We believe Axis is amongst the 4 private Banks in India that has the right to win long term. It offers opportunity for long term compounding but where entry valuations are significantly in favour in a richly valued market.

Partners are aware that we already own ICICI Bank, HDFC Bank and Kotak Bank as our core Banking positions.

Why add a 4th Bank? Banking is not a winner takes all business. The RBI ban on issuing of additional credit cards (now lifted) and repeated technology outages at HDFC Bank is a reminder that one never knows where risk lurks. If there is opportunity for multiple players to do well, one should spread the risk.

We believe Axis is amongst the 4 private Banks in India that has the right to win long term. It offers opportunity for long term compounding but where entry valuations are significantly in favour in a richly valued market.

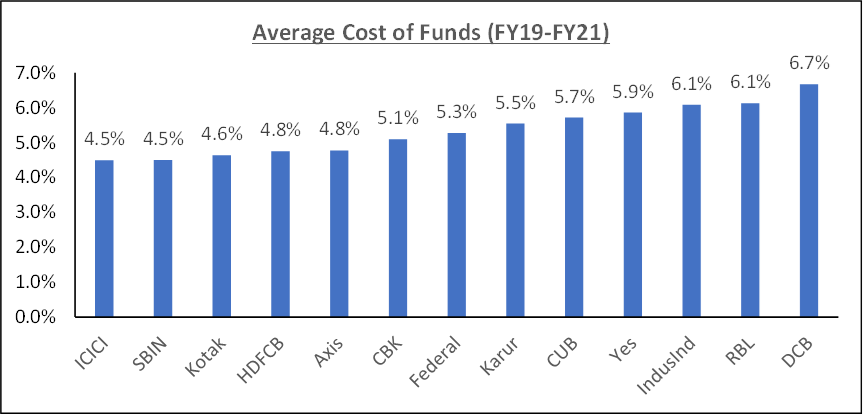

The principal value of any Bank lies in its deposit franchise. A bank’s Cost of Funds (COF) determines its right to win long term because it can choose the risk it wants to underwrite. If COF is not in the top decile, you are doomed to a vicious cycle of pursuing higher risk segments which eliminates resilience during a crisis. And it takes time to build a superior COF position. Low valuations accompanied by high COF is a high probability value trap. As one can see from the chart below, Axis’s deposit franchise is amongst the best in the business, even as it has ceded some ground to its peers in the last few years.

Source: Spark Capital

Financial institutions are like icebergs as the true risks in their Balance sheets are not well disclosed. Hence, a conservative mindset in credit and credibility on reported NPAs is key. Under new leadership, Axis Bank is undergoing a transformation to a fundamental culture of conservativeness with a more prudent provisioning policy, more granular loan book being built and prioritizing credit discipline over growth. 1

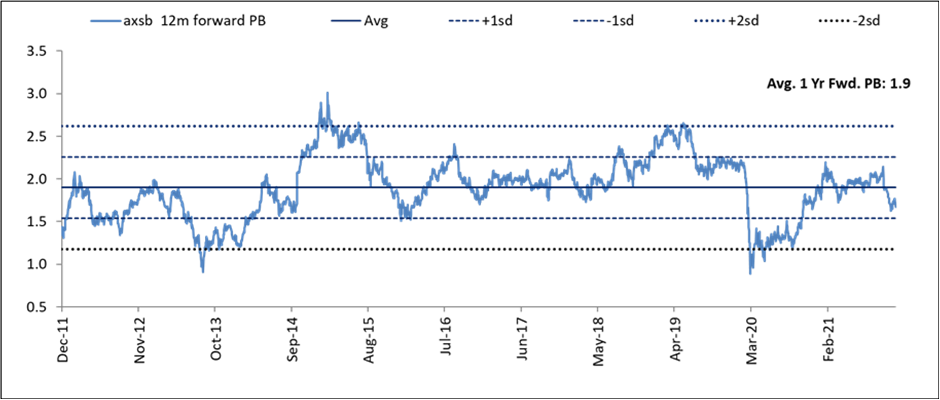

Why is the stock trading at close to 1 std deviation below mean valuations in a raging bull market?

Source: Bloomberg

- Axis was seen as a superior franchise to ICICI Bank till a few years ago with much lower cost of funds but ICICI Bank has now pulled ahead with more granular lower cost deposits and higher NIMs.

- Axis leadership does not seem as well settled as its peers. The top deck comprises people mostly hired from outside the bank with very low tenure at Axis vs peers. The average tenure within the group of the top leaders at Kotak, HDFC Bank and ICICI Bank is well over 20 years.

- This has led Axis to miss growth opportunities such as the one created when HDFC Bank was stopped from growing in Credit cards by regulators. And hence Axis has reported far lower growth than other Banks in H1 of this year.

- Moreover, there is also a credibility deficit that needs to be bridged. The CEO mentioned an 18% ROE target by 2022 (a CEO’s aspiration is Dalal street guidance) at the start of his tenure and the bank is far from that number at present.

Despite the above, we believe Axis Bank at present provides a compelling opportunity as this pessimism is being reflected in valuations (one std dev below mean) while growth is looking up. Hence, Axis offers a rare combination of both growth and valuation re rating.

- While ICICI Bank is a superior franchise at present, (it is also our 2nd largest position), we believe that 5 years from now Axis Bank can be a 15-17% ROE business while growing Book value per share at 15%+. The bank’s transformation journey is perhaps two years behind ICICI Bank, and it is well positioned to gain market share in the Banking system from weaker players.

- We don’t worry about short term growth rates in credit, and these can be especially misleading in Banks when cautiousness may be prudent in an unpredictable environment. And a leadership team which is reorganizing itself after a period of credit losses will understandably be more cautious in underwriting risk. That is not a structural issue in our opinion and growth rates will inch up over time.

- The management team is not in denial as can be seen from a recent interview of Amitabh here where he concisely lays out the work to be done for Axis to catch up with its peers.

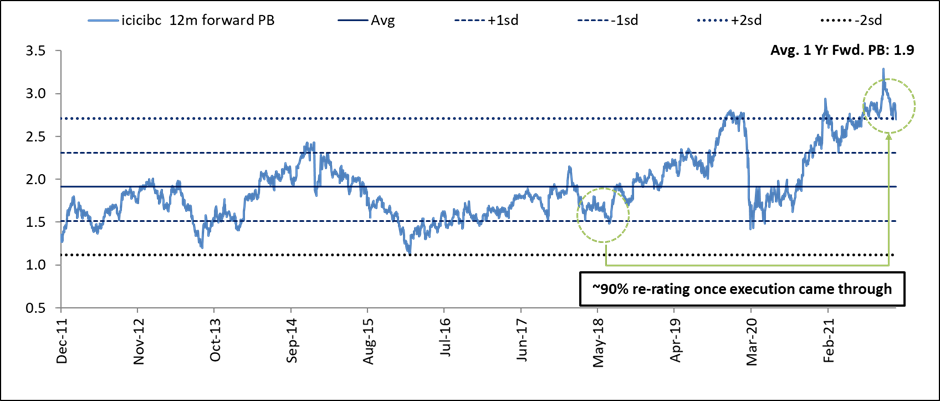

In our optimistic scenario, we assume Axis valuations re rate over time to one standard deviation higher than mean. In this scenario, the returns could be closer to what one has seen in ICICI Bank over last 3 years. When sentiment changes, multiple expansion happens swiftly (see chart below). However, markets tend to wait for certainty. Therein lies the opportunity as you can get superior outcomes by ignoring the herd if you are willing to bear short term pain and not play momentum. It was only 3 years ago that ICICI Bank was derided for having a fundamentally flawed culture and now ICICI Bank seems to be the consensus pick for the Banking stock of the next decade.

Source: Bloomberg

In our pessimistic scenario, Axis Bank’s transformation remains incomplete, and its deposit franchise weakens. Or it is unable to gain market share on Assets. This could happen if the Axis senior leadership team is not stable. In this case while returns in Axis Bank will be poor, the beneficiaries of its challenges will be the other three private Banks (ICICI, HDFC, Kotak). Hence, as a portfolio play, we will do fine as we are also participating in the others quite meaningfully and they would then generate significantly better returns than our base case estimates.

Please click here if you would like to download the PDF version of this blog

- As on 30 Sep 2021, total restructured loans for the bank stood at just 0.7% of loans, whereas the BB and below exposures are further ~1% of loans. Restructured loans as % of respective loans across segments are 0.7% for corporate, 0.8% for retail and negligible for SME. Provision coverage on overall restructured book is 24% with 100% cover on all unsecured retail. ↩︎