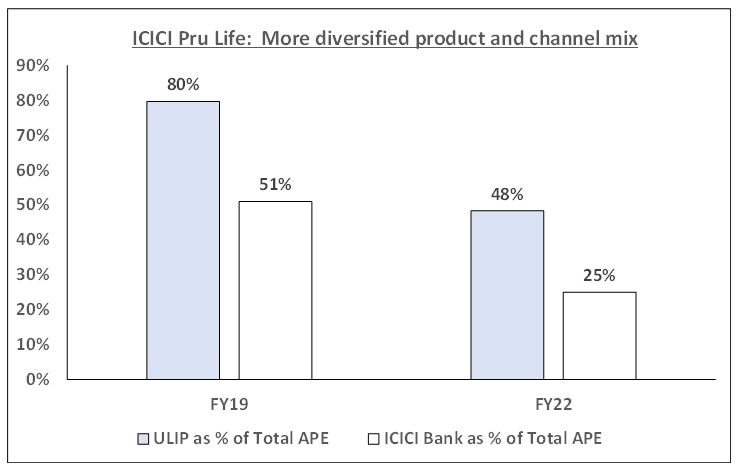

ICICI Pru Life has a growth problem. This is a function of excessive reliance on ICICI Bank/ULIPs a few years ago. ICICI Bank (its leading Bank distribution partner) has decided not to sell certain products it believes are not good for its customers. Management has been taking actions – signing up more distribution partners and reducing reliance on low margin ULIPs. ICICI Pru Life is a more de-risked business model on both channel and products vs 3 years ago.

Source: Company disclosures

The market is also concerned that ICICI Pru Life has been more aggressive vs its peers in selling Group Protection, a structurally lower margin business where risk may be higher due to lack of medical checks, and whether this is being done to boost growth. While we share these concerns, Group Protection is single digit share of ICICI Pru overall VNB. (Value of New Business is the expected Profits Insurance companies expect to make on new business over the life of the contract discounted to present value) Moreover, the long-term risk of mispricing in Group Protection is low as these are mostly annual contracts and not multi-year unlike Term Protection.

Thirdly, the market fears that VNB margins have peaked. We believe the industry is very-early in its evolution. Protection and Annuity are higher margin products, and their share of the overall mix will improve over time.

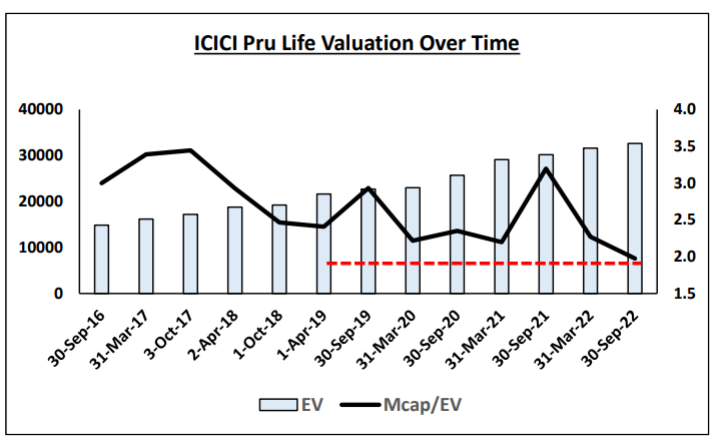

Growth concerns for ICICI Pru Life exist. However, unlike PSU Banks, it is not an issue of eroding competitiveness – there isn’t anything fundamentally wrong in the company’s strategy and it has a strong brand and distribution. The pessimism is being reflected in the price. If we are patient and take a long-term view, one can expect healthy returns as valuation multiples tend to re-rate positively when growth returns. We have seen the re-rating play out when growth returned with ICICI Bank ~3 years ago, Shaily ~2.5 years back, Bharti Airtel over last ~1.5 years and Axis Bank over the last 1 year. We expect the same story to play out in ICICI Pru Life. If we are wrong and growth stays muted, we don’t expect to lose capital as valuations offer downside protection. Hence, we want to give some more time for this thesis to play out.

Please click here if you would like to download the PDF version of this blog.