We hold a position in India Mart whose price fell sharply since then by ~35% in the last two weeks.

In this note we explain

a) Our Investment thesis on the company

b) Our hypothesis on what could explain the decline

c) How we have acted post the steep decline

Investment thesis

India Mart is a B2B product and service listing platform that allows buyers to discover vendors for specific products & services. Suppliers are allowed free listing but pay a price to get more visibility and leads.

We find India Mart an attractive long term investment opportunity as

- It has a long runway for Earnings growth in its core business through volume, pricing and operating leverage.

- Significant competitive edge which reflects in high market share and expanding margins

- Attractive economic model which generates Infinite ROIC.

- Option value of adjacencies.

- Conservative and disciplined management that we trust and which stands out vis-à-vis the more cowboy approach we see in new age tech companies

Long run-way of growth

India Mart customers are primarily SME. It has about 70 Lac “supplier fronts” on its platform of which 1.56 Lac are paying customers (balance are free-listings)

We believe the number of paying suppliers can continue to grow over time.

- There are 58 Lac SMEs in India who have registered for “Udyam” (needed to bid for Govt tenders and get subsidized loans)

- 120 Lac GST registrations in India.

- 18 Lac customers of the Software Tally.

- 1688.com, a similar business model in China, has 9 Lac paying customers (~6x of India Mart).

Average revenue per user

The average revenue per customer is ~48,000 today. We believe India Mart has significant pricing power which it can exercise once user growth slows to create win-win outcomes. For example 1688.com which enjoys ARPU of ~1.45 lacs has grown its top-line at 30% CAGR over 2015-20, primarily through price increases.

- As India Mart can track how much a customer is benefitting from enquiries/lead generation, it can segment and continue to migrate customers to higher pricing tiers where it offers suppliers more visibility.

- It can continue to provide more value-added services and charge a higher price for the same. For example, India Mart is adding features like product videos.

- India Mart plans on introducing differential pricing based on value of products, which can be ARPU accretive given high value nature of products transacted on platform (On Average ~$600)

Significant competitive edge

The business model enjoys network effects as a virtuous cycle gets created. More buyer participation attracts more seller participation which in turn gets more buyers on the platform. Today 100% of buyer traffic is generated organically without advertisements. ~36% of suppliers on the platform are also buyers and 55% of buyers are repeat buyers.

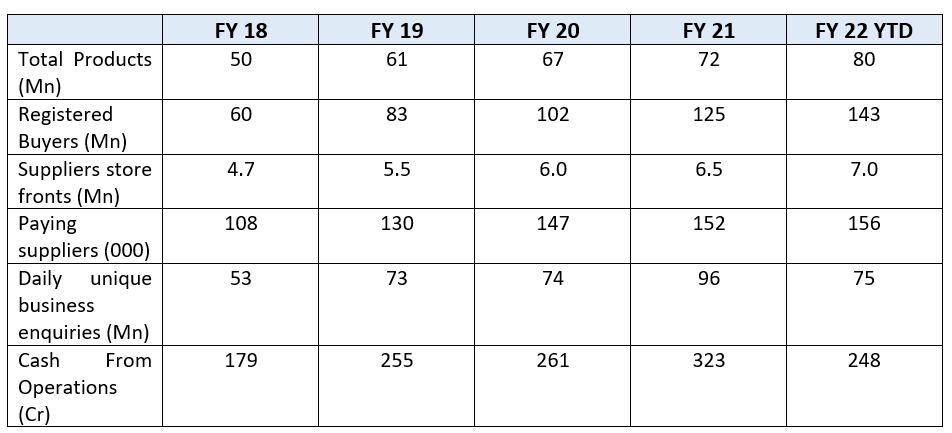

The number of products, buyers, suppliers and transactions on India Mart’s platform has continued to increase resulting in increase in Cash Generated from Operations.

Not surprisingly, India Mart is the dominant market leader.

Attractive economic model

The business has about 80% contribution margin (Revenue less Customer Service costs) and hence has significant operating leverage and better productivity as over time Revenues will increase faster than Fixed costs. Moreover, Contribution margins should also expand over time as more technology is leveraged for automation. Hence we expect EBITDA margins to keep expanding over time by 1%+ per year even as Revenue can grow 20%+.

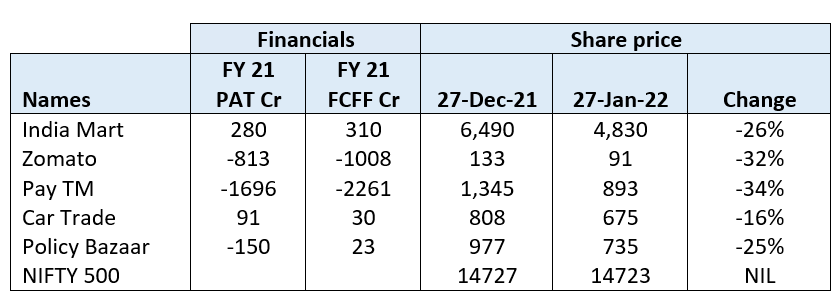

As suppliers pay in advance, India Mart operates on a negative working capital cycle and requires no fixed assets. Hence, incremental return on capital are very high with FCFF exceeding PAT as no significant re-investments in Fixed Assets required and all Technology expenses routed through the P&L Account.

Option value of adjacencies

We like to think of India Mart’s business definition as that of a “company enabling SMEs to compete in the digital age through enablement of commerce”. Hence, while its core offering is the product/service catalogue service, it can offer other products/services to SMEs over time. Hence, the average revenue per user can continue to grow non-linearly.

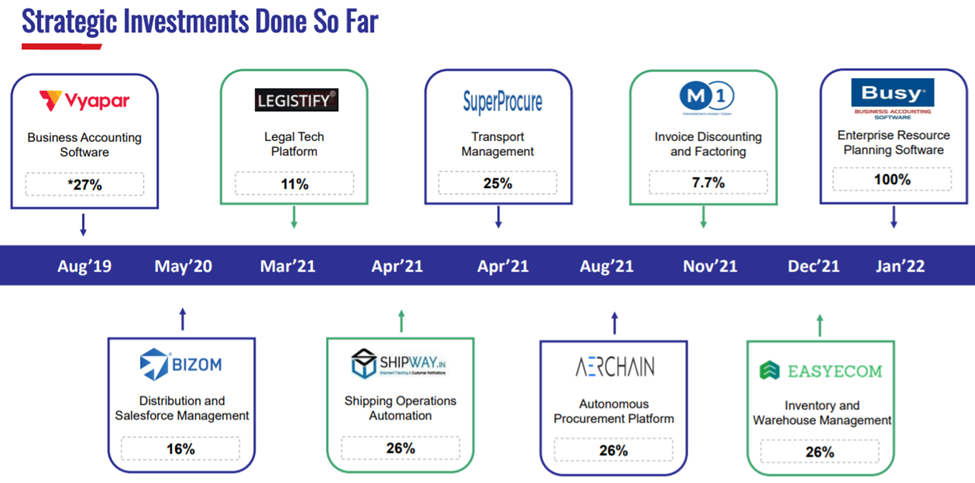

It has also recently acquired an accounting software company and continues to invest in start-ups in related service offerings that SMEs need. Its sales force can over time cross sell these products to suppliers registered on its website. This “Option value” can create growth over and above the 25% EBITDA growth we believe is achievable in the core business. While it is still early in the integration of acquisitions/investments to the core platform, progress on of the early investments, Vyapar, has been quite remarkable. Since Sept 2019 till date, paid users and monthly revenue run rate has increased from ~15k to 100k and 20 lacs to 1Cr+ respectively.

Conservative and disciplined management

The business has been built over 20 years with experimentation and discipline rather than the “fast burn” model one sees in new age Digital business models. All through the pandemic, the management has not talked up its prospects but talked about challenging business conditions. They have been very cautious in investments in adjacencies taking small stakes in companies, barring the recently announced 500 Cr acquisition.

Why has the stock price collapsed recently?

India Mart used to trade at about 2200/share pre the pandemic (about 2 years ago). It ran up to a peak of 9800/share in the last 2 years. It was trading at about 6800/share in mid-January and fell ~35% over the last 2 weeks.

The following reasons could have led to the price decline.

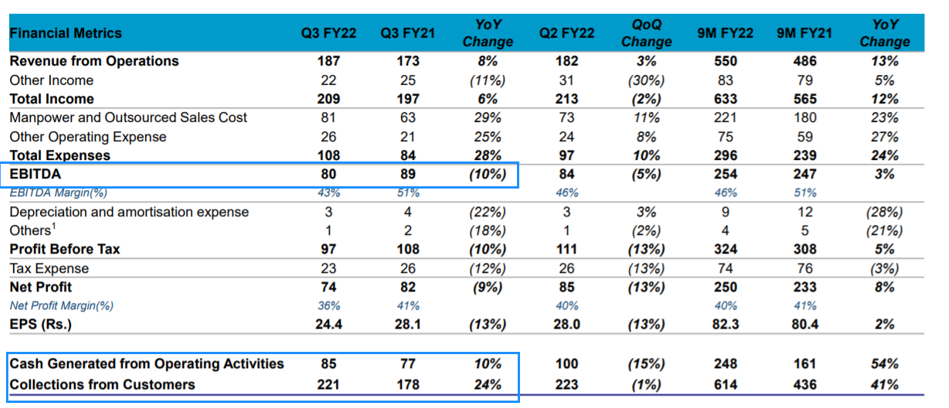

- The market did not like results. India Mart reported 8% Revenue growth and 10% EBITDA decline for Q3 results. This perhaps has not been taken well by the markets, especially for a Digital company that should thrive during Covid. India Mart’s progress should primarily be evaluated based on Cash Collections from customers and not on quarterly P&L which gets impacted by revenue recognition and how management steps up Sales and Marketing efforts. Hence, while EBITDA declined 10% YoY, Collections from customers grew 24% in the quarter and 41% for 9M comparison which we think is good execution in a tough environment for SMEs. What matters is Cash Flow and not accounting profits.

The pace of volume growth guided by management was too low relative to expectations. The management guided for about 6000 new customers per quarter, which implies ~15% volume growth. This was perhaps not exciting enough for the markets that have expected much faster Digital adoption by SMEs. This growth is reasonable in our view given the SME sector would be hurting due to lockdowns and the company has enormous pricing power once SMEs can experience what the company has to offer. Longevity of growth and pricing power is being underappreciated.

- India Mart announced a large acquisition which the market perceives as being reckless. India Mart has agreed to pay 500 Cr to acquire an accounting software company (BUSY) with Revenue of 40 Cr and PAT of 11 Cr. This deal does look expensive if judged standalone but we must respect judgement of entrepreneurs who have shown conservatism in the past and keep in mind current market context of prevailing digital valuations. We believe India Mart has significant ability to boost growth of this business due to cross sell potential to the 7Mn suppliers registered on its website, the less than 20% overlap in customer base and through its ~2600 field sales employee force. A strategic acquisition deserves a premium, and there is significant VC interest in Software/Digital assets at present. With a ~2,500 Cr cash balance and cash accretion of 300-350 Cr a year, this is something one can live with, especially when strategic synergies exist and no leverage is being taken.

Correlated sell off in Internet names. Almost all recently listed Digital business models in in India are loss making. These companies have sold-off recently (chart below shows 1 month price movement) and one wonders whether India Mart has also been collateral damage of a sectoral sell off despite being solidly profitable and cash generating

Solidarity stance

A sharp price decline always triggers an immediate re-examination of facts to ensure there is no new information that requires us to revisit our thesis. Based on what we know at present, the Investment case for India Mart has not changed.

We take rolling 5-year views. The ability to not worry about optimising short term outcomes helps us to take advantage of price dislocations. A sharp sell-off does not change our conviction as there are people out there operating with different time horizons, objectives and compulsions.

We typically hesitate from paying up over 50x PE ratios for any company as when you pay such high multiples, there is always the risk of “unknown unknowns” which you cannot eliminate. However, we believe a 50x Free Cash Flow multiple for India Mart is justified if it can grow bottom-line at over 25% for a decade (user growth, ARPU growth, operating leverage) and has a significant and expanding competitive edge with option value for growth in adjacencies. With Infinite Return on Invested Capital in the core business, it generates significant cash flow requiring no re-investment.

We had first bought India Mart two years ago and had trimmed some of our position on the way up when we felt valuations were euphoric. We had started buying India Mart on the way down for new accounts.

We have hence used this opportunity to add to our positions in accounts where we have cash.

Please click here if you would like to download the PDF version of this blog