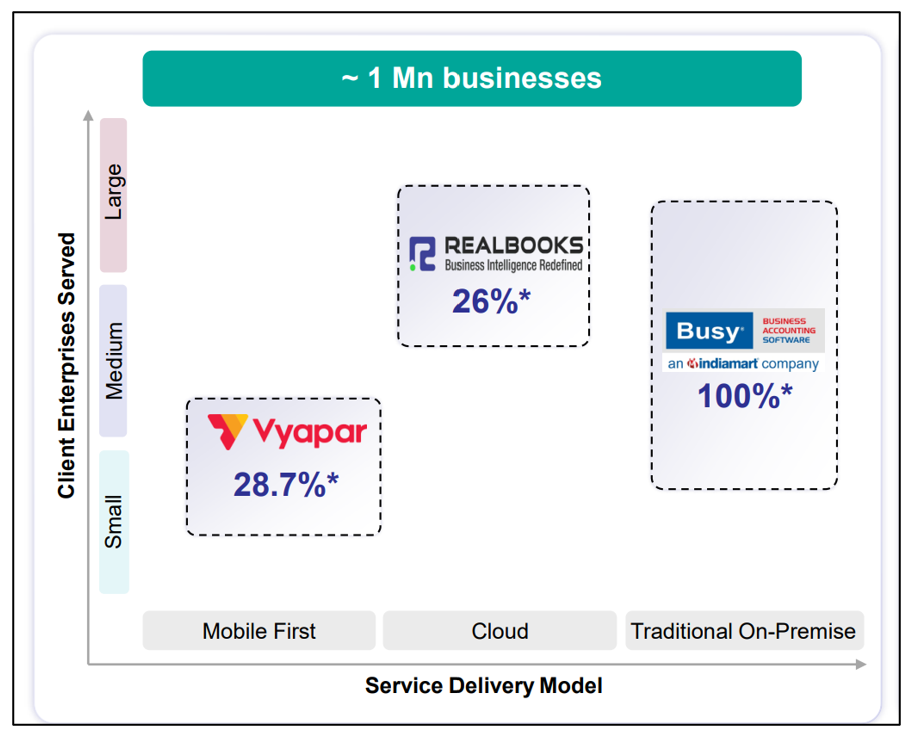

Significant option value from adjacencies.

IndiaMART has made multiple investments in businesses which have appeal to SMEs. And SMEs in India have now started paying for Software.

IndiaMART has invested ~680 Cr across Accounting businesses which tend to be very sticky.

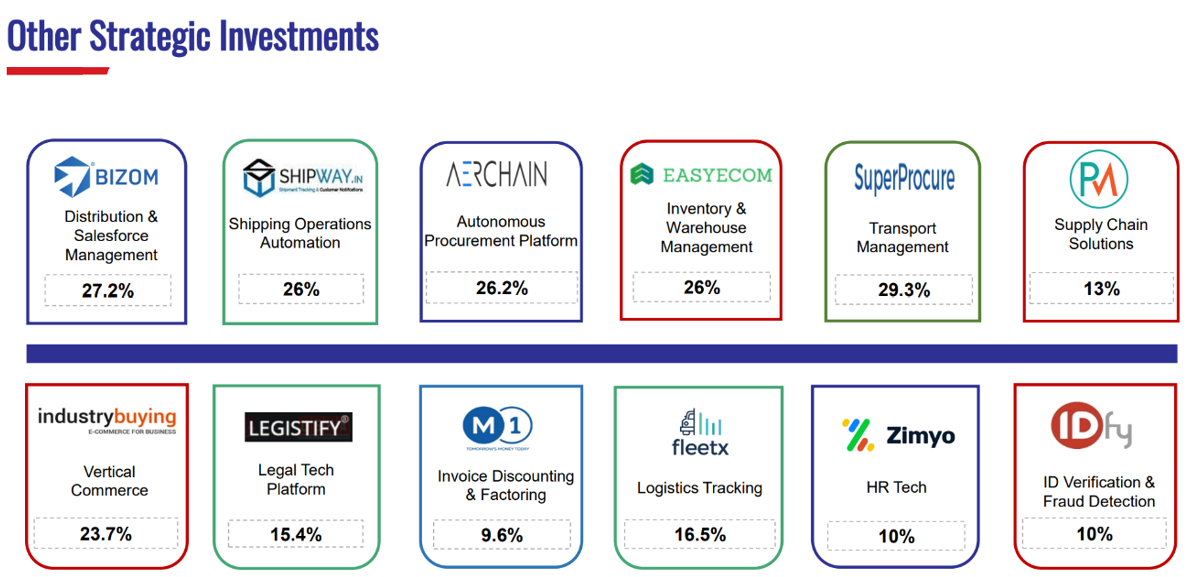

There are other strategic investments in business services needed by SMEs. These can be cross sold into the core user base registered on the platform once these businesses have achieved product market fit.

Our only grouse – why are they not taking bolder bets via larger equity stakes given their understanding of SMEs, the ability to drive synergies, and their ~2200 Cr cash pile?

Attractive upside/downside even in conservative scenario.

Our base case scenario is that IndiaMART is in Phase 2 of its evolution and can grow FCF at 15%+ CAGR for long periods of time. If this hypothesis is proven right, the stock is incredibly cheap at present.

However, at ~20x TTM FCF, even if we have misread the size of the market opportunity in the core Listings business, we find the upside/downside highly favourable. As explained above, there is significant room to further monetize the core user base of the platform and drive margin expansion.

We have hence increased our position size to 7%.

Where could we be wrong and the metrics that are key to our thesis

- Increase in churn rates in Gold and Platinum customers which would suggest the platform is not delivering value commensurate with fees charged.

- No increase in ARPU even as growth in aggregate paid users continues to stall.

“Be more patient” in investing is the “sleep 8 hours” of health. It sounds too simple to take seriously but will probably make a bigger difference than anything else you do.10

Please click here if you would like to download the PDF version of this blog

Disclaimer

The information or material (including any attachment(s) hereto) (collectively, “Information”) contained herein does not constitute an inducement to buy, sell or invest in any securities in any jurisdiction and Solidarity Advisors Private Limited is not soliciting any action based upon information. Solidarity and/or its directors and employees may have interests/positions, financial or otherwise in securities mentioned here. Solidarity may buy securities in companies owned by its clients. This information is intended to provide general information to Solidarity clients on a particular subject or subjects and is not an exhaustive treatment of such subject(s). This information has been prepared based on information obtained from publicly available, accessible resources and Solidarity is under no obligation to update the information. Accordingly, no representation or warranty, implied or statutory, is made as to the accuracy, completeness or fairness of the contents and opinion contained herein. The information can be no assurance that future results or events will be consistent with this information. Any decision or action taken by the recipient based on this information shall be solely and entirely at the risk of the recipient. The distribution of this information in some jurisdictions may be restricted and/or prohibited by law, and persons into whose possession this information comes should inform themselves about such restriction and/or prohibition and observe any such restrictions and/or prohibition. Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. Neither Solidarity nor its directors or employees shall be responsible or liable in any manner, directly or indirectly, for the contents or any errors or discrepancies herein or for any decisions or actions taken in reliance on the information. The person accessing this information specifically agrees to exempt Solidarity or any of directors and employees from, all responsibility/liability arising from such misuse and agrees not to hold Solidarity or any of its directors or employees responsible for any such misuse and free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors.

- Free Cash Flow ↩︎

- We assume 12% Cost of Equity ↩︎

- Basis 25 October 2024 prices. ↩︎

- Average Revenue Per User ↩︎

- Q2 FY25 Sales cost annualized. ↩︎

- IndiaMART has faced challenging situations in the past such as in the years FY 12, FY13, FY17 and FY19. ↩︎

- Buyers who have used the platform again in the last 90 days. ↩︎

- Broad Solidarity estimates discussed later. ↩︎

- IndiaMART has seen muted buyer inquiries growth over past 5 years. Initiatives taken by mgmt. (Better match making with relevant suppliers, increasing platform relevancy by adding products/suppliers) are showing sign of initial progress as H1 FY25 saw ~15% growth. ↩︎

- Source: https://collabfund.com/blog/rules-truths-beliefs/. ↩︎