Summary views

- We believe Axtel can grow bottom-line at ~13-20% over long periods of time (serving the food industry which is early in growth life cycle, from market share gains, Exports and Operating leverage), while converting 75% of PAT to FCF.

- Axtel is a high-quality business as it can grow at healthy rates while generating strong FCF (ROCE is ~60%+) given unique engineering edge, strong competitive position, and an Asset light business model.

- Current valuations basis our entry price1 are reasonable (~25x core FCF implies ~4% FCF yield) which offers a roadmap to ~15-20%+ IRR with reasonable growth assumptions.

- 15% IRR hypothesis assumes ~13% FCF growth, 4% yield and some de rating to ~22x FCF if Earnings cyclicality isn’t fixed.

- 20%+ IRR assumes ~15% FCF growth, 4% yield and valuation re rating to 28-30x FCF if cyclicality is reduced through further diversification. There is additional upside if the excess cash is used for any strategic investment or extension into adjacencies.

- Axtel remains an undiscovered Microcap story with no institutional shareholders or research coverage. If the Axtel management team communicates with the market and more players understand the story, we expect interest in the stock and valuation multiples to increase.

We have initiated a ~3% position weight and may use further price or time corrections to increase our position size.

What do they do?

Axtel is a leading Indian supplier of customised food processing systems for leading brands in the Confectionary, Snacks and Spices segment. At present they primarily cater to the domestic market but have a growing footprint in the global market (Exports is ~15% of Sales FY25).

Axtel designs, manufactures and assembles complete food processing systems which are highly customised and must meet stringent hygiene, safety and precision engineering norms. System design is critical as a complete system can involve anywhere between 10-50 individual pieces of equipment and there must be seamless flow within it.

In a later section, we explain why these products are complex to do and have high entry barriers.

Axtel Industries makes the following food processing systems.

| System category | What do they do? |

| Chocolates & Confectionary solutions | Integrated lines for entire stage from raw ingredient handling to final chocolate moulding. |

| Ingredients management systems | Bulk storage, pneumatic conveying, and precise dosing of solids and liquid fats. |

| Size reduction systems | Crush or grind raw materials into specific particle sizes required for food processing. |

| Sieving systems | Remove contaminants & ensure uniform particle size in powders or liquids. |

| Mixing systems | Blend diverse ingredients into uniform pastes or liquids with controlled shear and temperature. |

| Spices processing systems | Cleaning, grinding, and blending of various spices. |

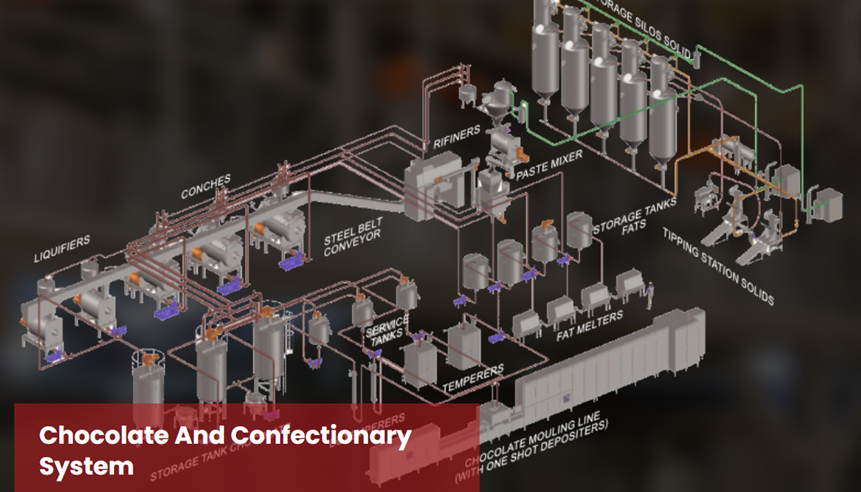

Understanding what Axtel makes using Chocolate systems as an example.

| Phase | Equipment | Function description |

| Phase 1: Raw material intake & storage | Tipping station (solids) | Entry point where bulk dry ingredients like sugar or cocoa powder are fed into the system. |

| Storage silos (solids) | Dry ingredients are pneumatically conveyed for large-scale, hygienic storage before processing. | |

| Fat melters | Large blocks of cocoa butter or vegetable fats are melted into a liquid state using controlled heat. | |

| Storage tanks (fats) | Hold liquid fats at precise temperatures to keep them ready for pumping. | |

| Phase 2: Preparation & mixing | Liquifiers | High-speed mixers that quickly blend melted fats and dry solids into a uniform liquid form. |

| Paste mixer | Combines dry and liquid ingredients to create a thick, consistent chocolate paste. | |

| Refiners | The paste is passed through rollers to crush particles down to a microscopic size for a smooth finish. | |

| Phase 3: Flavor development & conditioning | Conches | Intense mixing & heating occur here to develop final flavor and aroma while removing unwanted moisture. |

| Service & storage tanks | Finished chocolate is held at a steady temperature to ensure it remains liquid, stable, and ready for forming. | |

| Temperers | Chocolate undergoes precise heating & cooling cycle ensuring correct crystallization for glossy shine & firm “snap” | |

| Phase 4: Forming & cooling | Steel belt conveyor | Transports conditioned chocolate from processing area to the final production. |

| Chocolate moulding line | The tempered chocolate is precisely “deposited” into moulds via automated depositors to create final shapes. | |

| Cooling tunnels | Filled moulds travel through these temperature-controlled tunnels to solidify the chocolate before packaging. |

Brief history of Axtel

- Axtel Industries was founded 1991 by two friends, Mr. Ajay Parikh and Mr. Ajay Desai who were both engineers studying at MSU Baroda.

- The promoters got their early break from Amul Dairy who was looking to import substitute a sieving system which prompted Axtel to shift from trading to manufacturing.

- Subsequent years were spent establishing quality versus European competitors by targeting import substitution opportunities.

- They were able to establish credibility with some marquee names early in their journey (onboarded Nestle in the mid-90s, Mondelez in early 2000s).

- In mid 90s, Axtel expanded forayed into Spices industry by securing Pathak spices UK as a customer.

- Axtel has built strong tech competencies in house and over the years introduced multiple new technologies (high precision chocolate moulding lines, Cryogenic Grinding capabilities for aroma retention in spices, only domestic player in Steam Sterilization Systems for spices etc).

- They subsequently entered the Packaged Snacking segment in early 2000s.

- Over time Axtel added marquee customers across verticals (Hershey’s, ITC, Haldiram, Barry Callebaut etc).

- Backed by customer trust and tech capabilities, Axtel has shown confidence to expand capacities (2014 invested in a modern Vadodara plant, 2024 – incurred additional Capex to expand factory footprint).

- While Axtel today is primarily a domestic story (~85% of Sales), they have leveraged MNC trust to enter new geographies (USA, APAC, Middle East etc).

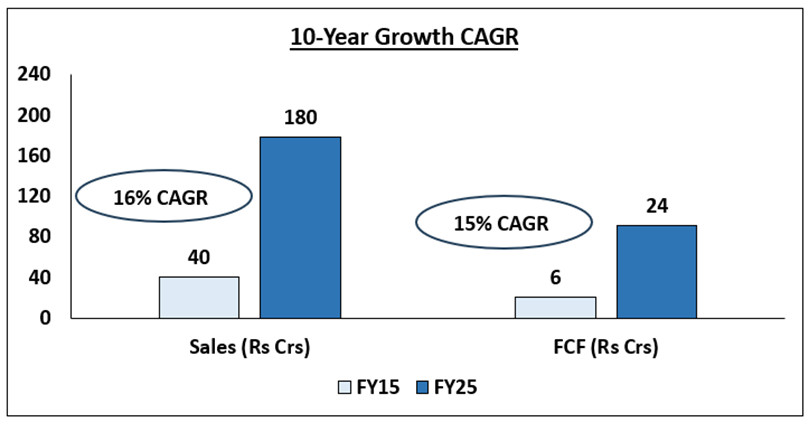

Axtel has demonstrated healthy growth over long periods of time.

Source: Ace Equity

Healthy growth has been accompanied by improvement in earnings quality, resilience in business model.

- Axtel has diversified across end industries (Confectionary, Spices, Packaged snacks, others 2, end customers and to some extent geographically.

- Customer concentration has meaningfully reduced from high dependence on few customers a decade back. Axtel has added new customers over time and have now sold their products to ~80 customers.3

- While there is year on year Earnings lumpiness (Axtel is a Capital good supplier and customers can delay offtake due to project delays at their site while revenue recognition is only done when orders are shipped), Axtel is an FMCG proxy which lends to sustainable growth over long periods of time.

- Even in the current Earnings down cycle Axtel remains profitable with very high ROIC and continues to enjoy strong debt free balance sheet (it is a net cash company).

Over time as Exports increases as share of Sales and Axtel enters new segments, cyclicality in profit growth can reduce as a slowdown in one market can be compensated with growth elsewhere.

Business evolution over time

| Particulars | Decade back | 2025 |

| End industries | Largely Confectionary | Confectionary + Spices + Packaged snacks |

| Equipment range (Within Systems) | Smaller systems Fewer equipment | Large and comprehensive systems |

| New competencies Developed | Example of import substitution (Milk powder sieving systems, Sugar grinders etc) Complex Chocolate moulding Lines Steam sterilization systems Material handling (Pneumatic conveying and silo systems) | Strong in-house end to end design capabilities Complex Chocolate making systems (Inclusions- Chocolates with nuts, precision shapes with Gems & Kisses etc, precise tempering /cooling) Cryogenic grinding (high quality spice blends as aroma loss prevented) Precision fabrication (CNC laser cutting, water jet cutting) |

| Key customers logos | Amul Mondelez Nestle Pathak Spices | + Barry Callebaut MDH Spices Haldiram Bikaji Puratos Hershey |

| Customer concentration | High customer concentration | Well diversified customer base |

| Geography Mix | Largely domestic Sales | ~15% of Sales from Exports Geographies catered to: USA, APAC, Middle East, Europe, Australia etc. |

Healthy growth prospects backed by healthy industry growth, market share gains (Import substitution, more Exports)

Axtel can grow aggregate Revenues at low to mid-teens and Profits/FCF at mid to high teens for long periods of time as:

- End industries (Confectionary, Spices, Packaged snacks) are early in their growth curve in India and are growing at high single digits to low double-digit rates.

- Domestic demand for Axtel can be stronger as their large, organized customers gain market share from unorganized players, increase automation at factories and as Axtel benefits from import substitution vs peers.

- Axtel can gain global market share as they enjoy MNC customer trust and have been increasing sales/marketing spends.

Domestic Sales (~85% of mix) can grow at low to mid double digits for long periods.

End industries are early in growth phase and enjoy growth longevity.

Confectionary segment

Chocolate consumption is growing at high single digits/low double digits 4as it’s a discretionary purchase that will benefit from rising per capita incomes in India and share gains from traditional Indian sweets (premiumization, longer shelf life etc) which is a very sizeable market. Axtel works with key major players (Mondelez, Hershey, MARs etc) and will be a key beneficiary of this trend.

Spices segment

The organized Spice industry is growing at low double digit growth rates. 5This will be driven by market share gains from the large unorganized industry who have ~60% of the market and are losing share due hygiene/adulteration concerns. Market leaders are also using premiumisation to differentiate ex: Blended Spices and with growing share of Exports etc.

Within the Spice industry there exists scope for automation (better hygiene versus manual processing). Axtel can be a leading beneficiary given strong customer base (Everest, ITC), and its focus on the food processing space unlike peers.

Packaged snacks segment

Packaged snacks industry in India saw a growth inflection point post Covid and is still growing at healthy double digit growth rates, 6driven by sustainable tailwinds (Quick commerce, customer preference for ready to eat snacks/meals due to lifestyle changes driven by nuclear families, greater women participation in workforce etc).

Scope for replacement of manual operations exists and Axtel is well positioned as a vendor to leading packaged snack cos like Bikaji, Haldiram, Pepsico, Nestle etc.

Opportunity: industry has strong Capex plans

| Segment | Customer | Gross Fixed Asset Rs Cr | Future Capex plans | |

| FY19 | FY24/25 | |||

| Confectionary | Nestle | 4,000 | 11,140 | ~5000 Cr multiyear Capex plan. |

| Including 10th Factory in Odisha. | ||||

| Mondelez India | 3,930 | 7,200 | Invest 4,000 Crs over 2023-2026. | |

| Hersheys India | 165 | 365 | ||

| Spice | Orkla (MTR + RTE) | 405 | 1,225 | |

| MDH | 135 | 675 | ||

| Packaged snacks | Bikaji | 485 | 1,280 | |

| Haldiram Snacks | 1,590 | 2,720 (FY23) | Plan to expand manufacturing globally. | |

Axtel Industries is competitively well positioned to gain domestic share via import substitution.

While Axtel’s domestic market opportunity is hard to quantify given lack of market research, there exists a sizeable share of imports into India as reconfirmed with our customer checks.

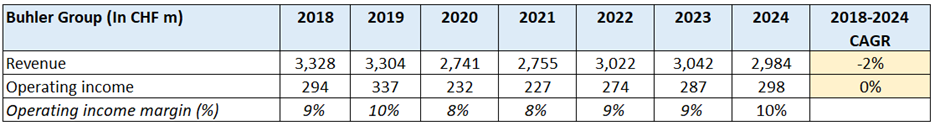

Axtel is very competitively positioned in India given limited credible Indian vendors, lack of Chinese vendors and edge over imports (mainly European vendors like Buhler, Gea, Azo, Gericke etc) due to comparable quality, while offering a meaningful cost advantage with strong support service.

Axtel has made significant investments over the years to bridge the gap versus imports.

- Axtel has meaningfully expanded its design and engineering team (100+ engineers) and now offers end to end capabilities.

- Investments in technical competencies means Axtel can now offer entire systems in their niche to customers which offer performance comparable to global standards.

- For customers who can’t even afford 1 hour of downtime, Axtel’s ability to offer 24×7 local support through large after sales service team is a strong edge.

We believe Axtel is best positioned to capitalize on this import substitution opportunity amongst Indian vendors.

There aren’t many large credible Indian vendors at present in Axtel’s core segments. While there exist smaller domestic vendors, they mainly play in the low margin commodity spaces (simple mixing, storage tanks etc) and lack capabilities to break into the large ticket size, critical systems for grade A customers.

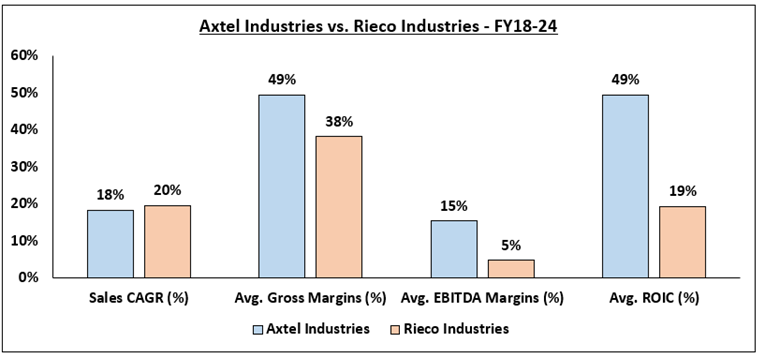

Axtel is perhaps the only focussed pureplay food processing present across all these 3 verticals, whereas Rieco Industries which is a subsidiary of Sudarshan Chemicals (a chemical manufacturer) is spread across Chemicals, pharma, cement, power, oil and gas etc.

This focussed approach on profitable niches has helped Axtel achieve comparable growth and superior economics versus competition.

Axtel can incrementally gain further share in Export markets

While market data is unavailable, we believe the global market opportunity can be quite large for Axtel given its current penetration. Anecdotally, Nestle has ~10 plants in India 7and 300+ globally.

Majority of competition is Europe based which is cost disadvantaged (employee cost, energy cost etc) and current challenging environment is resulting in small shops shutting down with larger players struggling for growth while making lower Profit margins.

We believe Axtel is still in its early phase of evolution in its Global growth story.

It has demonstrated some success in leveraging deep relationships with Indian subsidiaries of global giants to win projects across their global locations (example: Mondelez, Hershey’s, Puratos).

Now backed by confidence in their capabilities, Axtel has ramped up investments behind Sales/marketing (participation in trade exhibitions, expanded technical sales team, hired agents for some new geographies), and can sell individual equipment for which there is good demand.

As this translates to business wins, that could drive management confidence to further invest in building new products for global requirements (mega scale projects), local service support closer to the customer etc. However, our base case view is that Exports will gradually increase as % of Sales over time and is unlikely to grow non linearly given some constraints (slow global consumption demand, global peers enjoy strong goodwill and since global MNC procurement is centrally controlled risk aversion attitude/perception issues might take time to change etc).

We think Profit growth can be higher at mid-teens to high teens with Operating leverage.

There exists scope for Operating leverage on Fixed costs (we estimate ~20-22% of normalized Sales) as post recent expansion Axtel has sufficient capacities to sustain next few years growth.

Axtel business enjoys high ROCE as backed by favourable industry structure and technology edge.

Axtel operates in an industry which enjoys high entry barriers.

Industry has very high hygiene & sterilization standards as its linked to food. This means high stringency around technical parameters (highly automated systems for consistency, 100% traceability and high precision Mirror finish requirement with no bends, crevices, or projections as even a microscopic scratch can allow bacteria or foreign contaminants to accumulate).

Customer willingness to experiment with a new unproven vendor is low given any quality issues can risk damage to their strong brand name, systems are expected to last for very long periods (upto 20 years) and given malfunction risk is very severe as cost of downtime can end up being costlier than the equipment cost itself.

Domain knowledge which takes many years to accumulate is key to building a high-quality product.

- Axtel has ~30+ years of experience in this field resulting in mastery over the engineering.

- Premium Confectionary products have more complex recipes and require highly customised systems (inclusions of nuts, liquid fillings require machinery to evenly mix/distribute without crushing the nut, grinding/mixing generates heat which could impact chocolate aroma etc)

- Axtel specialises in solids with each food item (powder, spice, cocoa etc) behaving uniquely so design must consider ingredient flow to reduce friction/blockage risk in pipes and the varying viscosity/textures of different materials etc.

- Handling of certain fine powders (Ex: sugar, starch) carries dust explosion risk and requires safety certifications to be met.

High technical stringencies translate to favourable industry structure in India and globally.

Global competition is largely restricted to European vendors. Chinese players have limited presence in this industry given its boutique, customised nature and high hygiene factors involved as well as challenges in servicing (language barriers, lack of local support).

While local domestic players can fabricate individual equipments, they lack ability to build an integrated system which makes Axtel a preferred vendor. In certain sub segments Axtel has very strong positioning:

- Only domestic player that manufactures complex Chocolate moulding Lines

- Sole India player in Steam sterilization systems (eliminates pathogens from spices without using chemicals) for exporters to meet global sterilisation norms.

To ensure its domestic competitive positioning remains intact and new entrants do not get a foot in the door, Axtel is broadening its product basket and working with fast growing emerging brands (Ex: Too Yumm!).

Axtel today enjoys sticky relationships with marquee global/India brands resulting in expanded wallet share through larger repeat orders.

Axtel’s moat translates to very healthy ROCE/FCF generation.

- Axtel generates high pre-tax ROCE (60%+ 5-year avg.) which is quite unique for a B2B business. Drivers for high ROCE are

- Healthy profitability (50%+ Gross Profit margins translating to avg. ~15% EBITDAM) given highly customised/critical nature of products.

- Business is Asset light which drives high asset turns (avg. 3x GFA and ~10x NFA turns) as Axtel primarily does strategic value add activities in house (design, assembly, and some high value fabrication/machining) and standard components are bought out from vendors.

- Avg. NWC days has been tight at ~50 days (Axtel receives significant money as customer advances which is partially offset by higher inventory days as customers sometimes delays offtake and Revenue is recognized on dispatch and not using % of completion method).

- We expect steady state PATM to be ~15% which will translate to healthy Free cash flow generation (~75% of PAT converts into Free cash flow) which will allow Axtel to grow at a healthy pace will maintaining a pristine balance sheet (Net cash co).

| Steady state ROCE Tree | Current | FY30e | Comments | |

| 5 Yrs Avg | Scenario 1 |

Scenario 2 | ||

| Sales | 100 | 100 | 100 | |

| EBITDAM % | ~15% | ~18% | ~20% | EBITDAM expansion from more Exports, Operating leverage |

| Depreciation % of Sales | ~1.5% | ~1% | ~1% | |

| EBITM | ~13.5% | 17% | 19% | |

| Finance Cost % Sales | 0.5% | ~0.2% | ~0.2% | Minimal debt as asset light business |

| Other Income % Sales | ~2% | ~2.2% | ~2.2% | Treasury income |

| PATM | ~11% | ~14% | ~16% | |

| GFA Turns | 3.0x | ~4.0x | ~4.0x | Better capacity utilization at plant |

| NFA Turns | 9.8x | ~11.0x | ~11.0x | |

| Debtor days | 87 | 90 | 90 | |

| Customer advance days | 44 | 45 | 45 | |

| Inventory days | 80 | 80 | 85 | |

| Payable days | 62 | 60 | 60 | |

| Other liabilities days | 9 | 10 | 10 | |

| NWC Days | 52 | ~55 | ~60 | Assume higher NWC days as Exports % share increases |

| Net Debt/EBITDA | Net cash | |||

| Pre -Tax ROCE (%) | ~60% | 70%+ | 70%+ | |

We believe our buying price offers reasonable valuations for an initial position.

Axtel Industries is an attractive asset to own as it enjoys healthy growth prospects, high ROCE backed by unique engineering edge and is run by technocrat promoters who inspire deep customer trust with their ethics, execution track record and competencies.

Axtel stock price has corrected nearly ~40% from its peak. Markets chase Earnings momentum and weak short-term Earnings performance along with a broader Microcap sell off has resulted in stock going out of favour.

- The Earnings challenge can be explained by weak consumption environment in India, slowdown in Confectionary segment due to significant rise in cocoa prices (~4-5x between 2022-24).

- These challenges are cyclical with some green shoots visible (Cocoa prices have fallen ~50% from peak, consumer cos are indicating higher Capex post govt stimulus) and our confidence in their long term Earnings trajectory remains intact as end industries are underpenetrated and Axtel has scope to gain market share.

We find valuations basis our entry price quite attractive (~25x core FCF multiple implies ~4% FCF yield)8 and see a strong roadmap for 15-20% IRR even if Axtel grows FCF at ~13-15% CAGR.

There can be upside to these estimates if Axtel is able to show strong Export growth and grow FCF at > 15% CAGR, option value from excess cash being utilised to acquire new technologies or foray into new adjacencies. This is attractive especially given we expect a low return decade for Indian Equities from current valuation levels.

Over time as Axtel evolves and derisks further, fair valuation can be higher.

Businesses with High ROCE (such as Axtel) can command a higher valuation multiple 9as markets understand their story better and build confidence in their long-term growth prospects, Earnings predictability, and Terminal value.

We believe Axtel will be a better business over time.

- Earnings cyclicality will reduce as share of Exports increases and Axtel enters new segments

- Key-man risk should reduce over time as professionals (CEO/COO etc hired or promoted from within etc) become the face of the company. While the promoters are highly passionate and fully involved in the business, both promoters are in their mid-60s with next generation not involved in the business.

- As a Microcap co, the Axtel story is not well understood by the broader investor community. This could change over time through more investor communications and disclosures.

We remain optimistic on their long-term prospects and have initiated a ~3% position weight and may use further price or time corrections to increase our position size.

Please click here if you would like to download the PDF version of this blog

- Mcap of ~740 Cr (455/- share price) less cash of ~100 Cr means Core Mcap of ~640 Cr, whereas normalized 3-year avg FCF is ~26 Cr. ↩︎

- Some portion of Sales comes from other industries like Bakery, Flavours etc. ↩︎

- Axtel company page. ↩︎

- Source: Nestle, market research reports. ↩︎

- Source: Orkla, ICICI Sec report. ↩︎

- Source: Bikaji, Hindustan foods. ↩︎

- Including the Odisha facility which is currently under construction. ↩︎

- Mcap of ~740 Cr (455/- share price) less cash of ~100 Cr means Core Mcap of ~640 Cr, whereas normalized 3-year avg FCF is ~26 Cr. ↩︎

- Fair value on First principles DCF for a 50% ROE business increases from 25x to 35x PE 1 year forward if growth rates increase from 15% CAGR to 20% CAGR. ↩︎